Media Contacts

Helen Eng

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834

6/24/2025

The workplace benefits industry continues to seek new ways to personalize benefits offerings to address the unique needs of five generations in the workforce, according to the latest LIMRA-EY 2025 Harnessing Growth in Workforce Benefits study.

The study, conducted by LIMRA and EY and first published in 2021, offers a forward-looking perspective to help employers and workplace benefits providers address the needs of the current and future workforce. Similar to prior years, the 2025 study finds that many key factors driving the market remain:

Today, there are five generations in the workforce, with younger generations (Gen Z and Millennials) now making up just over half of U.S. workers. As workers increasingly rely on their benefits to address their financial, physical and mental well-being, employers recognize the need to offer workers flexibility and control in choosing the benefits that are right for their unique lifestyle and situation. As such, more than half of employers – and two thirds of large employers - say they expect to offer more benefits over the next five years, with 84% of employers (and 95% of large employers) saying benefits are necessary to attract and retain key talent.

Artificial Intelligence Will Drive Greater Satisfaction and Efficiencies

Economic and labor force uncertainty, however, seem to play a bigger role in employers’ decision-making. The study finds employers are hyper-focused on economic value and looking to brokers to help them navigate rising costs, while also responding to changing regulations, addressing their increased need for digital capabilities, and managing growing benefit complexity. Prior study results revealed greater reliance on digital solutions to address enrollment, communications and claims. Employers are also interested in using artificial intelligence (AI) to improve their systems.

As part of the study, researchers conducted qualitative interviews of brokerage leaders and found a majority of them believe AI will be a primary driver of disruption in four specific areas:

The New Frontier: Absence and Leave Management

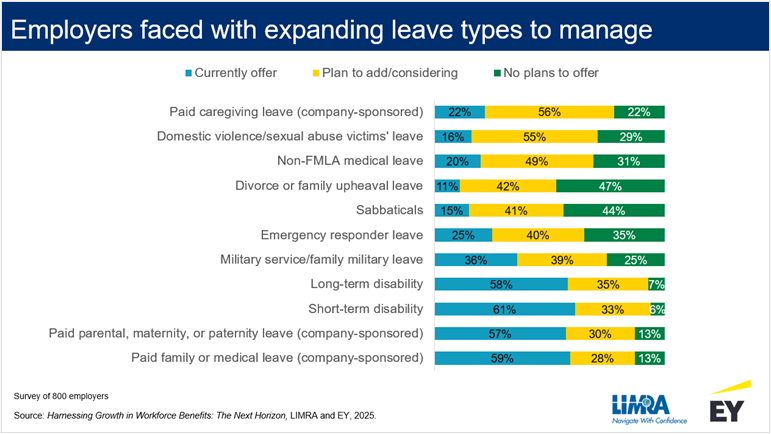

The paid leave landscape is shifting rapidly. As of 2025, 13 states and the District of Columbia have established mandatory paid family leave programs. An additional 10 states have voluntary insurance programs that provide paid family leave through private insurance. Add to this the vacation/annual leave, sick leave, short- and long-term disability, bereavement leave, and leave for jury duty or military service, the complexities of managing leave have grown substantially for employers.

The new study shows 92% of workers across generations said they were interested in paid family or medical leave, with a majority (54%) saying it is a priority. Along with medical, dental and vision, paid leave now is considered a “Core Four” benefit, which is driving greater need for leave management services. The study shows most employers either already offer or plan to offer a wide array of leave benefits to their workers.

To do that, employers are increasingly choosing to outsource their leave management, seeking platforms and support that can help them manage the expanding leave benefits that address the increasingly complex regulations, compliance challenges, process inefficiencies, and tools to avoid absence and leave mismanagement. Researchers suggest carriers have an opportunity to expand their services but must ensure their offerings and operations are ready to deliver an integrated, frictionless experience.

Of the employers surveyed, there were a few key capabilities they prioritized:

Ultimately, the latest study demonstrates the workplace benefits market continues to change as demographics, needs, and technology evolve.

To learn more about the study and its findings, watch the latest Industry Insights with Bryan Hodgens episode: Generational Shift Drives Change in Workforce Benefits.

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834