Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

2/1/2023

Recent surveys from LIMRA and NAILBA revealed that more intermediaries – broker general agencies (BGAs) and independent marketing organizations (IMOs) – reported larger revenues in 2022 over 2021. About 50% of intermediaries reported revenues of $5 million or more in 2022 compared to just 35% in 2021, a 15-point increase.

Multiple factors could explain the stark jump in reported revenue growth: increased sales in 2021, and mergers and acquisitions. Yet, another possibility points to intermediaries prioritizing expanding their advisor networks. In both 2021 and 2022, BGAs/IMOs ranked growing their network of producers as the number one business priority (77% and 82%, respectively).

“The increase in reported revenues could be related to BGA/IMOs pursuing their network growth goals,” noted Peter Dewitt, assistant research director for LIMRA. “The intermediaries are looking for revenue growth by more independent producers selling through them.”

As network growth remains a significant business priority for intermediaries, these two advisor trends could affect their success and ultimately their revenue.

Less seasoned independent producers are more likely to offer financial planning services than more experienced independent producers (49% versus 35%), according to LIMRA and NAILBA data. Seeking to grow their businesses quickly, newer producers would want to offer clients diverse services that address a broad range of financial concerns.

“Less tenured producers are more apt to adopt this comprehensive approach to serving their clients,” explains DeWitt. “The holistic approach gives the producers a better sense of the client’s overall financial picture, and they can offer a broader range of services to meet the client’s current needs. This opens an opportunity for building a lasting and rewarding producer-client relationship.”

Fifty-five percent of BGA/IMOs agree that contracting and working with investment-focused producers will provide significant growth for intermediary businesses.

Currently, only 37% of BGA/IMOs offer financial planning services. Yet, 74% of BGA/IMOs say at least 1% to 5% of their revenues will come from financial planning and wealth management services in the next three years; 31% expect 10% or more of their revenues to come from these services.

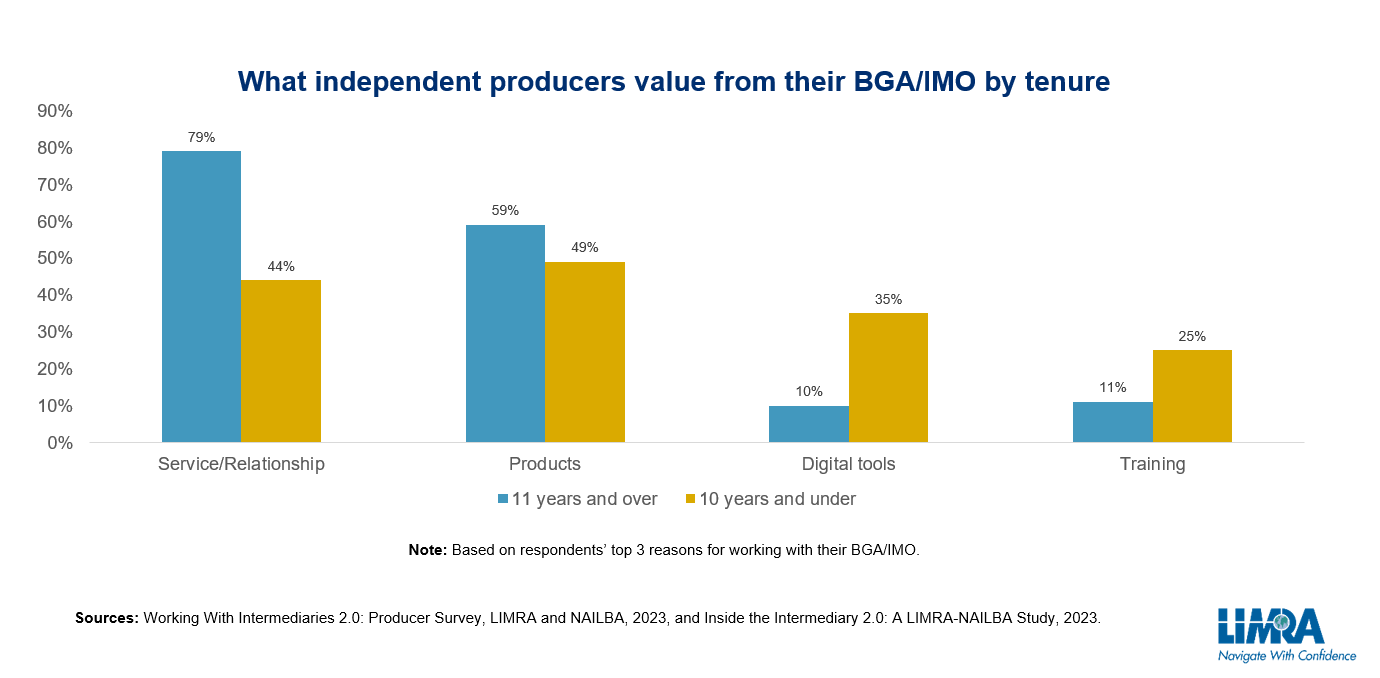

Independent producers who are new to the business are looking to their intermediaries for digital tools and training. Most independent producers cite service/relationships and product offerings as the major reasons for working with a BGA/IMO. However, 35% of newer independent producers say digital tools are a major reason, with 25% citing the need for training.

From the BGA/IMO perspective, technology as a business priority jumped up seven percentage points in 2022, from 44% to 51%. Since less tenured producers value technology and training, what BGAs/IMOs can provide to producers could determine whether they do business with them.

For BGAs and IMOs to continue increasing their advisor networks, and ultimately their bottom line, they will need to increase the digital tools and training they offer, especially those that support holistic financial planning and wealth management services. This will help experienced and inexperienced independent producers close sales and increase their book of business.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257