Media Contacts

Helen Eng

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834

1/27/2026

After several years of remarkable expansion, the U.S. life insurance industry enters 2026 with both strong momentum and a shifting economic landscape. LIMRA’s 2026 forecast suggests that while growth will continue, it will be moderated as consumers’ concern about economic uncertainty increases.

The past four years have been unusually strong for individual life insurance sales, with new annualized premium hitting record highs in 2021, 2022 and 2024 and premium expected to do it again in 2025. Looking back there are four factors that fueled this growth:

Heightened Awareness Since the Pandemic

“LIMRA research shows, like the 1918 Flu Pandemic, the COVID-19 pandemic raised consumers’ awareness about their need for life insurance and this perception has remained elevated ever since,” said Sean Grindall, chief member relations and solutions officer, LIMRA and LOMA. “Today, just half of U.S. adults own life insurance, and more than 100 million acknowledge they have a coverage gap. This combination of awareness and unmet need has created significant opportunity over the past five years.”

Favorable Economic Conditions

Lower interest rates and a robust equity market boosted the appeal of indexed universal life (IUL) and variable universal life (VUL) products. Meanwhile, a strong job market and rising wages helped younger adults — who often overestimate the cost of coverage by more than tenfold — feel more financially capable of purchasing term or whole life insurance.

Product Innovation in Simplified and Middle‑Market Products

Simplified IUL and final expense products surged, particularly among lower‑ and middle‑income consumers. This segment saw double‑digit policy growth not experienced since the 1990s, signaling renewed engagement from a historically underserved market.

Technology and Distribution Expansion

Advances in underwriting automation, digital applications, marketing, and lead generation have made the buying process faster and more accessible. These improvements benefit both financial professionals and consumers, reducing friction and expanding distribution reach.

2026: A New Economic Reality Dampens Growth Prospects

Despite strong demand fundamentals, the economic backdrop entering 2026 looks very different from the conditions that fueled recent growth.

“LIMRA’s Consumer Sentiment study shows that 52% of Americans are highly concerned about the economy. Inflation remains stubborn, and although easing, it is still above pre‑pandemic levels,” noted Bryan Hodgens, senior vice president and head of LIMRA Research. “The Federal Reserve has taken a slower‑than‑expected approach to lowering interest rates, though stabilization around 3% is anticipated this year. Rising unemployment, meanwhile, is expected to pressure middle‑market consumers—particularly those shopping for term life.”

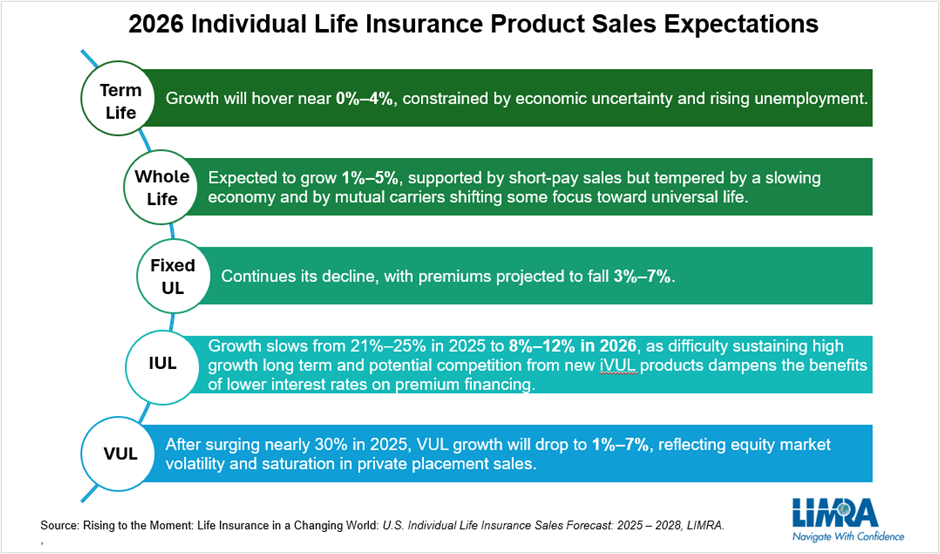

Against this backdrop, LIMRA projects overall life insurance new annualized premium to grow between 2% and 6% in 2026, slightly above the historical average of 3.1% but well below the double‑digit surge of 2025.

What Will Drive Growth in 2026

Even with economic headwinds, several forces are expected to support continued expansion. Among them include:

The life insurance industry enters 2026 with strong underlying demand, expanding distribution, and technological tailwinds. While economic pressures may temper growth — especially in the middle market — the industry’s momentum, innovation and evolving product landscape are poised for another year of expansion.

For carriers and advisors, the opportunity lies in meeting consumers where they are: offering accessible solutions, emphasizing living benefits, and leveraging technology to deliver a seamless, modern experience.

To watch the full episode of Industry Insights with Bryan Hodgens: What’s Ahead for Retail Life Insurance and Annuity Sales in 2026?

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834