Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

10/12/2021

Get the Facts and Join Us for a Twitter Chat to Learn More

According to Secure Retirement Institute® (SRI®) research, 83% of all U.S. workers report they are saving for retirement. But only 55% of workers are confident they know how much they should be saving for retirement.

While the exact amount people should save for retirement varies depending on their individual circumstances, the facts indicate that many Americans aren’t saving enough. According to SRI, 7 in 10 U.S. workers contribute less than 10% of their salary to their employer-sponsored retirement plan. According to SRI analysis of consumer data, the median savings amount among those with any savings is $64,000.

For older workers (Gen Xers and Baby Boomers), 26% say they have less than $50,000 saved for retirement. Two-thirds of this group save less than 10% in their employer-sponsored retirement plan and 37% save less than 5%. Given that less than 40% of these workers will have access to a defined benefit or pension, it is likely they will have to rely primarily on their savings and investments to fund their retirement.

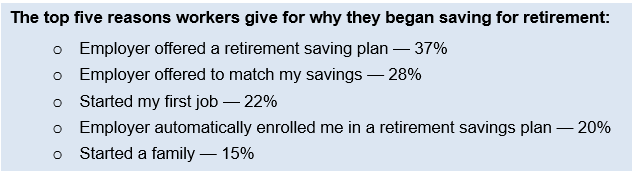

SRI research shows having access to an employer-sponsored retirement plan significantly improves the likelihood of workers saving for retirement. When asked what prompted workers to begin saving for retirement, three of the top five responses were related to their employer-sponsored retirement plan.

October is National Retirement Security Month, an awareness campaign designed to bring attention to the importance of planning and saving for retirement. SRI has pulled together a National Retirement Security Month Fact Sheet, highlighting facts about the state of retirement preparedness in the United States.

Join Our Twitter Chat #ChatAboutRetirement

Date: Monday, Oct. 25, 2021, from 1 to 2 p.m. EST

Where: Join us at @LIMRA on Twitter using your personal handle or your company’s handle

Hashtag: Use and follow #ChatAboutRetirement during the above timeframe.

LIMRA will moderate the discussion and drive the conversation on Twitter using the questions and statistics below. Remember to use the #ChatAboutRetirement hashtag in each tweet.

Twitter Chat Questions:

Q1: Younger workers, often weighed down with student debt, put off saving for retirement or save less than recommended. What are some of the reasons it is important to begin saving at the start of one’s career?

Q2: Despite the fact that women are more likely to live longer in retirement, SRI research finds women are less likely than men to save for retirement (78% versus 87%). How can our industry help women prioritize their retirement financial security?

Q3: Forty-four percent of those not saving for retirement say they can’t afford to. What are some strategies to overcome this?

Q4: Four in 10 workers say they started saving for retirement because their employer offered a retirement savings plan. But almost 30% of U.S. workers don’t have access to an employer-sponsored retirement plan. What are the best strategies for them to save?

Q5: SRI research shows when people develop a formal written retirement plan they are twice as likely as those who don’t to be confident they will be able to live in their desired lifestyle in retirement (79% versus 38%). For those who don’t already have one in place, what should be included in a formal retirement plan?

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257