Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

10/17/2019

As advisor practice models continue to blur, LIMRA-EY research finds the most successful insurance advisors have expanded their business to include investments, estate and trust planning, as well as retirement planning.

In an industry that historically relied on the volume of transactions to drive sales, advisors need to rethink their approach if they want to grow their business. Metrics such as number of clients served or premium written only tell part of the story. Advisors can better measure success by looking at how efficient their practice is, the depth of their advisor-client relationships, and—most importantly—their areas of potential growth.

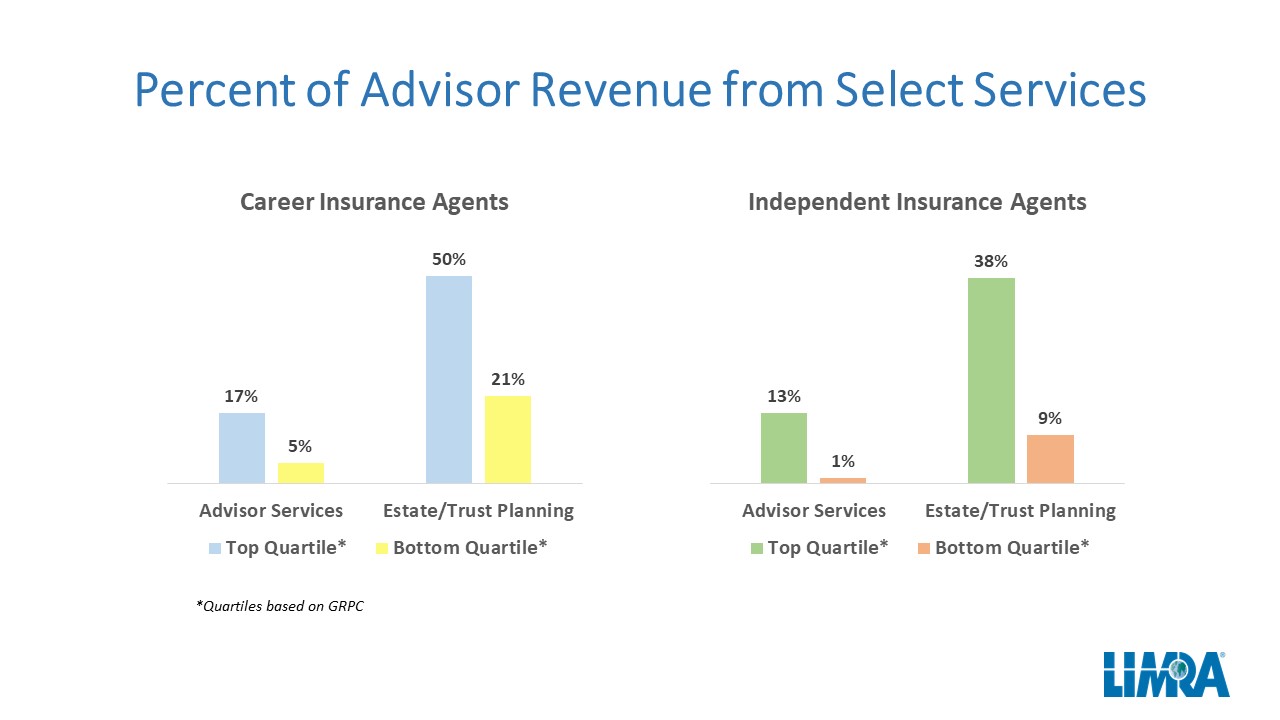

One way to measure success is through gross revenue per client, or GRPC, which measures how much revenue is derived from a client. Advisors can look at their book of business relative to their average GRPC. Advisors can identify clients with low GRPC and target them for additional products/solutions by taking a more holistic approach. They can identify clients with high GRPC, who are most profitable, to ensure they keep these clients by maintaining strong relationships. Advisors can also create an ideal client profile for prospects by identifying prospects with similar characteristics of high GRPC clients (see chart below).

Characteristics common across channels that increase GRPC include attaining professional designations, offering more specialized and varied services and doing more retirement planning. Designations earned by an advisor reflect skill, expertise and—more importantly— imply the advisor can offer multiple products and solutions.

Characteristics common across channels that increase GRPC include attaining professional designations, offering more specialized and varied services and doing more retirement planning. Designations earned by an advisor reflect skill, expertise and—more importantly— imply the advisor can offer multiple products and solutions.

Successful insurance advisors are expanding their services and products to meet clients’ needs for investment, retirement, insurance and estate planning. Insurance advisors who offer retirement income planning to all clients typically reap 2.5 times higher average GRPC than those that do not offer such planning to any clients.

Completing a formal retirement income plan contributes toward building trust between the client and the advisor, and ultimately in gathering assets. Twice as many clients with a formal retirement plan trust their advisors (33%) as opposed to clients without a plan (17%). LIMRA Secure Retirement Institute research shows clients with a formal written income plan feel their advisors are more accessible, have a better understanding of their long-term needs, and are more likely to put clients’ interests first. They are also more likely to consolidate assets with their advisors.

As the financial services landscape continues to evolve, advisors who can position themselves to most efficiently meet client needs will gain success. Looking at GRPC is one way advisors can position themselves for future growth.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257