Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

10/23/2017

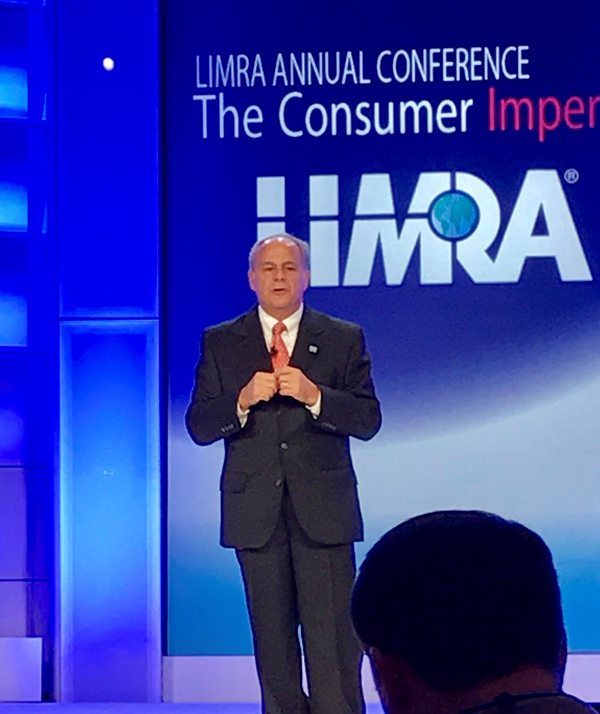

NATIONAL HARBOR, Md., Oct. 23, 2017—Opening the 2017 LIMRA Conference amidst more than 750 attendees, Robert A. Kerzner, CLU, ChFC, president and CEO of LIMRA, LOMA and LL Global, explored how new technologies – including artificial intelligence (AI) – have the potential of spurring growth and greater consumer engagement.

“Growth is the imperative but there are many obstacles – low interest rates, increased regulatory pressure and intensified competition – that undermine a company’s priorities to invest in alternate business models, and technology,” said Kerzner. “Today’s leaders need to be ninja warriors if they hope to achieve sustainable growth.”

One of the biggest opportunities is through artificial intelligence. Kerzner noted the number of InsurTech start-ups focused on artificial intelligence has more than tripled since 2014: “The interest and investment in artificial intelligence has just exploded over the past three years, and I believe it is where many will invest.”

Sharing examples of insurers using chatbots and voice recognition technology, Kerzner described the many ways artificial intelligence can be used to improve the customer experience. He also highlighted examples of companies using Big Data and artificial intelligence to generate leads, simplify underwriting and detect fraud.

“The question all leaders need to ask is should I invest in day-to-day solutions that will improve the customer experience and create efficiencies,” asked Kerzner. “Or in technology that will disrupt and create the next business model?”

Citing LIMRA research that finds that more than 60 million American households are underinsured, Kerzner said the old ways of reaching Americans were no longer adequate. “Companies need to explore new business models, and invest in technology to improve the customer experience to avoid others disrupting you.”

Technology has created new opportunities for affinity relationships through online platforms. Kerzner cited several examples of insurers working with tech start-ups to target specific markets, like those interested in running, cycling or adhering to a vegetarian or vegan diet.

“Digital affinity marketing will become more important,” Kerzner noted. “Companies need to find partners that will open the door to market segments our industry has not yet successfully reached.”

Kerzner concluded his remarks encouraging his audience to test new ideas and technologies that may uncover a new path to growth.

“The experimentation will lead to incremental change but it will also lay the groundwork for the big breakthrough. The reality is the world is moving fast and change is the only constant. Those who embrace change and leverage evolving technologies will be better positioned for the future.”

The LIMRA Annual Conference is one of the largest gatherings of executives representing all sectors of the financial services industry. The conference brings together leading experts and company executives to examine today’s most important issues, and to revisit, and possibly rethink, the ideas that have informed the industry's strategies and tactics to date.

-end-

Catherine Theroux, 860-285-7787, ctheroux@limra.com

Erica Iorillo, 860-285-7875, eiorillo@limra.com

Joseph L. Giasullo, 860-285-7786, jgiasullo@limra.com

LIMRA, a worldwide research, consulting and professional development organization, is the trusted source of industry knowledge, helping more than 850 insurance and financial services companies in 64 countries. Visit LIMRA at www.limra.com.

Follow us on Twitter: @LIMRANewsCenter

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257