Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Brooke Lacey

Senior Public Relations Specialist

Work Phone: (860) 298-3920

Mobile Phone: (413) 530-6184

LIMRA.com and LOMA.org will be offline for scheduled maintenance on April 26, 8 p.m. - 11:00 p.m. EDT.

5/5/2022

Keeping their family safe is an important priority for mothers.

Over the past two years, COVID-19 accentuated the many concerns mothers have. LIMRA research finds women in general were more worried about the economy and its impact of the family’s financial security. They expressed greater concerns about disruptions in childcare and schooling, access to health care, food and other household necessities. As we come out of the pandemic, identifying ways to help mothers feel secure in their families’ wellbeing will be essential.

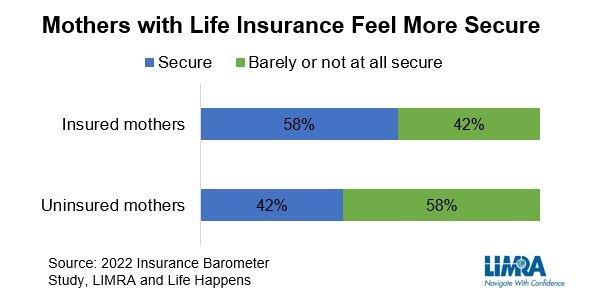

Life insurance can offer security. The 2022 Insurance Barometer study found people who have life insurance feel more financially secure than uninsured people. This is also true for mothers. Insured mothers are 38% more likely to say they feel financially secure than uninsured mothers.

Yet, research shows less than half of women with children under 18 own life insurance. And while 51% of mothers — representing 26 million women in the U.S. — believe they have insufficient life insurance coverage, less than 1 in 3 say they plan to obtain coverage within the next year.

Barriers to purchase

What prevents mothers from getting the coverage they know they need?

According to LIMRA research, misconceptions about cost deter many mothers from getting the coverage they need. Four in 10 mothers say they don’t own life insurance because it is too expensive, yet two thirds overestimate the cost. The majority of mothers also feel they don’t know enough about life insurance. According to the 2022 Insurance Barometer Study, only a third of mothers feel very knowledgeable about life insurance. This perceived lack of knowledge undermines their confidence in making a decision on how much life insurance they need or what to buy.

In honor of Mother’s Day, our industry should commit to engaging and educating women — especially mothers — about how accessible and affordable life insurance is. Getting more women fully insured will give them the peace of mind that their families will be financially secure if the unthinkable were to happen.

LIMRA is honored to lead the Help Protect Our Families campaign, an industrywide effort to raise awareness about the importance of life insurance and help carriers and distributors address the growing coverage gap in the United States.

View this infographic to learn more about mothers’ perceptions about life insurance.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Senior Public Relations Specialist

Work Phone: (860) 298-3920

Mobile Phone: (413) 530-6184