Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

2/27/2019

In November 2018, the Internal Revenue Service increased the limit on 2019 annual contributions to a traditional or Roth Individual Retirement Accounts (IRAs) from $5,500 to $6,000. For those over age 50, the additional catch-up contribution limit remains $1,000.

the Internal Revenue Service increased the limit on 2019 annual contributions to a traditional or Roth Individual Retirement Accounts (IRAs) from $5,500 to $6,000. For those over age 50, the additional catch-up contribution limit remains $1,000.

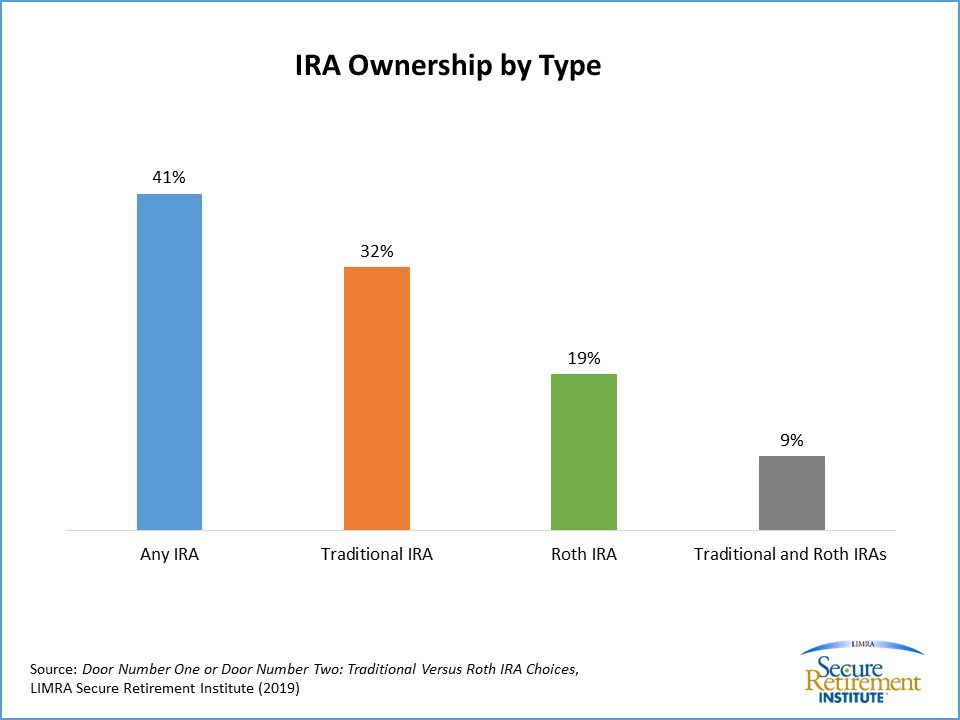

According to LIMRA Secure Retirement Institute (LIMRA SRI), 41 percent of Americans own a traditional or Roth IRA – 32 percent own a traditional IRA, 19 percent own a Roth, and 9 percent own both.

Since 1974, Americans have used traditional IRAs to save for retirement. Contributions can be made using qualified (pre-tax) income but are subject to income tax rates when assets are withdrawn. Additionally, traditional IRAs have a required minimum distribution at age 70 and a half – meaning retired IRA owners have to withdraw a certain amount each year after they reach 70 and a half.

In 1997, Roth IRAs were introduced, allowing Americans to save non-qualified (post-tax) income. The assets in these accounts can grow tax-free and are not taxed when withdrawn. Roth IRAs don’t have a required minimum distribution age like traditional IRAs, but not everyone is eligible to invest in a Roth IRA. Only single Americans who have a household income of $135,000 or less may invest in a Roth IRA; the household income limit for married Americans is $199,000.

Lack of knowledge is the biggest obstacle preventing Americans to invest in an IRA. The study found only 34 percent of all Americans believe they are knowledgeable about IRAs. Men are far more likely to say they are knowledgeable about IRAs than women. Forty-two percent of men consider themselves knowledgeable about IRAs, compared with just 27 percent of women. Of those who don’t own an IRA, nearly half (46%) felt they did not understand enough about IRAs to contribute to them.

According to the LIMRA SRI survey, older Americans are more likely to own traditional IRAs than younger Americans. Almost half (48 percent) of Silent Generation Americans (ages 73+) own an IRA, compared with just 3 in 10 Boomers, Gen X and Millennial Americans. This is not surprising. Older Americans are more likely to own a traditional IRA because they are less likely to have had access to a defined contribution (DC) plan during their working years, or they have rolled over their DC plan assets into a traditional IRA after they retired.

Ownership of Roth IRAs is much more level across age groups. About 1 in 5 Boomers (19 percent), Gen X (19 percent) and Millennials (18 percent) own a Roth IRA, along with 1 in 6 Silent Generation (16 percent) consumers. Forty-three percent of these consumers said they purchased a Roth IRA because their financial advisor recommended it. In contrast, only 23 percent of traditional IRA owners purchased their product because of an advisor’s recommendation. Another important factor in Roth IRA owners’ decisions - cited by 3 in 10 respondents - is the desire for having a mix of pre- and post-tax retirement savings. Roth IRAs represent one of the only types of accounts where withdrawals of earnings (under specified circumstances) are not taxed.

The study finds interaction with an advisor or financial services company increases the likelihood that an IRA owner will make regular contributions to their IRA. According to the ICI, overall, only 34 percent of IRA owners currently make regular contributions to their IRA account. Among those who do make ongoing or regular contributions to IRAs, more than half (53 percent) had been approached by a financial services company or financial professional to set up regular contributions.

LIMRA SRI supports the America Saves Week campaign (held February 25- March 4, 2019), which encourages Americans to save money, reduce debt, and build wealth. LIMRA SRI suggests that this is the perfect opportunity for advisors to check in with their clients to ensure they are systematically saving for retirement and planning for their financial future.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257