Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

4/3/2024

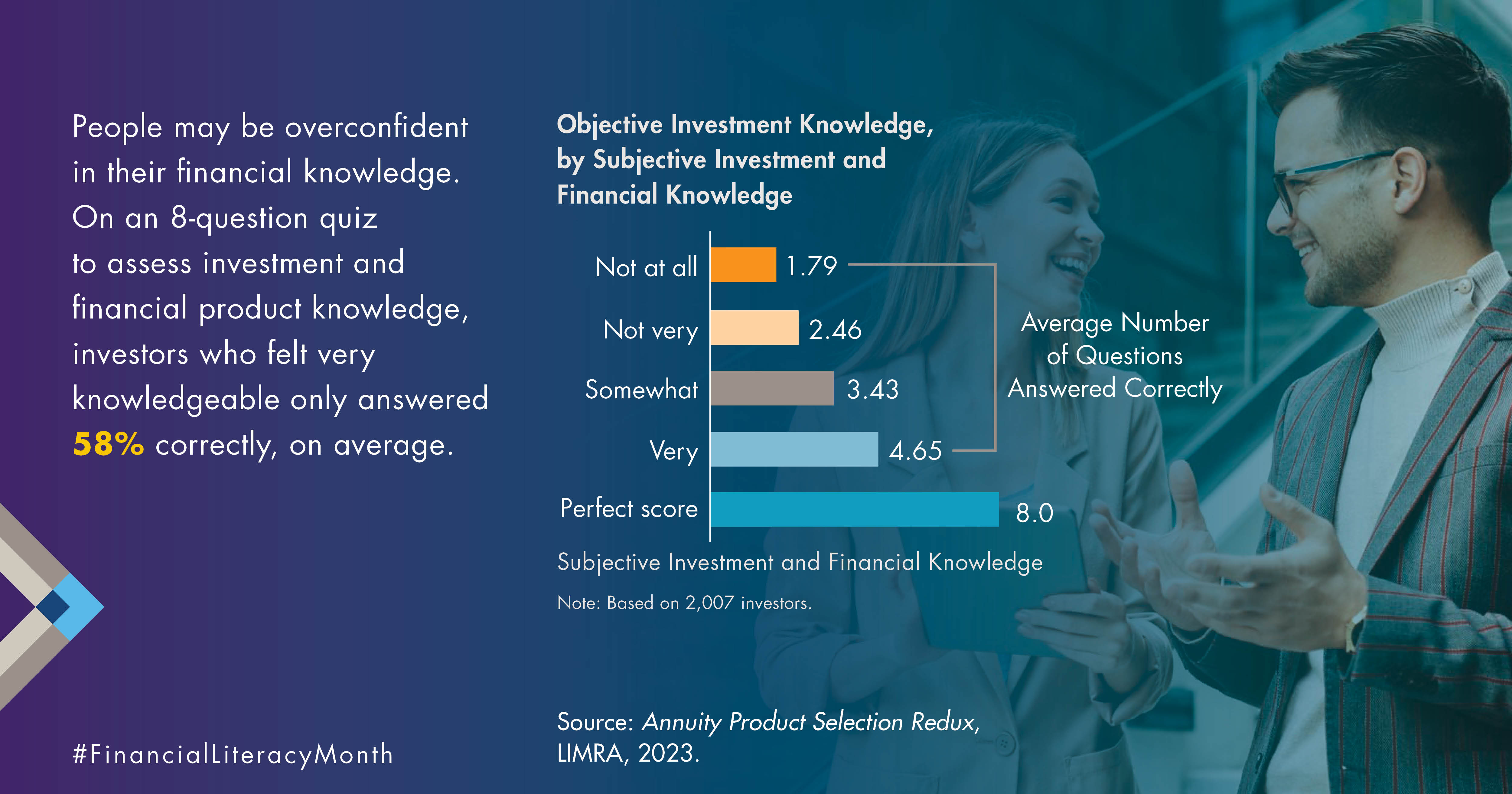

Financial literacy is understanding financial concepts and products to make wise decisions with one’s money. Being financially literate can lead to feeling more financially secure and able to withstand life’s unexpected expenses.

Ideally, financial literacy should begin at home. According to LIMRA, about 8 in 10 Gen Z and Millennial adults said their parents discussed finances with them while they were growing up. Younger adults are more confident in their understanding of financial matters than older generations.

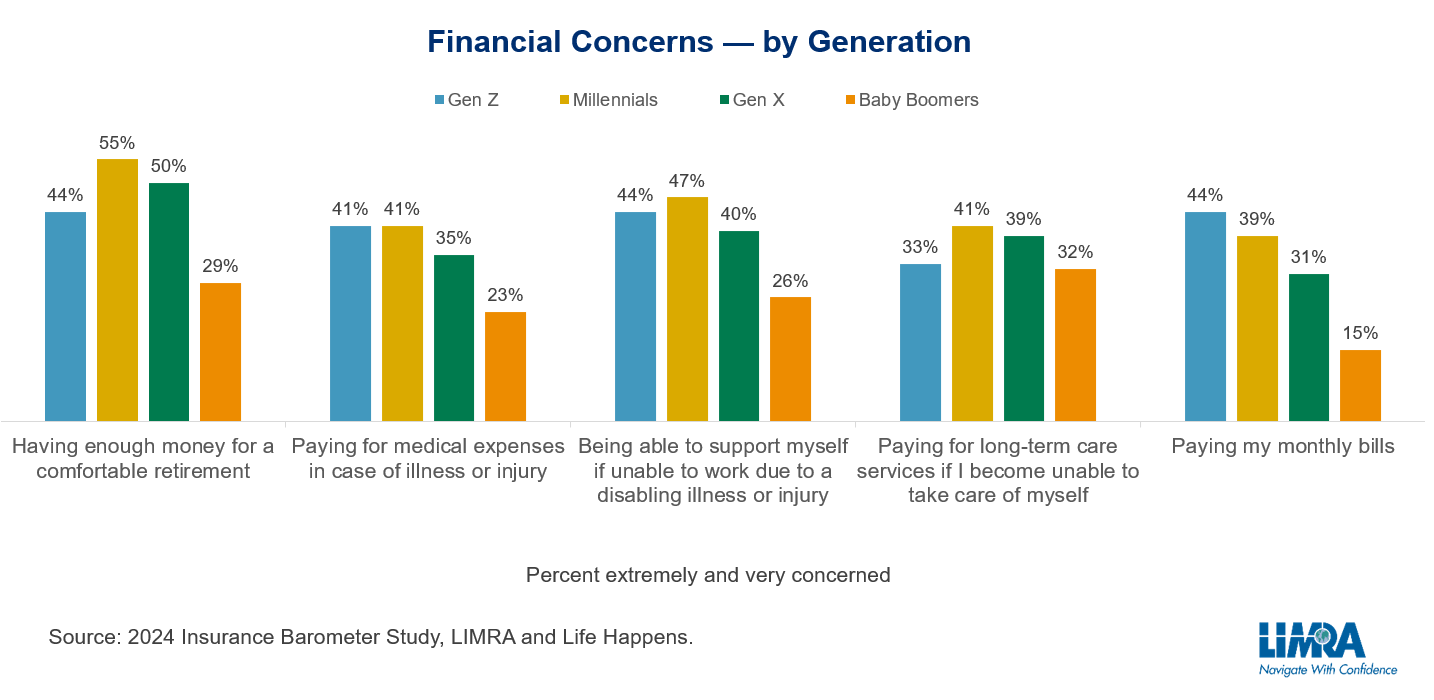

Yet, young adults feel less confident about their financial security. Data from the 2024 Insurance Barometer Study show that young adults report higher levels of financial concern than older generations about paying for medical expenses, supporting themselves if they are unable to work, and paying monthly bills. Time and life stages are significant here, as older adults benefit from having more life experience and time to build up their assets.

Additionally, more of today’s young adults are reaching major life milestones — marriage, children, or home ownership — much later in life than their parents did. Life events often jumpstart the purchase of financial products like life insurance. The Pew Research Center finds that 25-year-olds today were less likely than 25-year-olds in 1980 to be: married (22% versus 63% respectively), have children (17% versus 39%), or live somewhere independently of their parents (68% versus 84%).1

Arguably, young adults also face a tougher financial landscape today than their parents. The average cost of higher education, for example, more than doubled over two decades from $152,716.89 in 2004 to $320,431.43 (adjusting for inflation), according to the Bureau of Labor Statistics.2

Home prices nearly doubled over the past two decades as well – the Federal Reserve Bank of St. Louis reports the median home sales prices in the fourth quarter of 2023 reached $417,700.3

Young adults would, therefore, benefit greatly from additional financial knowledge to help them successfully navigate the additional financial challenges they face. Two ways to help young people navigate today’s financial landscape are through workplace benefits and financial professionals.

Workplace benefits programs can improve financial wellness:

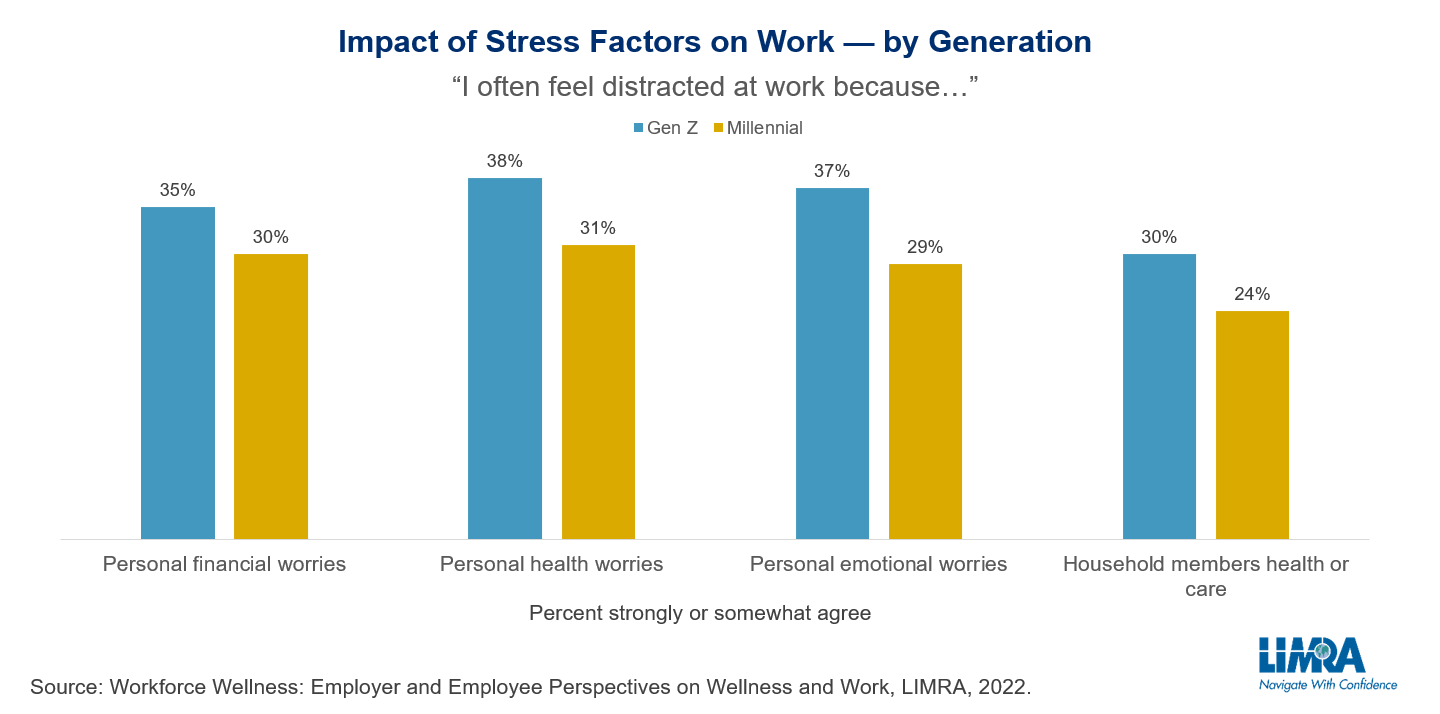

More than 30% of Gen Z and Millennials say their personal financial worries have been a distraction at work. More financial education can help workers address their financial challenges, reduce stress and improve employee focus and productivity.

LIMRA data shows that almost 7 in 10 young adults agree their employer should provide services that address financial stress. Additionally, 67% of Millennials and 64% of Gen Z workers agree their employers should offer employees financial education.

Financial professionals can boost financial literacy both individually and broadly:

Financial advisors can help young adults build healthy money management habits such as budgeting, saving for retirement, or funding an emergency savings account, while also demonstrating how products like life and disability insurance offer protection against the unexpected. A LIMRA consumer study shows that more than a quarter of young people say they value a professional who takes a holistic approach to their financial planning, addressing all areas of a customer’s financial situation.

Financial professionals can also use social media to promote financial literacy to a broader audience of young adults. Visual, educational, and engaging content can make it easier for young people to connect with financial information. Among those who use social media for financial information, LIMRA data show the top 3 social media sites for young adults to use are:

By helping young adults improve their financial literacy, they may take more action toward building a secure future regardless of the life milestones they achieve. A financial professional, for example, could highlight how a life insurance policy can be more affordable the younger and healthier a person is.

This month is a great opportunity for the industry to help improve consumers’ financial knowledge and encourage them to take steps to build toward a secure financial future. The best time to learn financial literacy was yesterday, the next best time is today.

Show your support for Financial Literacy Month:

Educate and engage your consumers this month with our social media factoids. Download static posts below:

To download the animated content, click the share icon

on the bottom right and then select "download"

1“Most in the U.S. say young adults today face more challenges than their parents’ generation in some key areas,” Pew Research Center, 2022.

2 Price Inflation for College Tuition and Fees Since 1977, Consumer Price Index, U.S. Bureau of Labor Statistics.

3 Average Sales Price of Houses Sold for in the United States, Economic Research, Federal Reserve Bank of St. Louis.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257