Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

8/17/2022

Facing increasing challenges to attract and retain talent, agency leaders and recruiters are exploring ways to revitalize their recruiting programs. Recent data from LIMRA highlight two possible tactics: Focus on what current financial professionals find rewarding about the job and improve transparency when discussing the role.

LIMRA surveyed 355 financial professionals with less than five years of experience. The survey reveals financial professionals find the career satisfying. Seventy-nine percent say they are either “very satisfied” or “somewhat satisfied” with their role so far. Additionally, 85% say they will either “probably” or “absolutely” stay in their current position for at least three more years, and 7 in 10 would recommend this career to a young job seeker.

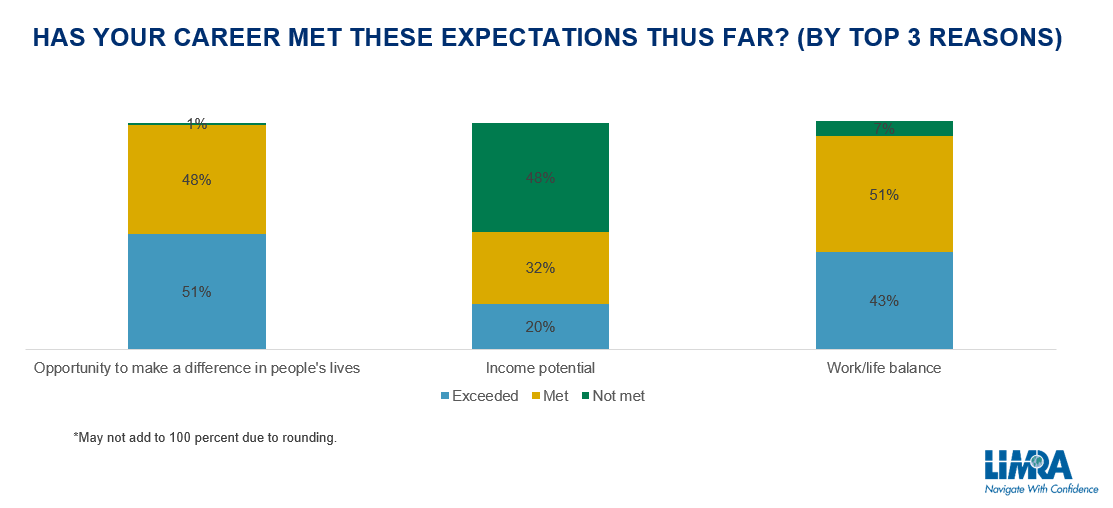

Driving satisfaction is how well the career aligns with financial professionals’ expectations for the role. The top reasons for becoming a financial professional are the opportunity to make a difference in people’s lives (30%), income potential (25%), and work/life balance (17%).

When asked if their career fulfills these expectations, financial professionals say their role meets or exceeds their expectations for making a difference in people’s lives (99%) and work/life balance (94%). When discussing the career with possible candidates, leaders and recruiters should highlight how an overwhelming majority of financial professionals say their career aligns with their goals for positive impact and flexibility.

For financial professionals who selected income potential as their number one reason for joining financial services, 48% say the expectation is unmet. A possible reason could be unanticipated difficulty in building and maintaining a client base.

In general, there appears to be a gap between a candidate’s understanding of the job and reality. Survey respondents commented that recruiters need to be more honest upfront about the difficult aspects of the role.

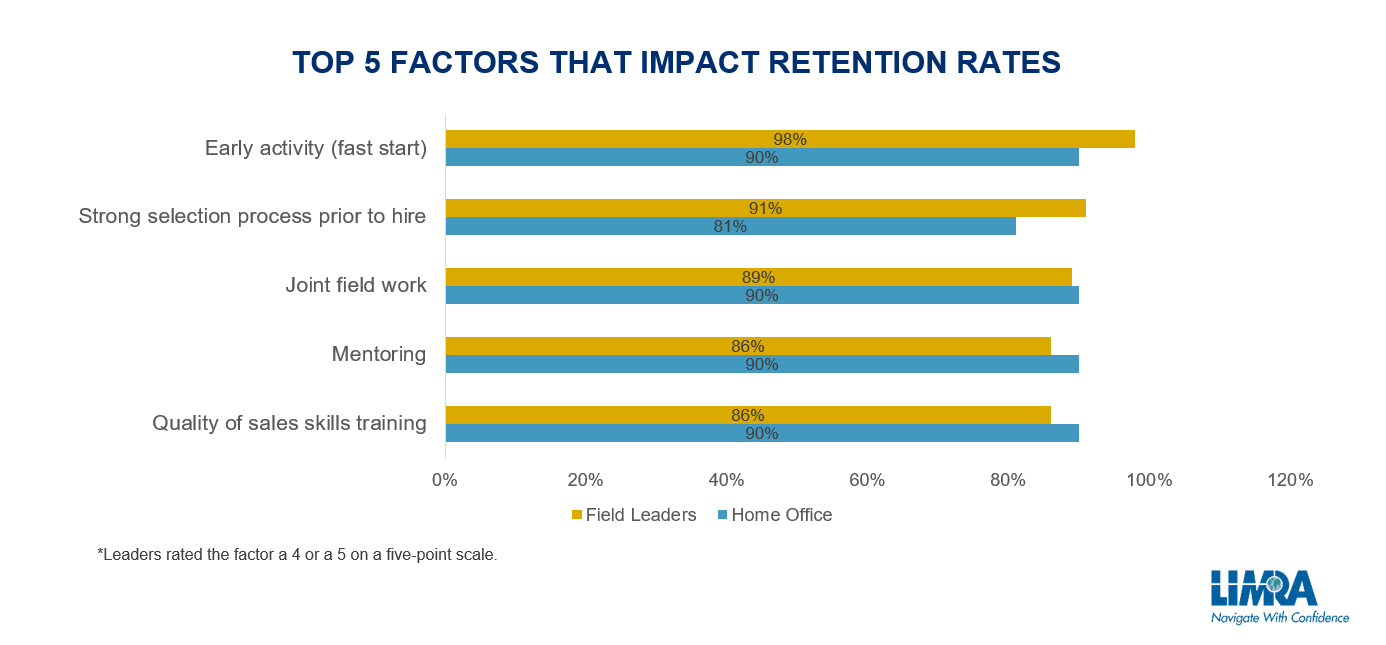

A recent LIMRA and Finseca joint study surveying 56 field leaders and 21 home office leaders found that field and home office leaders indicate the need for more transparency in recruiting conversations with candidates. Home office leaders agree that new financial professionals may not clearly understand the challenges involved with the role, while field leaders cited career mismatch as a major cause of financial professional termination (other factors include personal characteristics, following systems and processes, and lack of early activity). LIMRA data cited in the report shows that candidates brought in by recruiters have lower first-year retention rates compared to sales managers and office heads (44% versus 50% and 55% respectively).

Comments from both field and home office leaders included:

“It’s important that recruiters’ narratives align with what a new candidate will actually be doing,” said Margaret McManus, Ph.D., assistant vice president for talent solutions, LIMRA and LOMA. “Providing a more balanced view of the role and encouraging a candidate’s self-awareness could lead to better retention outcomes.”

Heightened transparency in recruiting will create an environment where new financial professionals can have greater job satisfaction, increasing the likelihood of them remaining with a company. Together, this may help distribution leaders and recruiters better assess and onboard qualified candidates who will succeed in the long run.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257