Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

5/18/2022

Most people are familiar with the benefits of disability insurance to protect one’s income in the event they get sick or injured and unable to work. But beyond income protection, disability insurance can help safeguard retirement goals by preventing early withdrawals. Pulling from retirement plans early can be more costly in the long run due to the loss of retirement funds coupled with tax penalties.

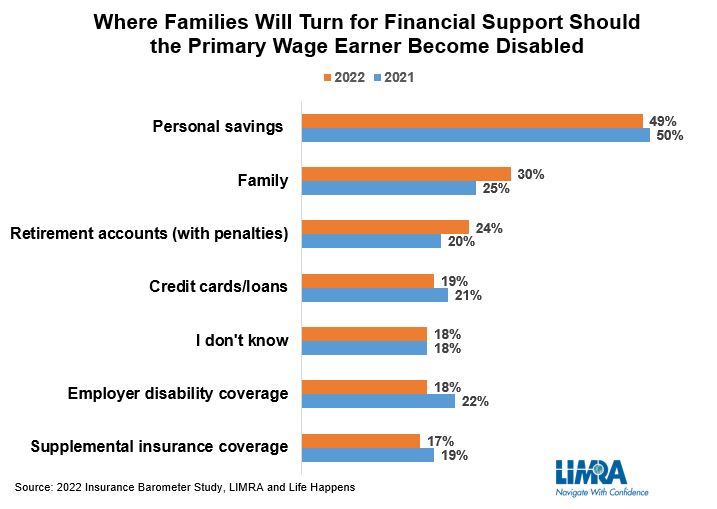

According to the 2022 Insurance Barometer Study, 24% of consumers say they would turn to their retirement savings should a disability befall them. Less than one-fifth of respondents said they would turn to some sort of supplemental insurance, disability insurance, or workplace compensation. LIMRA research shows the majority of consumers have no insurance against a disability and would need to tap into other sources of financial assistance, which threatens their long-term financial goals.

Interestingly, the Barometer Study shows that retirement planning was the top reason consumers give for purchasing disability insurance in 2022, up six percentage points over January 2020 (27% versus 21%). This suggests consumers are more aware of the risks that a disability could pose to a household income stream and retirement savings.

Other reasons prompting consumers to purchase disability insurance include knowing someone who was negatively affected because they didn’t have coverage, (27%), entering the workforce (25%), getting married (15%), having a child (14%), and starting a business (13%).

Currently, just 14% of consumers own individual disability insurance coverage, 17 percentage points down from an all-time high in 2012 (31%). Almost half (49%) of respondents indicate their households would face financial hardship in six months or less due to a disability.

The global pandemic brought to light the importance of protecting your income from sudden illness or injury. With disability insurance, you can prevent resorting to emergency withdrawals and stay on track for a secure retirement.

Disability Insurance Awareness Month (DIAM) is an industrywide campaign led by Life Happens, which is designed to highlight the importance of having adequate disability insurance coverage to protect one’s income in the event of a sickness or injury. LIMRA is proud to support the DIAM campaign each year.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257