Media Contacts

Helen Eng

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834

LIMRA.com and LOMA.org will be off-line for scheduled maintenance February 21, 2026 from 6 - 10 a.m. ET.

9/25/2025

Over the past four years, Hispanic Americans experienced a sharp decline in life insurance ownership. The 2025 Insurance Barometer Study found that life insurance coverage among Hispanics dropped eleven percentage points from 51% in 2021 to just 40% today, lower than any other ethnicity. Half of Hispanic Americans — approximately 20 million adults — say they don’t have enough life insurance to protect their loved ones or meet their financial goals.

How can life insurers reverse the decline?

Focus on how life insurance can protect families.

For many Americans, family is a driving force behind major financial decisions. The idea of familial protection among Hispanic Americans, however, has strong cultural roots that insurers can draw from.

In a separate qualitative LIMRA study on Hispanic Americans’ perspectives on life insurance, respondents shared that financially providing for the family — including extended family — is a personal responsibility that’s passed down from generation to generation. Therefore, Hispanic Americans take the act of saving money intentionally. The goal is to have enough finances saved to respond to emergencies and health issues without burdening loved ones later on in life.

"My husband and I support everyone [kids, my parents, and brother] in this list in one way or another. especially my parents, financially as well. They live 1000 miles away, and my mom's got dementia now, and it's just been a rough road getting everything situated from afar.” — Cristina, Non-Owner, English

“I send my parents money on a biweekly basis to help support them when it comes to house payments, groceries, or other necessities. At times, I provide my siblings with meals and gifts. I also provide them with money when requested” — Lizette, Non-Owner, English

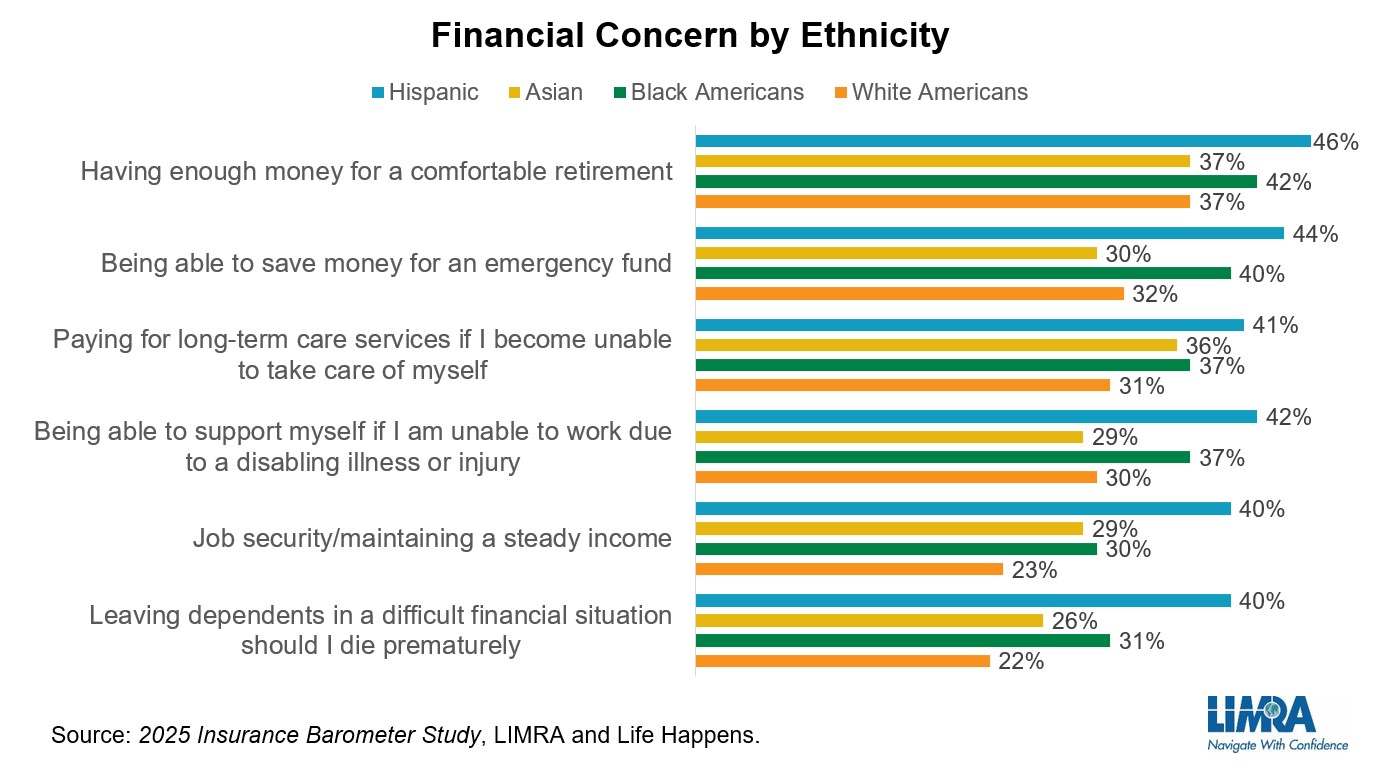

Interestingly, the fact that Hispanic Americans have elevated levels of financial concern could illustrate the influence of familial responsibility. According to LIMRA data, 40% of Hispanic Americans are concerned about leaving financial dependents in a difficult situation should they pass away, which is notably higher than other demographics — Asian Americans (26%), Black Americans (31%) and White Americans (22%).

Furthermore, 29% of Hispanics say their families would face financial hardship within one month should the primary wage earner die unexpectedly.

Because familial protection is deeply ingrained in Hispanic American culture, insurers should demonstrate how life insurance can contribute to securing their family’s financial future and legacy building.

Break barriers preventing Hispanics from purchasing life insurance.

Many Hispanic Americans face common misconceptions about life insurance — chief among them is affordability. In fact, 41% believe life insurance is too expensive, which contributes to lower ownership rates.

There is also a lack of familiarity with life insurance. Only 27% of Hispanic Americans consider themselves very knowledgeable about it, and for many, it’s a topic that was rarely discussed in the home. This leads to uncertainty around pricing, coverage options, and the overall value of life insurance, often causing it to be deprioritized in favor of more immediate financial needs.

“My main concern is how much an extra life insurance policy would cost. What if I can’t afford it?” — Shannon, Non-Owner, Spanish

Another hurdle is the complex purchase process. Over a quarter of Hispanic Americans say they’re unsure what type of policy to buy or how much coverage they need.

“In the past what stopped me was not understanding the policies, coverages, and limitations. The language used always seems convoluted and confusing.” — Marissa, Non-Owner, English

This presents a clear opportunity for insurers: simplify the process. By offering clear, jargon-free explanations and personalized guidance, insurers can help Hispanic Americans feel more confident and informed. Making resources available in Spanish and providing access to bilingual advisors can further bridge the gap — turning hesitation into action.

Be accessible and build trust.

In spite of knowledge gaps, Hispanic Americans generally have positive emotions about life insurance. According to LIMRA research, Hispanic Americans shared that they would feel a sense of relief and peace of mind when considering owning an insurance policy.

“It would give peace of mind. To feel protected and my family taken care of.” — Mark, Non-Owner, English

Yet if the insurance industry wants to better engage with Hispanic Americans, they should focus on building trust with this demographic. Insurers can start by inviting the family into conversations about life insurance. As mentioned earlier, life insurance was likely not discussed by many Hispanic Americans. Inviting spouses, parents, or adult children to informal sessions can help normalize the conversation and create transparency.

Additionally, show how life insurance aligns with cultural values of familial protection. Present life insurance as a means of legacy planning and securing one’s family rather than preparing for end-of-life financial coverage.

“To me, leaving a legacy means making sure my daughters can do whatever they want in life without having to worry about me... Generational wealth isn’t just about money - it’s about giving them freedom, choices, and never becoming a burden.” — Kathy, Owner, Spanish

As we honor Hispanic Heritage Month alongside Life Insurance Awareness Month, the industry has a unique opportunity to better connect with Hispanic American families. Rooted in values of saving, caregiving, and legacy, Hispanic Americans are actively seeking tools and guidance to protect what matters most. Building trust, demonstrating cultural understanding, and providing education, life insurers can empower more Hispanic Americans to create a secure financial future for generations to come.

To learn more about the Hispanic American market for life insurance, visit: Bridging the Gap: Empowering Hispanic Consumers in the Life Insurance Market

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834