Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

3/23/2022

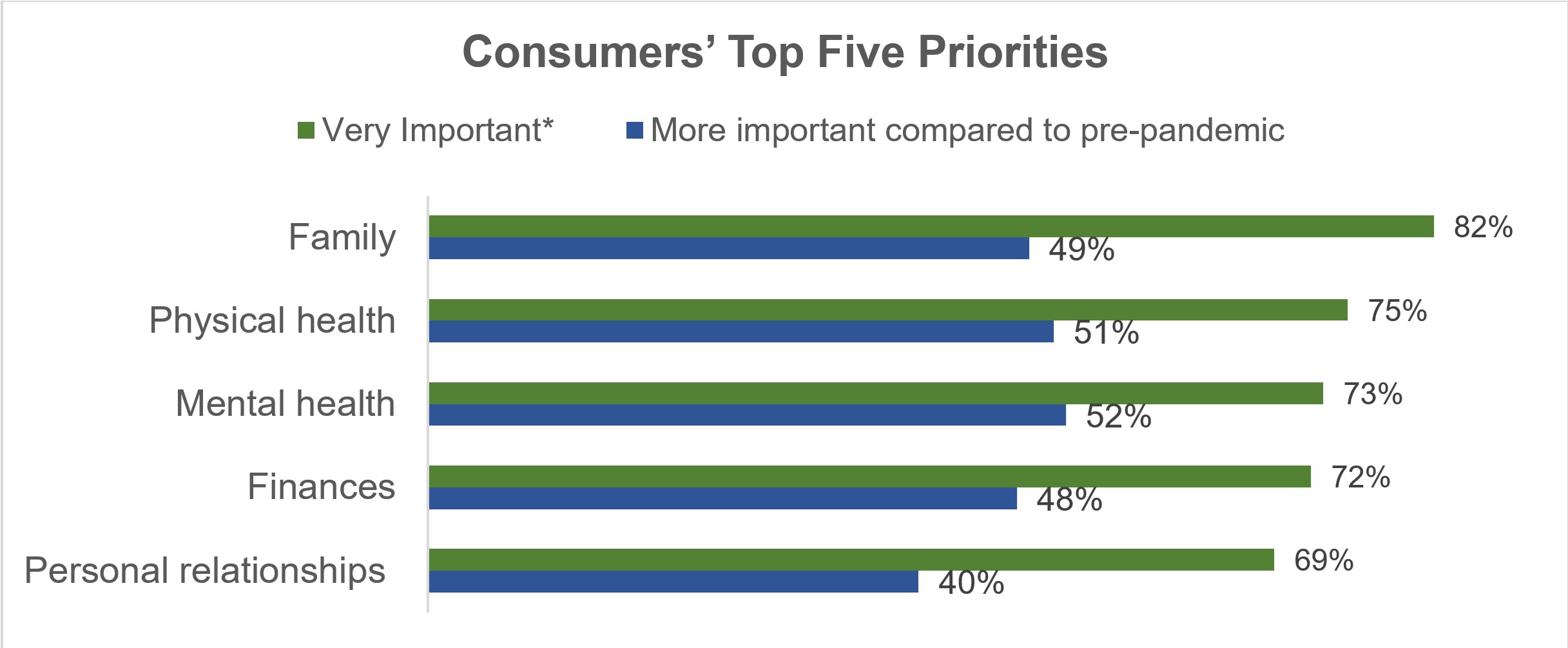

In light of the pandemic and other financial challenges, many Americans view family as more important today than before the pandemic. According to LIMRA’s latest Consumer Sentiment Survey, 82% of consumers give family a high rating when presented with a list of things that are priorities for many people. Nearly half of Americans (49%) see family as more important today than pre-pandemic. Additional priorities for Americans that are more important today than before the pandemic include physical health, mental health, finances, and personal relationships.

*Rated 8 – 10 on a 0 – 10 importance scale

The increased importance of family today versus before the pandemic parallels a greater interest in and demand for life insurance. According to LIMRA’s and Life Happens’ 2021 Insurance Barometer Study, 31% of consumers said they were more likely to buy life insurance due to the pandemic. We are seeing this translate into record individual life insurance sales with the highest growth recorded since 1983.

“Four in 10 people who witnessed their friends and family members become severely sick from COVID-19 reported higher levels of stress and financial concerns,” noted Jennifer Douglas, research director at LIMRA. “Today, more Americans are worried about providing their families with a strong financial safety net, so the impact of external variables, like the pandemic or the economy, can be mitigated.”

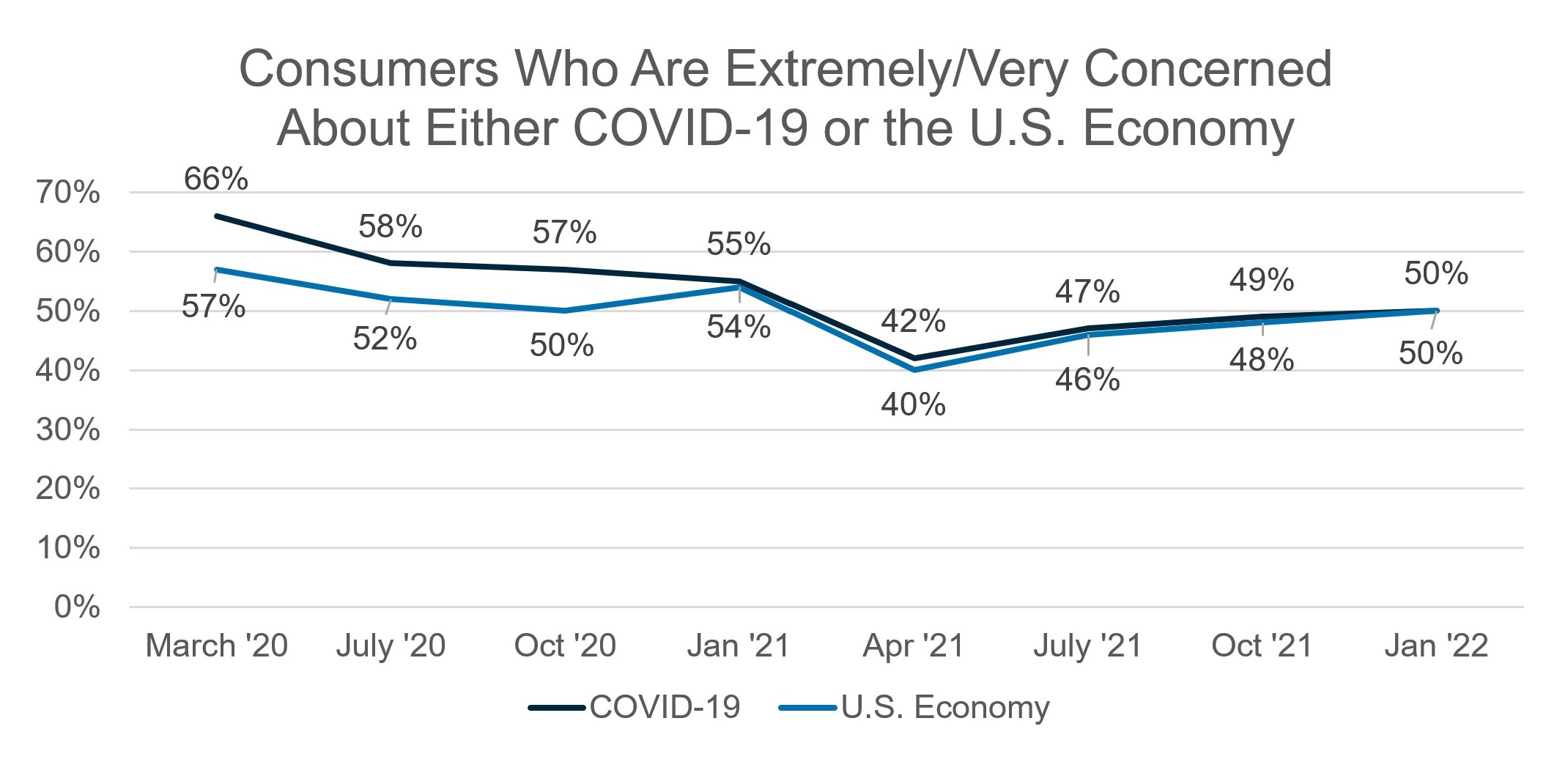

Data from January 2022, coinciding with the peak of the Omicron variant, showed concern for both the pandemic and the economy increased to 50%, which were 8 and 10 percentage points higher, respectively, than in April 2021. In addition, confidence in a “return to normal” waned in January 2022 with just 3 in 10 believing life was “back to normal” down 6 points from October 2021.

Source: Consumer Sentiment in the Time of COVID-19, January 2022, LIMRA

Despite concerns about COVID-19 and the economy, consumer confidence in insurance companies remains high. In January, 84% of consumers had at least some confidence in insurance companies, with 1 in 3 adults having “quite a bit” or an “extreme amount” of confidence. This represents a five-point increase from two years ago.

“Life insurance provides consumers peace of mind about their loved ones,” says Douglas. “Their heightened confidence in insurance companies speaks volumes about how our industry aligns with consumers’ highest priority.”

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257