Media Contacts

Helen Eng

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834

12/16/2025

The consequences of needing long-term care (LTC) can be financially and emotionally overwhelming. A U.S. Department of Health and Human Services study found that seniors needing LTC services will pay an average annual cost of $138,000.1 Without coverage, families often bear this burden, creating stress for caregivers and jeopardizing financial security.

The likelihood of needing long-term care is strong, yet many Americans are unprepared:

The reality is, at some point, most Americans will need long-term care. A 65-year-old has a 70% chance of needing some form of LTC during their remaining lifetime.2 Despite the high likelihood, very few Americans plan for long-term care. LIMRA estimates just 3% of Americans own any type of long-term care insurance, and the Alliance for Lifetime Income by LIMRA finds that only 44% of consumers* discussed the possibility of needing LTC services during their retirement years.

Consumers do seem aware of the pitfalls, however. The 2025 Insurance Barometer Study shows that over one-third of consumers are very or extremely concerned about paying for long-term care services if they can no longer support themselves, and nearly three in five consumers say they need LTC insurance. The Alliance for Lifetime Income by LIMRA also finds that 65% of consumers* worry about becoming physically dependent on others.

While solutions exist in the retail market, including stand-alone LTC insurance and hybrid life insurance policies, the workplace is also a great resource for working adults to start preparing for their potential long-term care needs.

The workplace can help jump-start long-term care planning:

According to LIMRA data, two in five employees consider long-term care insurance benefits to be very important. More than one in five employees share that they want LTC insurance, but it is not currently offered through their employer. Uncertainty also hampers the workplace opportunity. More than half of employees cannot positively say whether or not they have access to a LTC benefit.

Employers, too, are noticing their employees’ long-term care concerns. Fifty-four percent of employers — and nearly three-quarters of employers with at least 1,000 employees — expect their workers to be very interested in this benefit five years from now, according to LIMRA research on LTC workplace solutions. Many employers are also adding caregiving benefits and paid family medical leave, which help support broader LTC needs.

Workplace LTC solutions are attractive to younger workers:

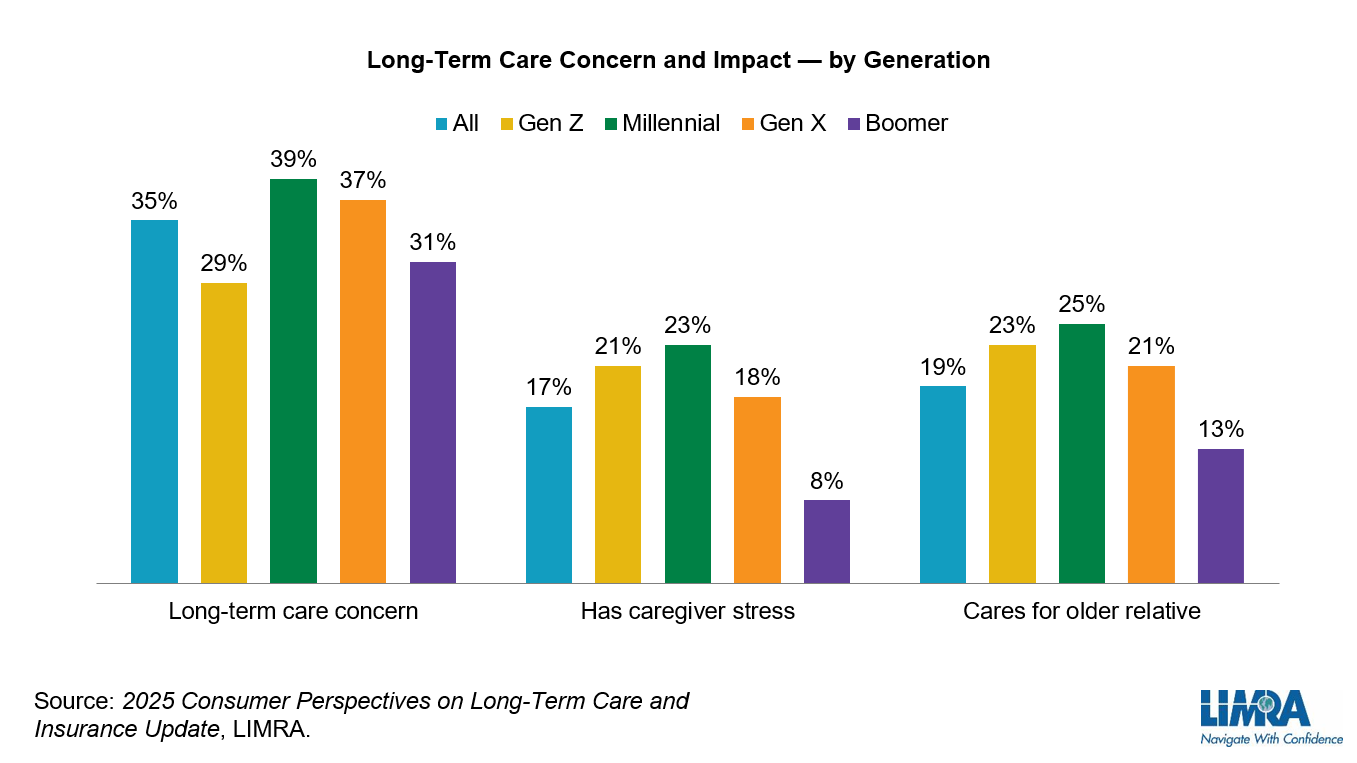

For millennials in particular, long-term care solutions through the workplace can be especially appealing. A separate LIMRA study found that millennials have the highest level of concern for potential long-term care costs, have the highest level of caregiving stress, and are the most likely generation to be sandwiched between caregiving for their children and their aging parents.

Most LTC products on the retail side are marketed to older adults. By making LTC solutions more available through the workplace, younger adults can benefit from locking in more affordable rates and enrolling in combination life insurance products that provide for LTC.

Employers aren’t the only ones noticing — carriers are too:

LIMRA research suggests carriers who currently do not offer a workplace LTC solution will soon enter the market. With government regulations, such as the Washington Cares Act, aimed at addressing long-term care needs, the environment might become more favorable for marketing LTC products in the workplace. Better targeting recent caregivers and small businesses may lead to warmer audiences for workplace LTC solutions.

A successful financial plan should address a person’s whole financial situation, including what happens when they can no longer take care of themselves. Starting to plan young can help safeguard against the likelihood of being denied LTC insurance when it’s needed. Going through the workplace for long-term care solutions can help provide a launchpad for LTC planning, helping Americans take the steps today to secure their financial tomorrow.

1 “Long-Term Services and Supports for Older Americans: Risks and Financing”, Department of Health and Human Services, 2022.

2 “How Much Care Will You Need?” LongTermCare.gov.

*Ages 45-85 with at least $150,000 in investible household assets.

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834