Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

7/9/2019

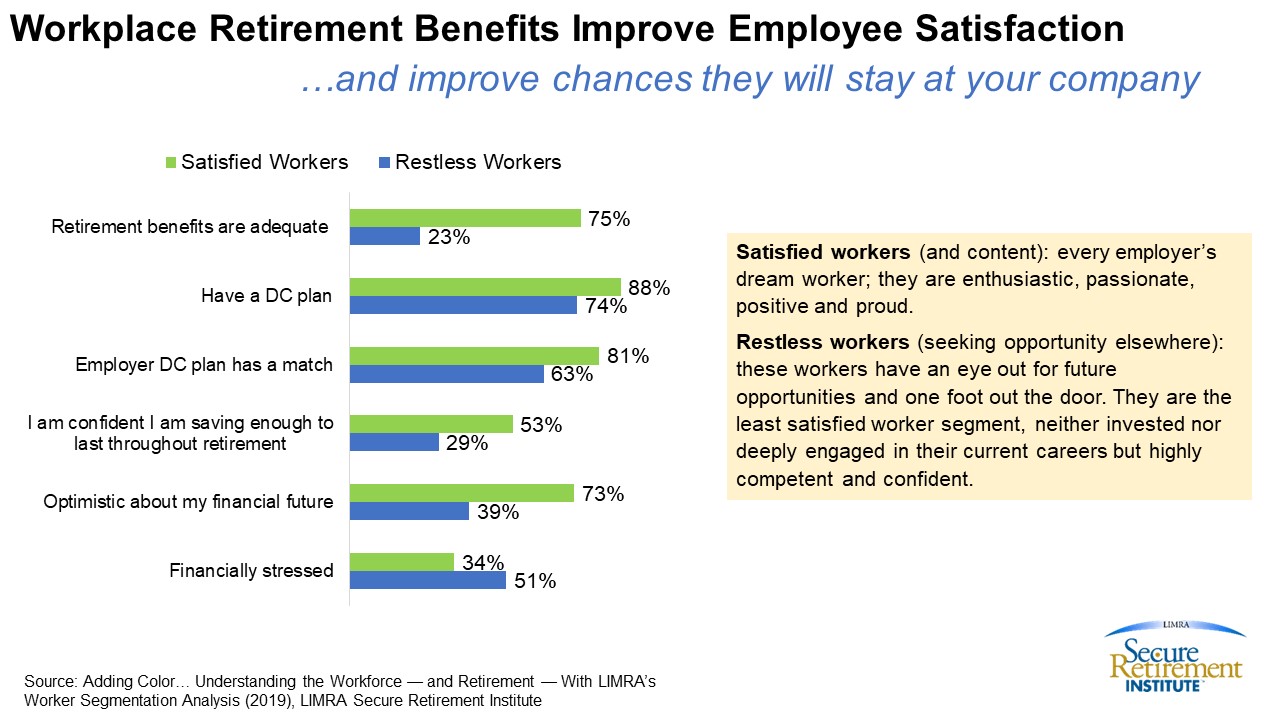

With the unemployment rate at its lowest level in 50 years, competition for strong employees is high and employers are looking for ways to attract and retain good workers. New LIMRA Secure Retirement Institute (LIMRA SRI) research suggests that “satisfied” employees are more likely to feel positive about their employer, their employer-sponsored retirement benefits, and more likely to feel their employers help them plan for retirement. In turn, these employees are half as likely to leave their current position as workers identified as “restless.”

The LIMRA SRI study identified four distinct worker personalities, examining how their workplace perceptions influence their experiences and mindset. These segmentations can be valuable in helping employers and benefits service providers design, communicate, enroll and manage retirement programs. Overall, the study found these personalities transcended age, gender and income.

The four categories are:

Satisfied (and content): every employer’s dream worker; they are enthusiastic, passionate, positive and proud.

Settled (it’s just a job): less satisfied with their employers and their benefits, but far from disengaged.

Resigned (but probably sticking it out): not actively dissatisfied, but largely neutral about their employers, more likely to be dissatisfied with their own jobs and role in the workplace (than Settled or Satisfied workers); these workers tend to have larger financial stresses and concerns than other segments.

Restless (seeking opportunity elsewhere): these workers have an eye out for future opportunities and one foot out the door. They are the least satisfied worker segment, neither invested nor deeply engaged in their current careers but highly competent and confident.

Researchers found virtually all satisfied workers (99%) felt workplace benefits were critical to their financial security and they were nearly twice as likely to feel their retirement benefits were adequate, compared to the other worker segments. They were also more likely to participate in their employer-sponsored DC plan and have an employer match.

The study found across all groups, the number one financial goal was achieving retirement security. Yet, LIMRA SRI researchers found financial stress contributed to lower confidence levels in workers’ financial security. Not surprisingly, more resigned and restless workers report being financially stressed: 51% of resigned workers and 48% of restless workers said they were financially stressed, compared with just 34% of satisfied workers and 39% of settled workers. As a result, satisfied and settled workers were far more likely to feel financially secure and optimistic about their financial future than resigned and restless workers.

Future Financial Needs Worry All Worker Segments

LIMRA SRI finds all workers are more comfortable in their ability to meet more immediate and short-term financial responsibilities (paying current healthcare costs and paying for their current needs) than longer-term needs (like future healthcare and retirement), but resigned workers are much more likely to feel concerned about meeting their current financial obligations than the other workers. When it comes to longer-term goals — saving for retirement and future healthcare costs — levels of concern for all workers rise considerably. Nine in 10 are concerned about saving enough for retirement and more than 8 in 10 are concerned about saving for future healthcare costs.

Opportunity to Convert?

In many cases, workers in the resigned category could be converted to become satisfied employees if employers helped them address some of their financial challenges and stress. Fewer than 10% of resigned workers felt they were very knowledgeable about investment products and services and three-quarters of them are concerned about meeting their financial obligations. Deploying a financial wellness program and leveraging and promoting the financial educational tools and resources from their plan providers could help these workers alleviate some of the stress and dissatisfaction that have undermined their enthusiasm for their positions and the company.

More findings from the study can be viewed: Understanding the Workforce: The 4 Personality Segments to Consider for Retirement Benefits Strategies.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257