Your go-to source for retirement market information and insights

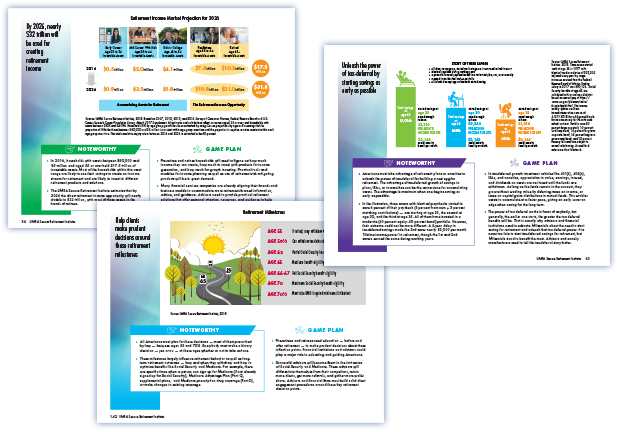

The Retirement Income Reference Book is ideal for informing strategic decisions and preparing presentations. The book is full of facts and easy-to-understand charts and figures designed to help you and your organization capture a share of the huge retirement market. Printed copies can be purchased by members for $100 or less; nonmembers pay $15,000.