U.S. Life Insurance Premium Sets New Record in 2023

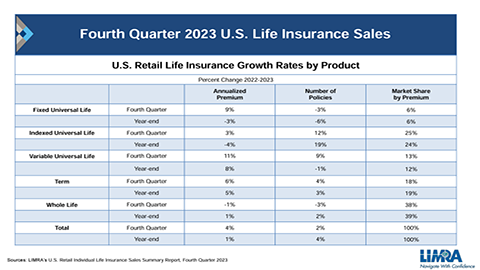

For the third consecutive year, total U.S. life insurance new annualized premium set a new sales record. In 2023, new annualized premium increased 1% to $15.7 billion, according to LIMRA’s U.S. Life Insurance Sales Survey, which represents 85% of the market.

Go To Page