Media Contacts

Helen Eng

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834

LIMRA.com and LOMA.org will be off-line for scheduled maintenance February 21, 2026 from 6 - 10 a.m. ET.

9/2/2025

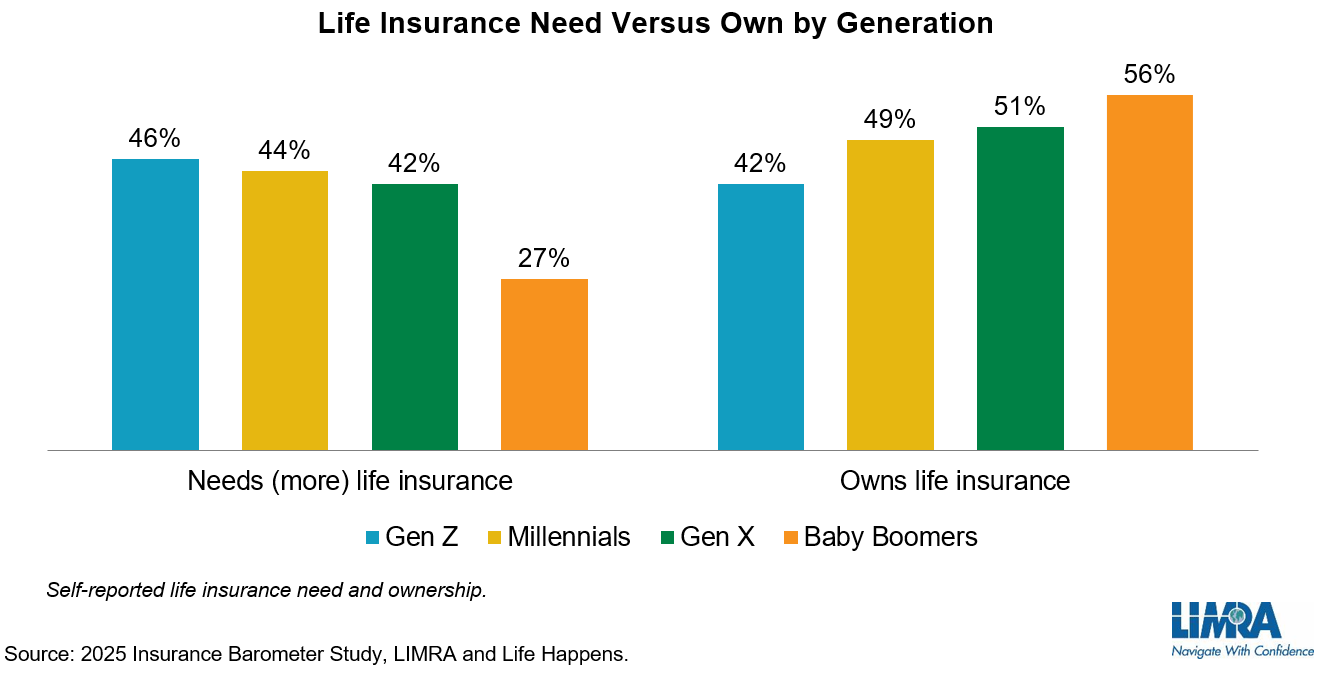

Young adults are entering their prime working years and reaching major life milestones — buying a house, marriage and parenthood — making them ideal candidates for life insurance. The 2025 Insurance Barometer Study shows Gen Z and Millennial adults are the most likely to say they need life insurance, or more of it, yet the least likely to believe they have enough coverage.

Across LIMRA research, we observed a major culprit that consistently prevents young consumers from purchasing life insurance: price misconception. Simply put, young adults don’t believe they can afford an insurance policy.

Our recent LIMRA qualitative study on young adults’ perceptions of life insurance revealed that some expect life insurance premiums to be similar to auto insurance, which can be five times or more as expensive for healthy young adults. Because they believe life insurance is unaffordable, they likely will not prioritize it. As one participant states:

“Perceived price has kept me from purchasing life insurance because I’ve heard that it can be expensive, so I haven’t even made it a priority because of that.” — Alanna, non-owner, age 35

In fact, 37% of Gen Z adults and 46% of Millennials say one of the most common reasons they haven’t purchased coverage is because it is too expensive. When asked to guess the premium of a $250,000, 20-year, level-term policy for themselves, healthy adults ages 18 – 30 overestimated the median cost about 10 – 12 times more than its true cost.

Yet, young adults who own life insurance — like the participant below — shared their pleasant surprise at how affordable their monthly premiums were.

“I would say the amount that I paid for life insurance every month is actually a little bit lower than I even thought it would be…. So, I would say I’ve been surprised, but in a good way.” ― Michelle, owner, age 32

It’s clear from the research that, if life insurers offer more transparency around the true cost of a life insurance policy, it will help young adults overcome their trepidation about the cost and prompt them to buy the coverage they need to protect their loved ones.

In today’s connected world, there are more tools than ever to educate consumers —especially through their smartphones. Social media is a powerful channel, with 80% of Gen Z and Millennials using it to research financial products. YouTube, Facebook, and Instagram are their top three go-to platforms.

But it’s not enough to simply push information. Young adults crave authenticity and clarity, not scare tactics or sales pitches. In LIMRA’s qualitative study, young adults shared the types of life insurance content that would deeply resonate with them:

Additionally, AI tools are emerging as valuable resources for education. Nearly 6 in 10 young adults say they would use an AI tool to research life insurance. According to LIMRA research, young adults say comparison and budgeting tools would provide clarity on the best products and how much insurance they can afford. Chatbots and video can also help explain life insurance in simple terms.

“More user-friendly, side-by-side comparison tools could have helped me more easily evaluate different providers and options, reducing the time spent comparing policies.” ― Patrick, owner, age 32

“It would be nice to have a quick educational course about life insurance to ensure consumers are educated and understand the basics of life insurance. For those that aren't familiar, there are some terms that might cause confusion.” ― Christian, owner, age 28

Life Insurance Awareness Month is an excellent time to elevate the importance of life insurance ownership. It could also be an opportunity for the industry to reshape how they connect with young adults. By investing in educational tools that make it easy to dispel myths and misconceptions, the industry can foster a generation of informed, confident buyers who are ready to protect their families.

At LIMRA, we are proud to celebrate Life Insurance Awareness Month. To help educate and engage your consumers this September, please visit our 2025 LIAM page for curated resources, fact-sheets, and thought leadership.

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834