Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

4/4/2024

More than half say they’d be interested in taking a blood test to screen for cancer

If you could take a blood test to detect certain types of cancer, would you take it? If it was offered through your life insurance company, would you be confident that your information would be kept private?

The multi-cancer early detection (MCED) test is a blood test that can simultaneously screen for multiple types of cancer in seemingly healthy people. It can help detect cancer in parts of the body not easily accessible through a physical exam or biopsy.

This type of testing may be particularly beneficial in detecting cancer in young adults. According to the American Cancer Society, younger adults are the only age group with an increase in overall cancer incidence between 1995 and 2020 — the rate has risen by 1% –2% each year during that time period.

LIMRA’s U.S. Consumer Sentiment surveys — conducted in July and October 2023 — explored consumers’ opinions regarding MCED tests, both in general and when offered by life insurance companies.

Many consumers are unfamiliar with the MCED tests. Only 10% are either very familiar or somewhat familiar, with 18% saying they’re slightly familiar and 72% being not at all familiar with these tests.

Despite this lack of knowledge, 57% of adults said they would be interested in taking a blood test to screen for cancer.

Few Companies Offering MCED Tests

In May 2022, Munich Re Life US and GRAIL, LLC, partnered to bring GRAIL’s MCED test to the U.S. life insurance industry, promoting proactive screening among eligible life insurance policyholders. Later that year, John Hancock Insurance began offering access to GRAIL's Galleri® MCED test to a pilot group of existing customers through the John Hancock Vitality Program.

Access to MCED tests could potentially impact consumers’ interest in life insurance. Nearly half (46%) of consumers say having access to early detection of cancer would make them more interested in life insurance. Interest is even higher among Millennial (60%) and Gen Z consumers (50%), who may be less likely to qualify for traditional cancer screenings.

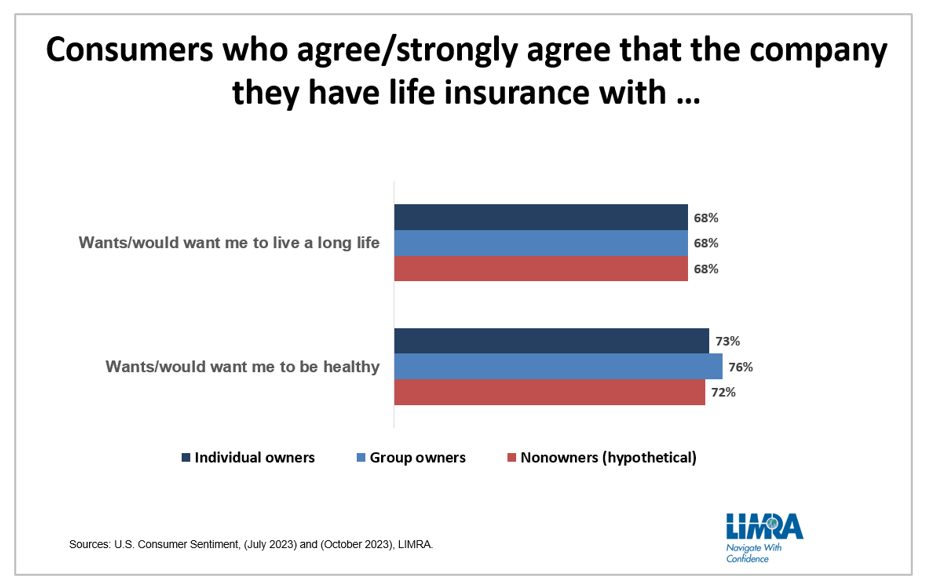

Many consumers understand that life insurance companies have a vested interest in their customers’ well-being. Two in three customers agree that they have a life insurance company that wants/would want them to live a long life. In addition, 3 in 4 customers say their life insurance company wants/would want them to be healthy.

Consumers with individual life insurance have more favorable opinions than non-owners, especially when it comes to trusting the carrier with their medical information: Half of insureds believe their medical information would be safe and not compromised with a life insurer compared with 40% of those without coverage.

Life insurance companies offering MCED tests to their current customers need to prioritize transparency in their communication. By openly conveying that these tests are intended to promote the well-being of policyholders, with no impact on premiums or coverage, insurers can foster trust. Moreover, acknowledging the carrier’s own benefits derived from delayed claims can further enhance transparency and establish a mutually beneficial relationship focused on enhancing health outcomes, creating a win-win situation for both the insurer and their customers.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257