Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

1/21/2020

Approximately 60 million Americans save for retirement through an employer-sponsored retirement plan, like a 401(k) or 403(b) plan. At least quarterly, these retirement plan participants receive account statements, disclosures and written communications to help them monitor their savings, understand the choices they have made within the accounts and the costs associated with these investments.

In October 2019, the Department of Labor (DOL) proposed a rule, allowing ERISA retirement plan disclosures to be posted online to reduce printing and mail expenses for employers and make disclosures more readily accessible and useful for America’s workers. According to the DOL this would save an estimated $2.4 billion in costs over the next 10 years by eliminating materials, printing and mailing costs associated with providing printed disclosures.

The Secure Retirement Institute® (formerly LIMRA SRITM) surveyed consumers who save in a retirement savings account to find out how they preferred to get their retirement plan information. Given recent advances in technology and greater access to the internet, is there greater interest in receiving all communications associated with retirement plans electronically?

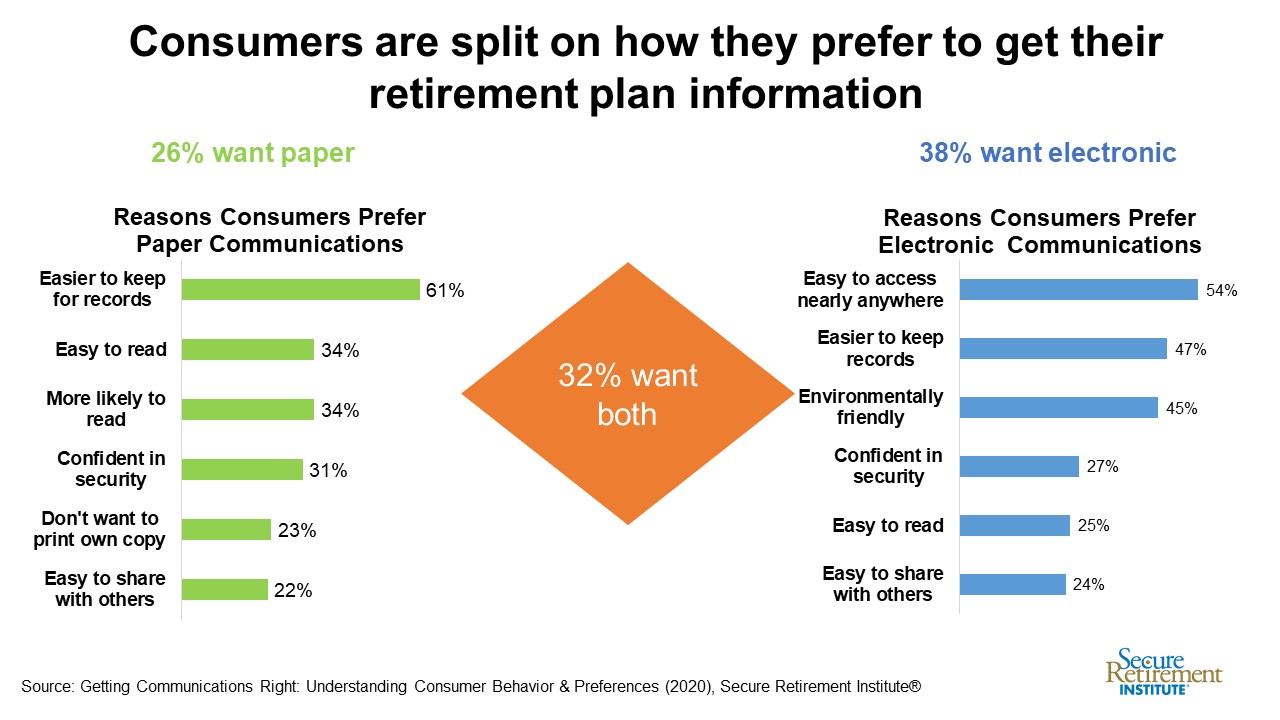

Turns out, there is no consensus among consumers for any specific format (paper only, electronic only or both). Four in 10 say they prefer to receive communications from their retirement plan providers electronically through email or an online portal. One quarter prefer to receive paper copies and 32% want to receive communications from their retirement plan provider both electronically and in hard copy.

The primary reason consumers give for preferring paper communications is recordkeeping (61%). More than a third (34%) say paper communications are easier to read and that they are more likely to read the communications in paper form. Security was cited by 3 in 10 consumers – this is especially true for Millennials and adult Gen Z consumers who believe their information is more at risk with electronic communications than paper copies.

The primary reason consumers give for preferring paper communications is recordkeeping (61%). More than a third (34%) say paper communications are easier to read and that they are more likely to read the communications in paper form. Security was cited by 3 in 10 consumers – this is especially true for Millennials and adult Gen Z consumers who believe their information is more at risk with electronic communications than paper copies.

For those who favor electronic communications, more than half (54%) say it is because they can access the information almost anywhere. Surprisingly, this increases with age (42% of adult Gen Z/Millennials select this reason versus 54% of Gen Xers and 68% of baby boomers). Forty-seven percent say it is easier for recordkeeping and 45% believe electronic communications are more environmentally friendly. Being environmentally friendly was especially appealing to women, those with more than $100,000 in household assets, and those who are currently working and not retired.

Given the cost savings, it would be advantageous for plan sponsors and recordkeepers to persuade their workers to accept electronic communications. The study found the majority (6 in 10) of retirement plan account holders who currently receive paper communications would accept receiving communications via a secure online portal. Findings suggest promoting the security, easy access and recordkeeping as well as environmentally friendly aspects of electronic communications can help persuade plan participants to switch to electronic communications.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257