Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

7/16/2019

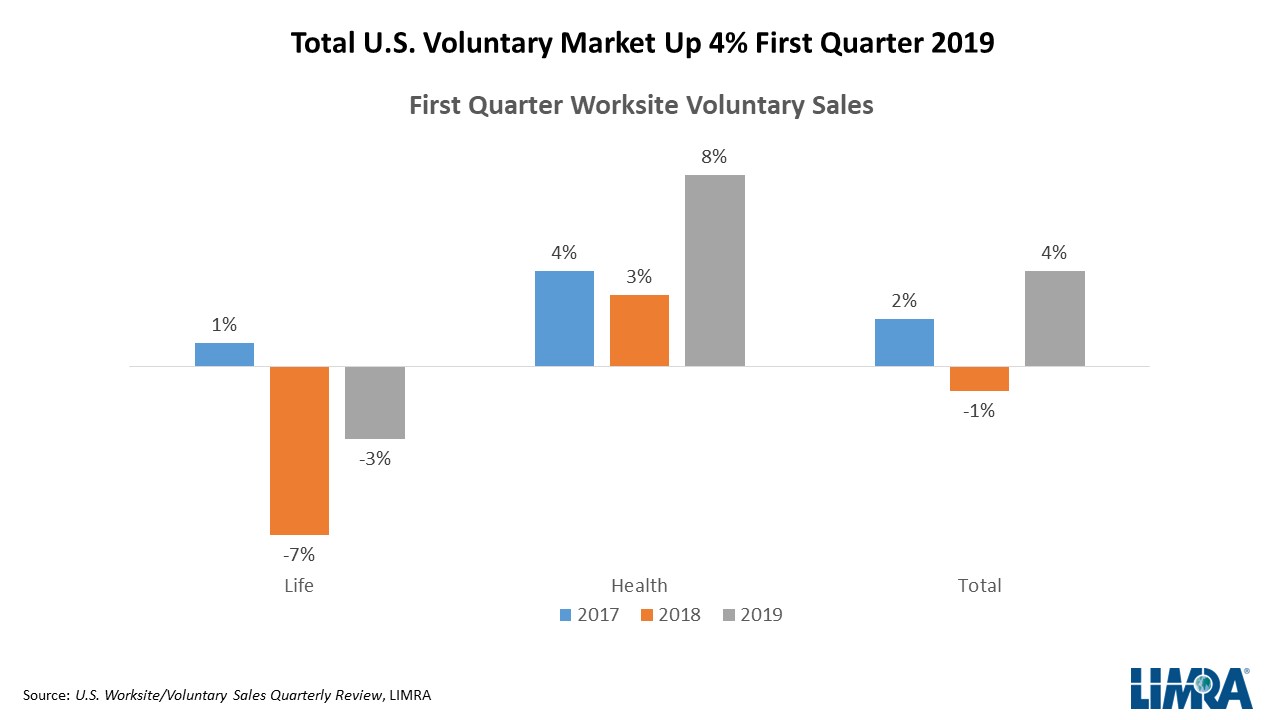

LIMRA research finds new annualized premium for voluntary products reached just over $3 billion for the first quarter of 2019, up 4% compared with first quarter 2018. LIMRA defines voluntary benefits as insurance products available at the workplace that are 100% funded by the employees.

Voluntary health products fueled the growth, reaching almost $2 billion in premium, up 8% compared with the prior year. LIMRA research shows voluntary critical illness premium has consistently recorded positive growth since 2011. For first quarter 2019, premium was up 19%, with seven of the top 10 voluntary critical illness carriers achieving double- or triple-digit increases. One of the reasons for this continued growth is because it is a newer product with lower penetration in the employer market, so there is more room for critical illness to grow compared with more established voluntary health products.

In addition to critical illness, voluntary hospital indemnity sales also had a solid start to the year. Sales for this product have fluctuated in recent years but first quarter 2019 results were very positive, up 34% compared with first quarter 2018. Four of the top five voluntary hospital indemnity carriers had double- or triple-digit increases in the first quarter.

While the majority of voluntary health products saw growth in 2019, short-term disability premium fell 9% compared with results in first quarter 2018. Individual company results were mixed for this product, as four of the top 10 voluntary short-term disability carriers reported declines in first quarter sales.

Looking at voluntary life insurance products, this is the third year that first quarter sales of term life have declined. First quarter 2019 total voluntary life insurance premium was a little over $1 billion, down 3% compared with first quarter 2018 results. Despite the overall decline, some products reported positive growth: standalone accidental death and dismemberment (AD&D) premium increased 28% compared with the prior year and universal life and variable universal life premium improved 12% in the first quarter of 2019. Term and whole life both showed declines.

To view the growth rates of the individual product lines, please visit the newly updated Fact Tank.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257