LIMRA: Workers’ Benefits Satisfaction Tied to Understanding and Knowledge; Can Total Compensation Statements Correct the Course?

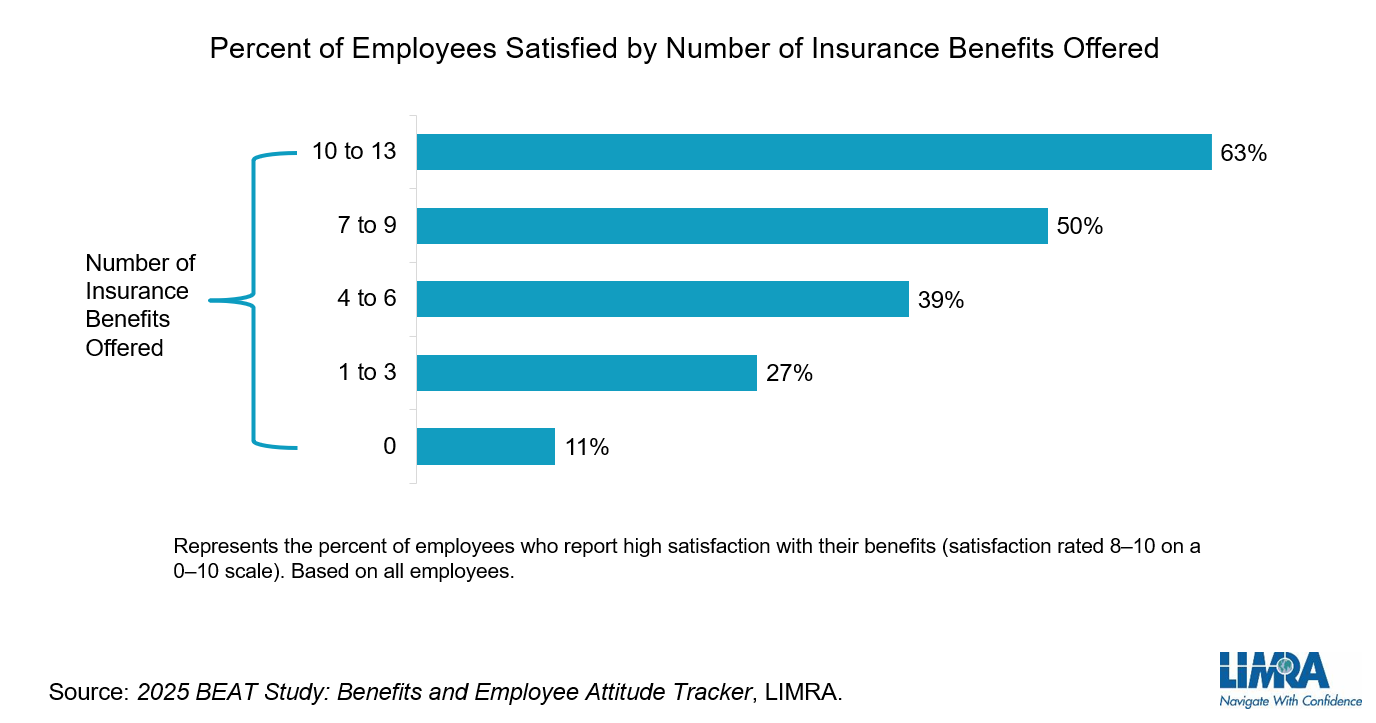

A new LIMRA study finds 7 in 10 workers are at least somewhat satisfied and 43% are highly satisfied with their overall benefits packages.

Go To Page