Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

3/5/2024

Women’s History Month is a time to recognize women's contributions to American history. As the life insurance industry, we can use this time to continue helping more women build a financially secure future with life insurance. Here are three reasons why the life insurance industry should continue to engage the women’s market:

1. 54 million women say they need (or need more) life insurance.

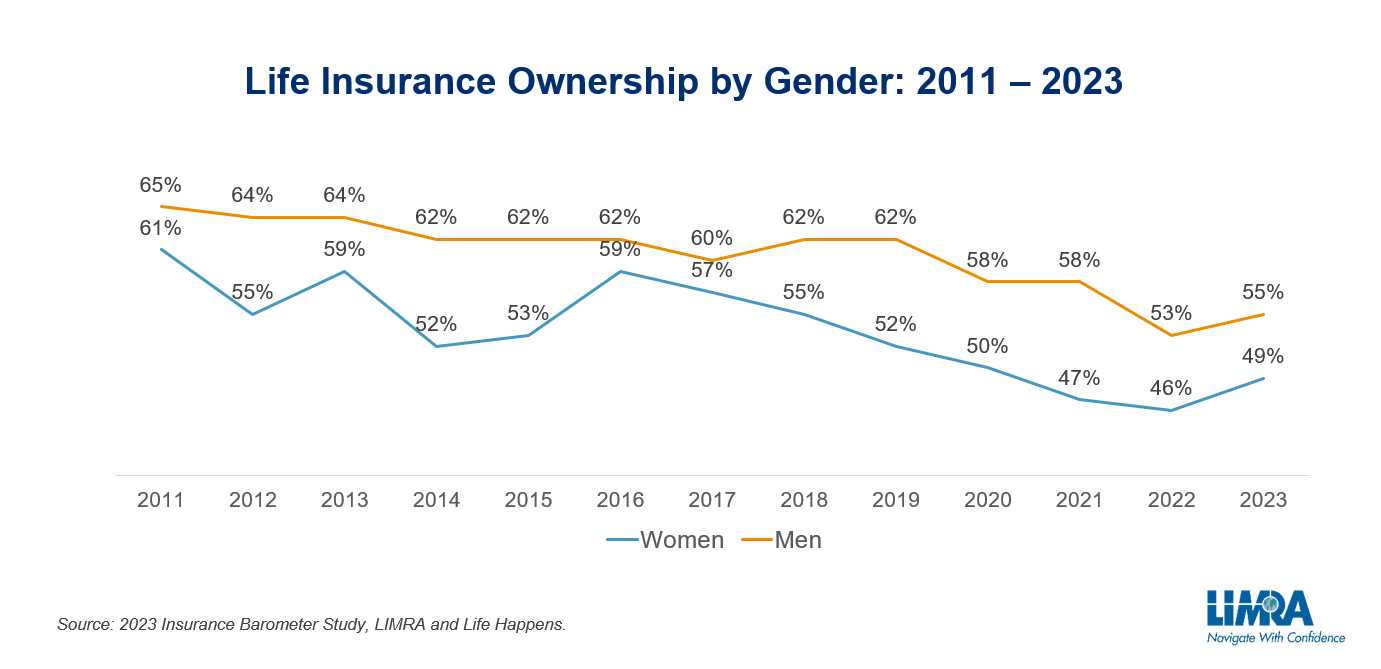

Consistently over the past 13 years, a greater proportion of men than women report owning life insurance. According to LIMRA’s 2023 Insurance Barometer Study, 55% of men said they had life insurance coverage, versus 49% of women. This does not mean women don’t understand the value of life insurance. In 2023, 44% percent of women — representing 54 million women — acknowledged they had a coverage gap, and 4 in 10 said they planned to buy coverage within the year.

2. Life insurance could address the financial concerns that many women share.

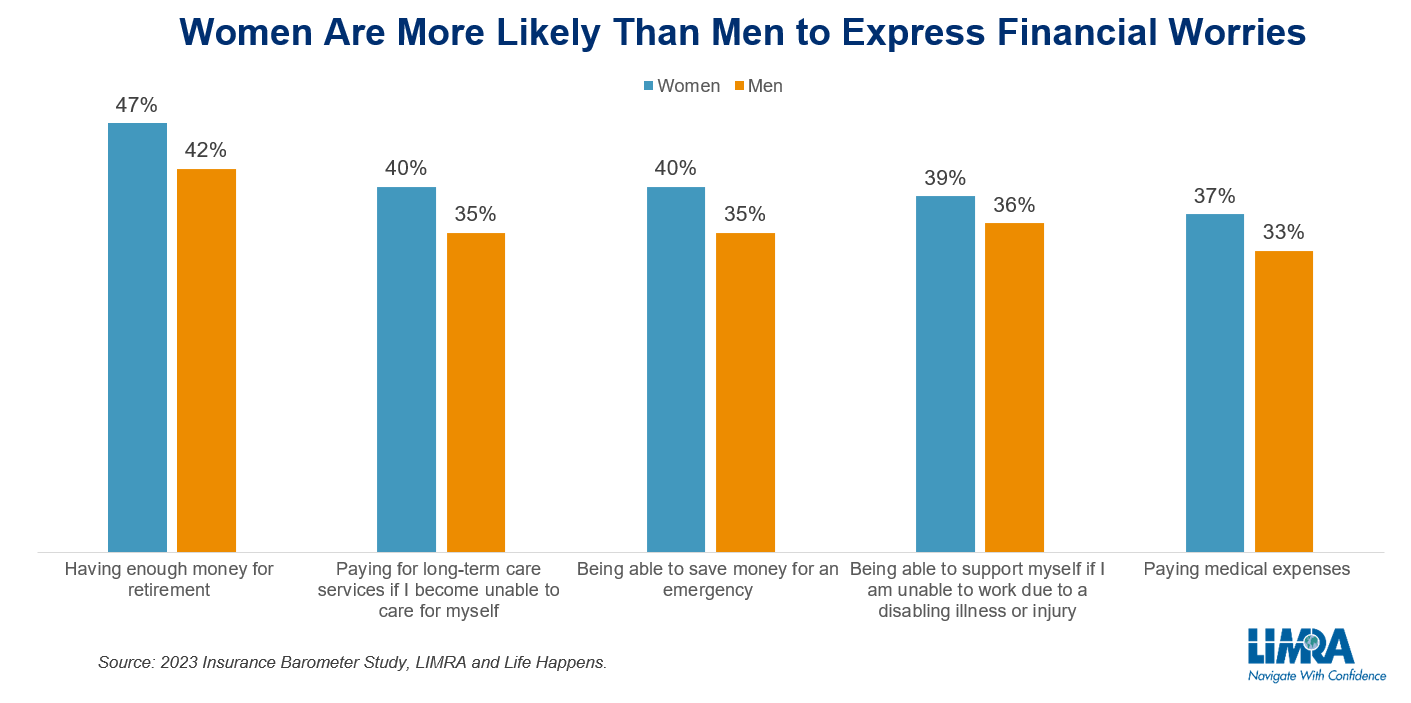

LIMRA research shows women consistently have greater concerns about their financial security. From having enough money saved for retirement or building an emergency fund to paying their bills and supporting themselves if they can no longer work, women are more likely than men to say they are very or extremely concerned about their ability to meet these financial risks.

This provides an opportunity for the industry — insurers and financial professionals — to show how life insurance can help alleviate some of these financial concerns by illustrating the different uses of a life insurance policy. According to LIMRA data, women say they would use the cash value of a life insurance policy to cover burial experiences (57%), offset financial emergencies (30%), help with retirement savings (29%), and build multi-generational wealth (25%) among other uses.

3. Women are searching for a financial advisor.

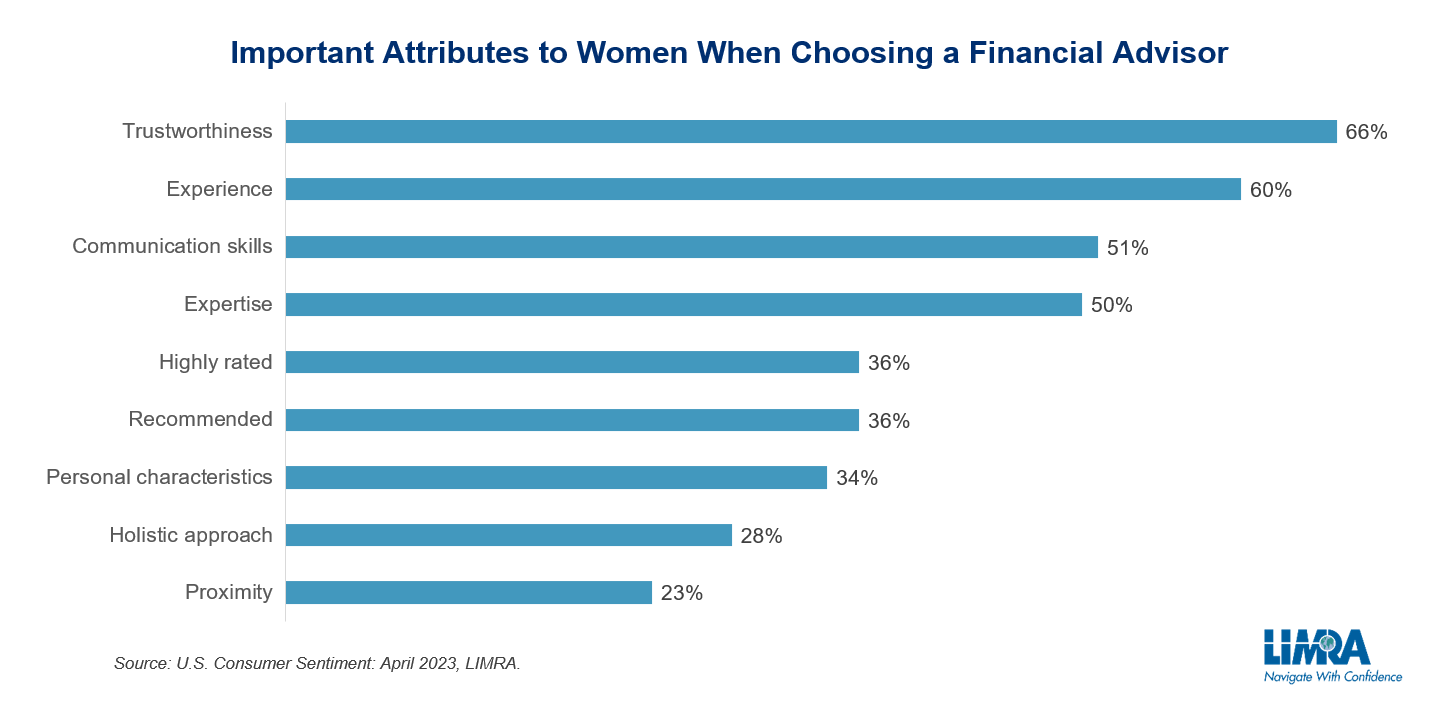

One-quarter of women are looking for a financial advisor. For single mothers, that percentage increases to 34%. LIMRA studies suggest women tend to trust advisors, but they want a professional who understands their needs.

A LIMRA survey shows women value trustworthiness (66%), experience (60%), and communication skills (51%) as the most important characteristics for selecting a financial professional. Ultimately, they want someone to help them succeed financially while not taking advantage of their lack of financial confidence.

A financial professional can help women overcome common misconceptions that deter many women from obtaining life insurance coverage. According to LIMRA research, common misconceptions women have about life insurance include:

As mentioned earlier, insurers and advisors can debunk these misconceptions by talking about the different ways life insurance can support their financial goals. Two ways to approach this include building a well-resourced website and maintaining an active social media presence.

Nearly 3 in 10 women (29%) say they prefer to buy life insurance from a company’s website. LIMRA recommends companies’ websites provide robust tools (such as policy calculators) and educational resources (blogs, visual aids, etc.) that can help women better understand the different types of life insurance products as well as how these products would support their financial goals.

Insurers and financial professionals with an active social media presence can help educate women and provide a platform where they can ask their questions more directly. The top three sites for women who use social media to learn about financial topics are:

There are several reasons for our industry to engage in the women’s market. Women recognize their insurance gaps and are looking for a financial advisor to help them address their needs. By meeting women where they are and listening to their needs, financial advisors can help more women protect their families’ financial security with life insurance.

To learn more about women and their perceptions about life insurance, 54 Million: The Women's Market Represents a Big Opportunity for Life Insurers.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257