Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

9/4/2019

Today’s employers are faced with increasing challenges to fund their benefits programs. According to LIMRA research, the number one concern for benefits plan sponsors is managing benefits cost – 75% of employers consider this a critical issue.

One of the ways some employers have sought to mitigate their defined benefit (DB) plan liabilities is though pension risk transfer.

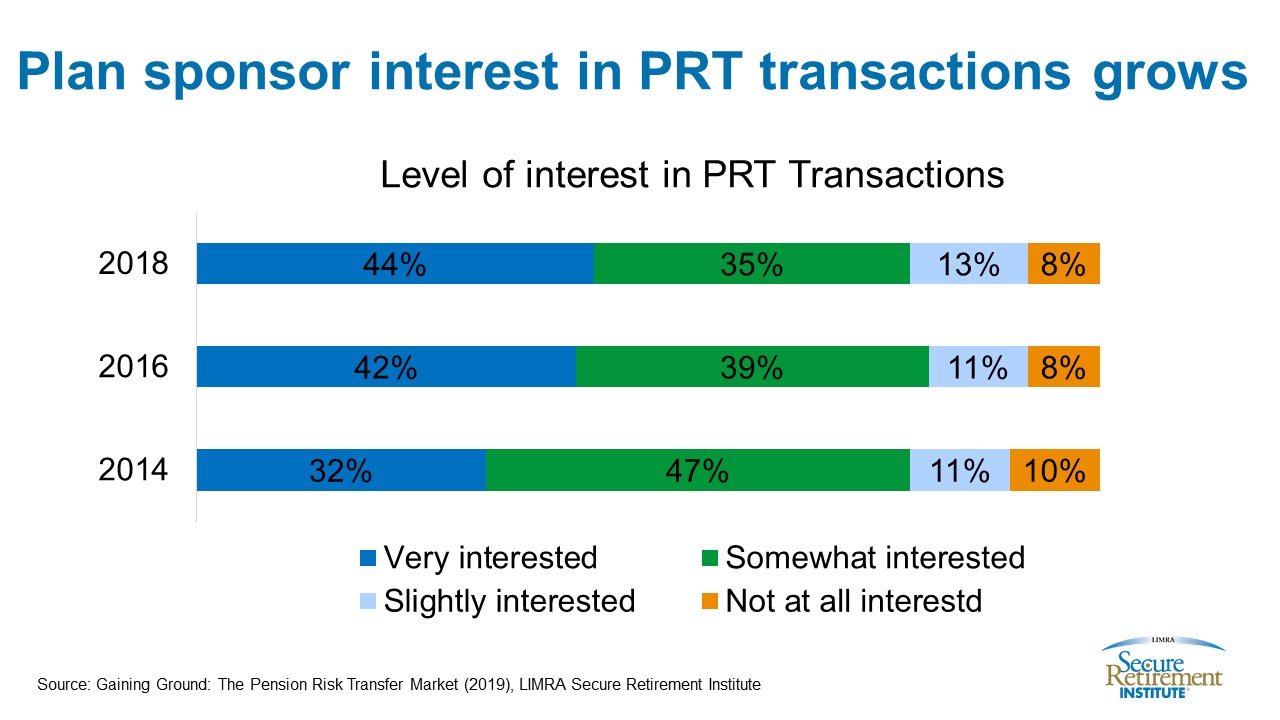

A new LIMRA Secure Retirement Institute (SRI) study finds 8 in 10 private-sector DB plan sponsors (who also offer a defined contribution plan) are at least somewhat interested in a pension risk transfer transaction (PRT). Four in 10 plan sponsors say they are “very” interested in PRT, marking a 12 percentage-point increase from plan sponsors surveyed in 2014.

PRT sales trends also demonstrate increased interest. According to SRI’s pension risk transfer sales survey, single premium buy-out sales (a product that allows an employer to transfer all or a portion of its pension liability to an insurer) have surpassed $1 billion for the past 18 quarters. Recent growth in this market has predominantly been driven by small to mid-sized deals. Annually, the number of contracts sold has increased 76% from 2014 to 2018.

The study shows half of all plan sponsors with frozen DB plans are very interested in PRT products. Among companies with active DB plans, 39 percent are very interested in PRT, suggesting there may be some additional opportunity for PRT beyond those plans already frozen.

Freezing a plan is one of the first actions plan sponsors take before purchasing an annuity from a private-sector insurer and entering into a PRT deal. The study finds 46% of employers with both a DB and defined contribution plan have frozen their pension plans. Companies may freeze their DB plans in order to cut costs and enhance competiveness, or mitigate the volatility of their funding obligations due to fluctuating equity markets, participant longevity, plan assets amounts and interest rates.

Over the past few decades, market conditions and regulatory changes have made it increasingly difficult for employers to offer DB pension plans. Sustained low interest rates, market volatility, increased longevity of plan participants, and rising Pension Benefit Guaranty Corp (PBGC) premiums present major obstacles for plan sponsors who maintain DB plans.

As a result, many have sought ways to reduce their exposure to the liability risks associated with their plans. Some companies have taken steps to reduce their pension plan risk exposure including making additional contributions to improve the plan funding ratios, freezing plans, employing liability-driven investment strategies, and offering lump sums to terminated participants.

For those plan sponsors not interested in PRT products, 42% say it is because they already address their pension risks through alternative means. Three in 10 say they don’t know enough about PRT products. Another 3 in 10 cite the high cost of purchasing an annuity as a reason they’re not interested in PRT products, which may be a flawed perception.

According to Mercer Pension Buyout Index1, the estimated cost for companies transferring their pension liabilities to an insurer by purchasing an annuity (i.e., a buyout) versus the approximate economic cost of maintaining their pension obligations is approximately the same. But market volatility, the increases in PBGC premiums, which are scheduled to continuing rising through 2020, and increases in participant longevity still make de-risking an attractive option for most plan sponsors.

Favorable economic conditions and growing awareness and interest in de-risking pension liabilities will continue to spur market growth. With just over $10 billion and over 160 contracts in new pension risk transfer business in the first half of the year, SRI is forecasting sales to be between $20-25 billion in 2019.

1 https://www.mercer.us/our-thinking/wealth/mercer-us-pension-buyout-index.html

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257