Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Brooke Lacey

Senior Public Relations Specialist

Work Phone: (860) 298-3920

Mobile Phone: (413) 530-6184

4/30/2024

Over the past several years, there has been a great deal of attention focused on the huge number of Baby Boomers retiring. More than 11,000 Americans are turning 65 each day — equating to over 4 million a year.

LIMRA research suggests these retirees and those that came before them are more likely than future retirees to be better situated to enjoy financial security throughout their retirement. Later generations will not necessarily be in the same position unless they develop a holistic plan that includes mitigating risks and creating a guaranteed income stream.

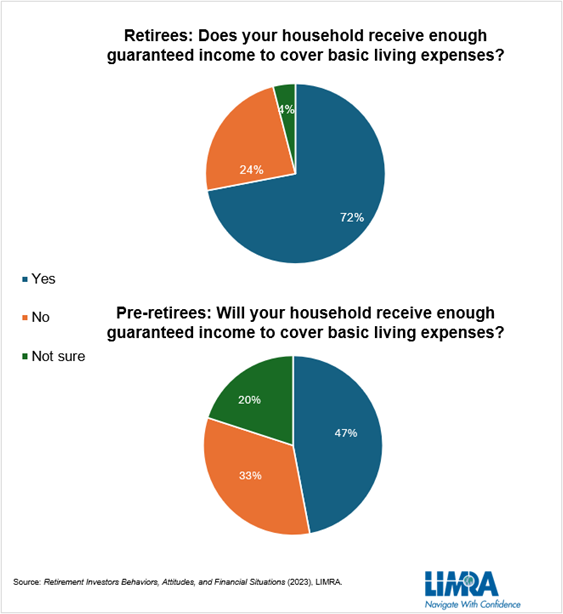

According to LIMRA’s Retirement Investors — Behaviors, Attitudes, and Financial Situations, half of today’s retirees have access to pension income. These pensions provide guaranteed lifetime income that allow retirees to feel more confident in their ability to cover basic living expenses in retirement with guaranteed income sources. LIMRA research finds 72% of today’s retirees report that their households receive enough income from lifetime-guaranteed income sources to cover all of the household’s basic living expenses.

According to LIMRA’s Retirement Investors — Behaviors, Attitudes, and Financial Situations, half of today’s retirees have access to pension income. These pensions provide guaranteed lifetime income that allow retirees to feel more confident in their ability to cover basic living expenses in retirement with guaranteed income sources. LIMRA research finds 72% of today’s retirees report that their households receive enough income from lifetime-guaranteed income sources to cover all of the household’s basic living expenses.

But for those approaching retirement, access to a pension is much lower and continues to drop with younger generations. This shift means future retirees will have to rely primarily on their personal retirement savings to fund their retirement. As a result, less than half (47%) of working adults ages 50–75 believe they will be able to cover basic living expenses in retirement with guaranteed income sources. This represents an 11 percentage-point drop from 2017.

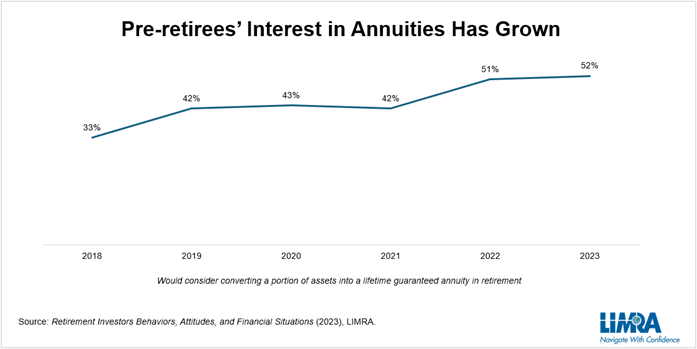

The pandemic and resulting market volatility have had an impact on investors’ mindset. Forty-five percent of investors say stock market volatility has made them more interested in investments with downside protection. As a result, interest in annuities — which was as low as 33% in 2018 — jumped in 2022. For the first time, a majority of pre-retiree workers (51%) said they would consider converting a portion of their assets into a lifetime-guaranteed annuity in retirement. Pre-retirees’ interest remained high in 2023, with 52% willing to consider annuities.

This increased interest in annuities is likely because many future retirees understand they won’t have enough guaranteed income from Social Security or pensions to cover basic living expenses in retirement.

The industry has seen this play out over the past two years. Favorable economic conditions (particularly rising interest rates) and consumer interest in investment protection and guaranteed growth drove record annuity sales in 2022 and 2023. In particular, fixed annuity products —which offer principal protection and guaranteed growth — represented 74% of total annuity sales.

Growing Opportunity for In-Plan Annuities

In addition to the growing demand for retail annuities, there is a surge in worker interest to invest in an annuity within their employer-sponsored retirement plan. In 2023, over three-quarters of defined contribution (DC) plan participants in their 40s, and two-thirds of all participants, would be likely to invest in an in-plan annuity if it were to be offered by their employer. Earlier LIMRA research found nearly two-thirds (64%) of Gen Z and Millennials are interested in contributing to an in-plan annuity.

Among DC participants who are at least somewhat likely to select an in-plan guaranteed income investment option, the top motivators include:

Tomorrow’s retirees are expressing greater interest in annuities to help them protect against market volatility and create guaranteed income for retirement. There remains much work to be done to educate consumers, employers and advisors about the unique benefit of owning an annuity and the peace of mind annuity owners have knowing they will not outlive their savings in retirement.

To learn more about how the industry can help future retirees, watch April’s LinkedIn Live episode of Industry Insights With Bryan Hodgens.

Additional LIMRA insights:

Members can learn more about the annuity market through our new Industry Advantage, our new, just-in-time-learning program:

-end-

Methodology

Between July and August 2023, LIMRA surveyed 4,500 retirees and non-retired workers who were ages 40 to 85, with $100,000 or more in household investable assets, and who have primary or shared financial decision make responsibility in their households.

About LIMRA

Serving the industry since 1916, LIMRA offers industry knowledge, insights, connections, and solutions to help more than 700 member organizations navigate change with confidence. Visit LIMRA at www.limra.com.

About LOMA

Established in 1924, LOMA helps to advance the financial services industry by empowering more than 700 financial services companies to navigate change with confidence. Visit LOMA at www.loma.org.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Senior Public Relations Specialist

Work Phone: (860) 298-3920

Mobile Phone: (413) 530-6184

Did you accomplish the goal of your visit to our site?

© 2024, LL Global, Inc. Unauthorized use, reproduction, or reprinting of this material (or any portion thereof) for any purpose, including use with any current or future form of an Artificial Intelligence tool or engine, without express and written permission from LL Global (LIMRA and LOMA) is strictly prohibited.