Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

9/10/2019

When it comes to researching (and eventually buying) financial services products, increasingly consumers expect their online experiences with agents and financial services companies to match their other online retail experiences. Understanding what consumers look for and where will help the industry improve the way they engage with today’s consumer online and open up new opportunities to sell insurance products.

LIMRA surveyed U.S. consumers who recently researched and/or purchased individual insurance products (life, disability, long-term care, and annuities) to find out what led them—both online and offline—to consider these products. LIMRA then compared the current data with data from a similar survey done in 2015 to look at how preferences and behaviors have changed over time.

While using the internet to research insurance products is still relatively new, about half of all consumers – and 6 in 10 Millennials – will consult both a financial professional and the internet when seeking information about individual insurance and annuity products. Baby Boomers are the most likely to rely solely on a financial professional, especially for annuities (37%). Of those who do not seek information online, 42% are Baby Boomers, 33% are Gen X and 15% are Millennials. Most often, these consumers want to meet with someone in person, and to be able to ask questions.

LIMRA’s new study found more people are using an online agent locator (increasing from 23% in 2015 to 29% in 2018). Although still a small percentage, the total number of people who found a financial professional through social media (e.g., LinkedIn or Facebook) has doubled, from 4% in 2015 to 8% in 2018.

Brand awareness continues to draw the most consumers to an insurer’s website. Nearly a third of consumers said they visit an insurer’s website because they are familiar with the brand or already own a product from that company. LIMRA found, however, a growing number of people are locating insurance company websites using other methods, including online ads, online review/opinion sites, or on social media.

What are consumers looking for online?

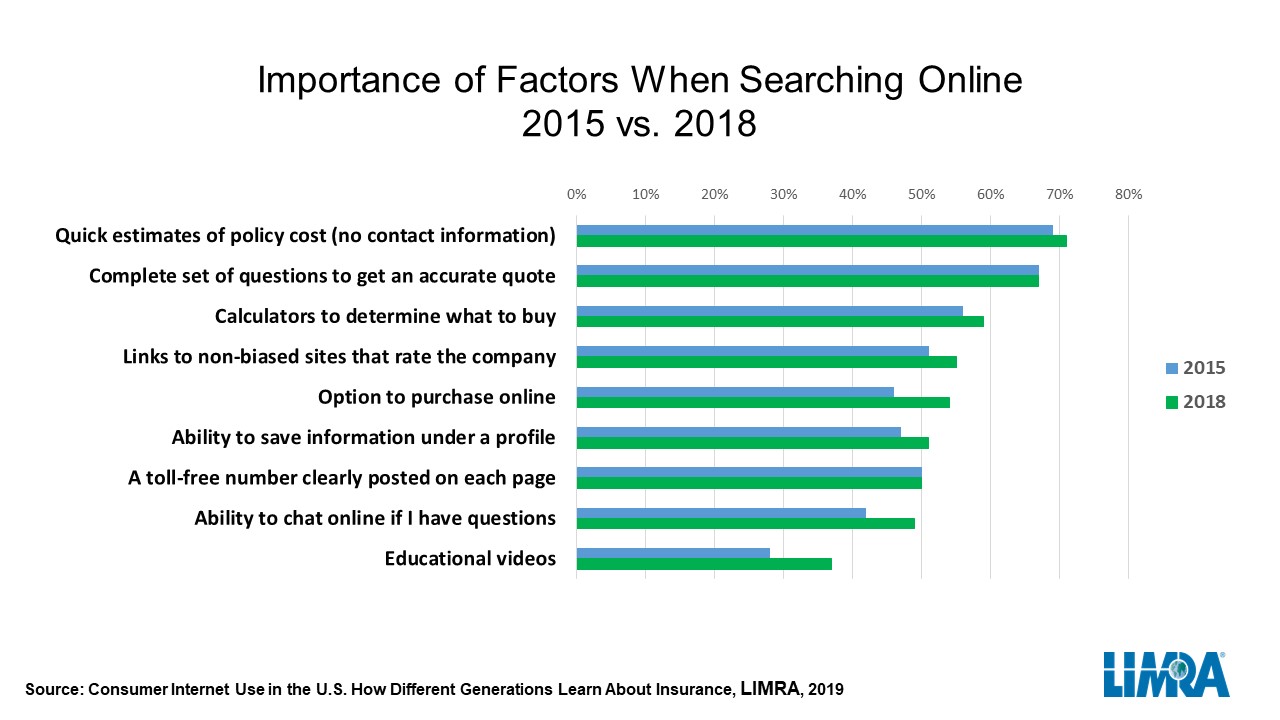

Seven in 10 consumers say it’s very/extremely important to be able to get a quick estimate on the cost of a policy, and just as many would like to answer a set of questions to improve the accuracy of that quote. More than half of all consumers – and almost two-thirds of Millennials – are looking for online calculators to help them determine what and how much insurance to buy. These findings are consistent with the study done in 2015.

A growing number of consumers expect to have the ability to buy insurance products online. In 2015, 45% of consumers felt this was very/extremely important, by 2018, it had jumped to 54%.

Looking toward the future, insurers need to be responsive and proactive both online and in-person. LIMRA research shows the ability to access online information is more important to those making buying decisions about insurance. To successfully engage these shoppers, insurers and agents must create a personalized, online experience that is easy for consumers to research products, while also increasing their confidence that they are choosing the right policy for them.

Looking toward the future, insurers need to be responsive and proactive both online and in-person. LIMRA research shows the ability to access online information is more important to those making buying decisions about insurance. To successfully engage these shoppers, insurers and agents must create a personalized, online experience that is easy for consumers to research products, while also increasing their confidence that they are choosing the right policy for them.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257