Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

11/15/2022

November is National Long-Term Care (LTC) Awareness Month, a national conversation on long-term planning in the event that individuals need support with everyday living. Long-term care involves services, both medical and non-medical, provided to people who cannot perform basic activities of daily living such as dressing or bathing. People receive long-term support and services at home, in the community, or in a facility. According to the Department of Health and Human Services, someone turning age 65 today has almost a 70% chance of needing some type of long-term care services and supports in their remaining years.

Yet, LIMRA data indicate many consumers lack a full understanding of what long-term care insurance is. A LIMRA survey reveals that more consumers think they own LTC insurance than actually do. While 29% of survey respondents believe they own some form of stand-alone LTC insurance coverage or combination life/LTC insurance coverage, data shows actual LTC ownership is closer to 3.1%1. Furthermore, a OneAmerica study revealed that 29% of consumers researched LTC planning, but only 16% implemented a plan.

Many consumers mistakenly think their health insurance or Medicaid will cover various aspects of LTC services when that might not be the case. Medicaid coverages, for instance, are limited to certain services and times, vary state-to-state, and may require consumers to limit their assets to qualify. Such misconceptions could cost consumers who have not adequately prepared for long-term care.

“There’s a significant need in our industry to educate more consumers on the importance of long-term care planning,” notes Alison Salka, senior vice president and director of research for LIMRA and LOMA. “Companies that offer understandable solutions may have an advantage when attracting new buyers.”

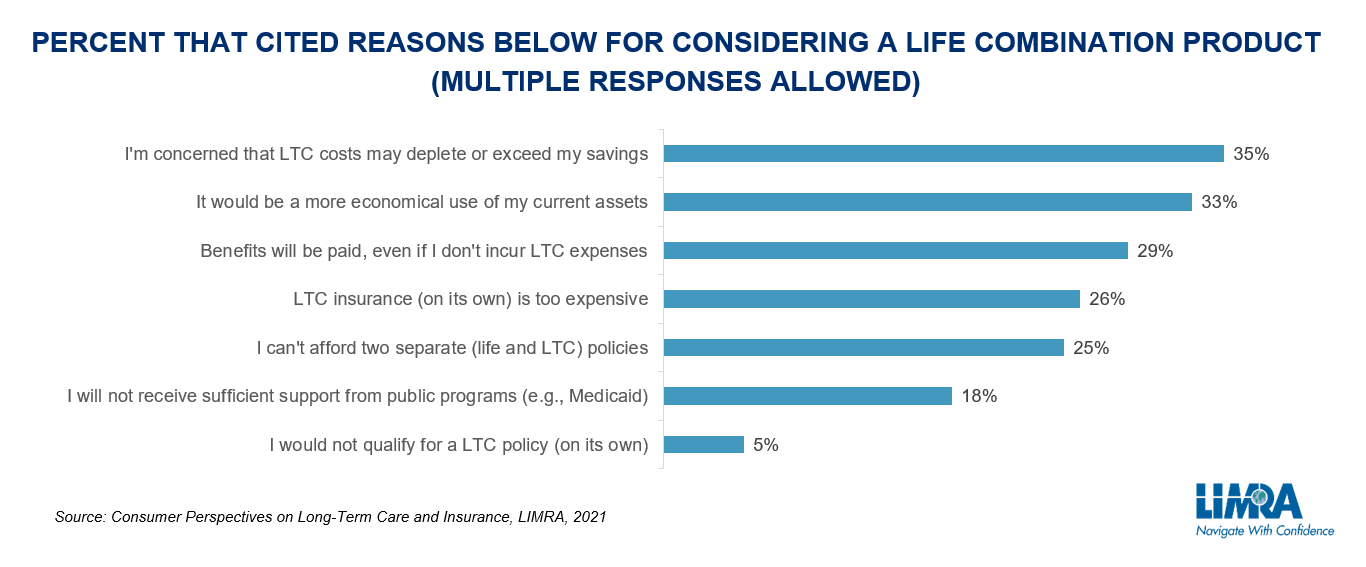

Along with educating consumers on the true nature of long-term care, financial professionals should consider discussing life combination products that provide LTC. A LIMRA survey shows 35% of consumers worry LTC costs will deplete or exceed their savings. Thirty-three percent say a life combination product would be a more economical use of their current assets, and 29% say they like receiving a benefit regardless of whether LTC expenses incurred. Twenty-six percent of consumers also believe stand-alone LTC insurance is too expensive.

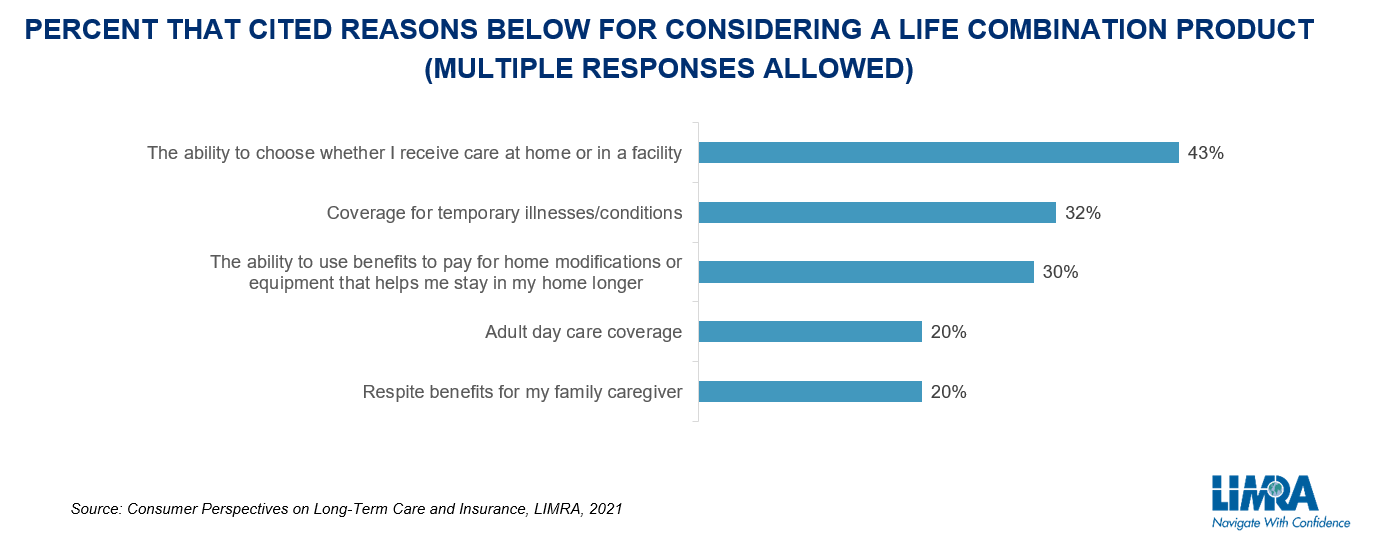

Life combination products have benefits beyond financial, mainly giving consumers a choice in where they receive care and peace of mind for families and caregivers. According to LIMRA, 43% of consumers value the ability to choose whether they receive care at home or in a facility. The OneAmerica report shows 52% of respondents cite removing the burden on their family as the primary purpose of long-term care planning.

Life combination products have benefits beyond financial, mainly giving consumers a choice in where they receive care and peace of mind for families and caregivers. According to LIMRA, 43% of consumers value the ability to choose whether they receive care at home or in a facility. The OneAmerica report shows 52% of respondents cite removing the burden on their family as the primary purpose of long-term care planning.

“Long-term care planning can reduce a lot of financial stress for seniors and their families,” says Salka. “This month, let’s raise awareness about the significant risk of needing long-term care in retirement and help Americans develop a holistic financial plan that includes a strategy to address the potential costs of long-term care services.”

1Based on U.S. Population Estimates, and LIMRA estimates.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257