LIMRA Research Finds Generational Shifts Are Impacting Employee Benefits

4/15/2019

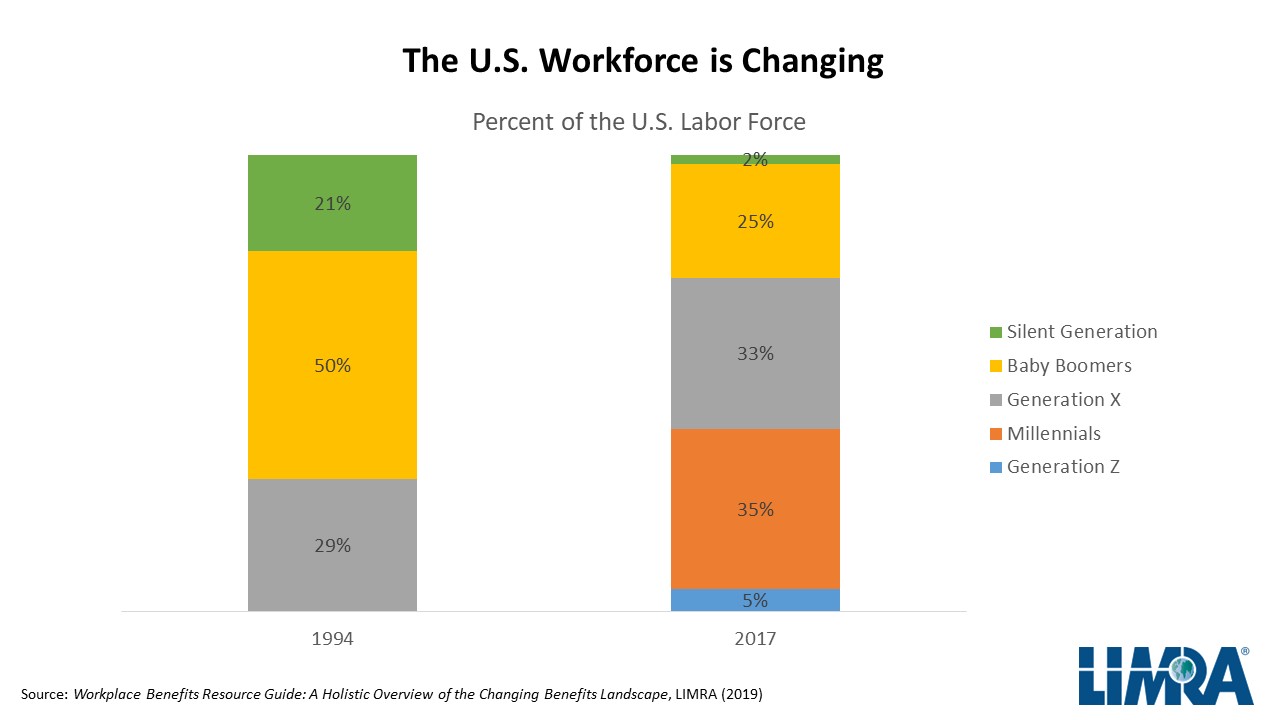

Workplace benefits have long been a perk of employment, but over the years they have changed to keep up with workers’ needs. Each generation grows up with different experiences and expectations. As a result, employers adjust their benefit strategies and portfolios to respond to the changing attitudes and demographic and economic experiences of each new generation of workers. There are currently five generations in today’s workforce – more employed generations than ever before – but unlike in the 90s when the Baby Boomers took up half of the workforce, there is no one dominant generation.

A recent LIMRA study looked at how three generations, Baby Boomers, Generation X (Gen X) and Millennials, viewed the importance of benefits. While all have medical insurance as the most important benefit, Millennials also ranked paid time off as equally important with 77% giving them a 4 or higher out of a 5 point scale. Gen X workers also found paid time off important, 85% ranked it a 4 or higher. While retirement savings plans weren’t as important for Millennials as they are for Baby Boomers and Gen X (71% versus 84% and 82% respectively), it still was one of the top three benefits cited.

LIMRA also examined employers’ views about benefits and what they feel is most important to their employees. Overall, LIMRA found employers tended to underestimate how important some benefits are to those under age 40, compared with what employees said. For example, employers’ perceived importance of life insurance for younger generations was only 44% but 60% of employees under age 40 said life insurance was important. Similarly, employers viewed work-life benefits less important for younger generations than their actual importance. Only 46% of employers thought work-life benefits were important to their under-40 employees when, in fact, 61% of employees under age 40 cited work-life benefits as important.

Employers also missed the mark, overestimating the importance of some benefits for workers ages 40 and older. LIMRA’s research finds older workers didn’t place as much importance on benefits like vision and dental as their employers assumed. Employers’ believed 83 percent of workers ages 40 and older would feel dental insurance is important but 60% of older workers said dental insurance is important. Similarly, 80% of employers believed their employees over 40 would rate vision insurance as important while just over half of workers over age 40 (51%) considered vision insurance as important.

This data suggest that employers should take the time before open enrollment season and get to know what their employees really want from their workplace benefits. Understanding the priorities of workers of all ages will enable employers to provide the right mix of benefits that will attract younger workers and retain their experienced workers.