Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

1/28/2019

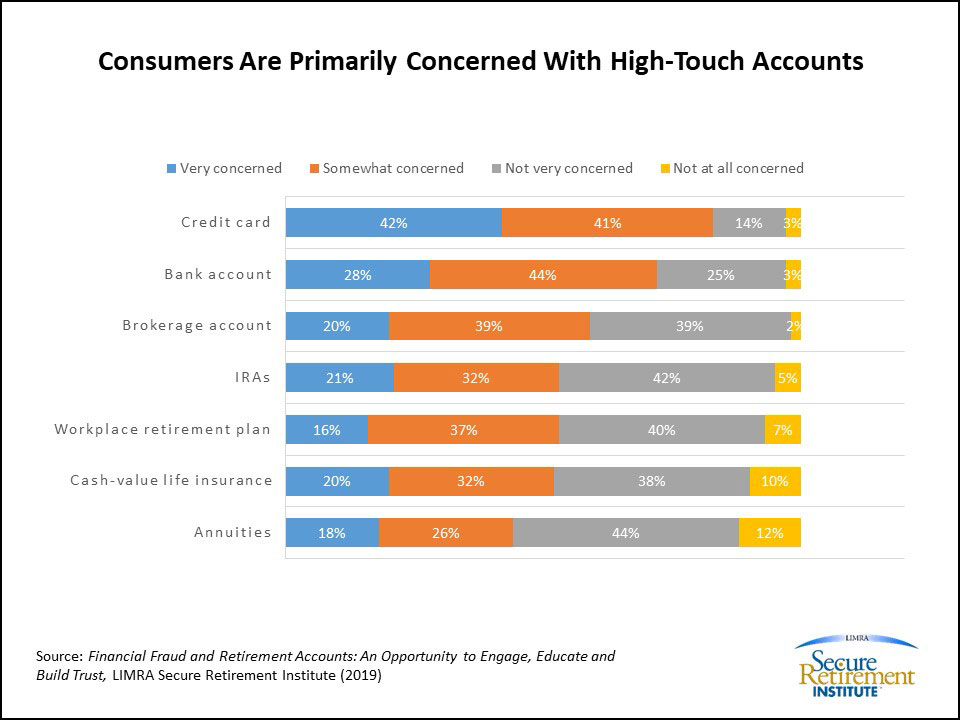

The report, Financial  Fraud and Retirement Accounts: An Opportunity to Engage, Educate and Build Trust, noticed that levels of concern vary significantly across the different types of financial products. Consumers tend to worry about “high-touch” products, such as credit cards and bank accounts, more than they worry about long-term savings accounts, like workplace retirement plans, IRAs and annuities. The study finds 83 percent of American cardholders say they are concerned about credit card fraud, while just 53 percent of retirement plan savers are concerned about their workplace retirement plan.

Fraud and Retirement Accounts: An Opportunity to Engage, Educate and Build Trust, noticed that levels of concern vary significantly across the different types of financial products. Consumers tend to worry about “high-touch” products, such as credit cards and bank accounts, more than they worry about long-term savings accounts, like workplace retirement plans, IRAs and annuities. The study finds 83 percent of American cardholders say they are concerned about credit card fraud, while just 53 percent of retirement plan savers are concerned about their workplace retirement plan.

“While it may be natural for consumers to worry more about products they use more often, recent LIMRA research confirms that the incidence of fraud is increasing among individual life insurance contracts, individual annuities and DC retirement plans1. This evolution is driven not only by the increased appeal of financial accounts that hold larger pools of money, but also by new developments in security for credit and debit cards that have prompted criminals to reevaluate their targets,” noted Ryan Scanlon, associate research analyst, LIMRA SRI. “The 30 percentage point difference between consumers who are concerned over their credit card and those who are concerned over their retirement plan highlights a dangerous blind spot – one that offers financial service companies an opportunity to engage their customers in a truly meaningful way.”

While any financial loss can be upsetting, loss to fraud can be particularly devastating. In 2017, identity fraud victims in the U.S. lost $16.8 billion and account takeover victims spent 15 hours on average in resolving fraud in addition to paying out-of-pocket expenses.2 The good news is LIMRA SRI finds that consumers are very open to learning about fraud prevention. In fact, 2 in 3 consumers (67 percent) indicate they want to receive information about how to detect and prevent financial fraud.

“With more than half of consumers identifying financial service companies as one of their top three sources for information on fraud prevention, the industry is well-positioned to answer the call for more education and strengthen client relationships in the process,” added Scanlon.

According to the report, other top sources of information consumers identified included credit bureaus (45 percent), financial advisors/planners (32 percent) and companies that manage retirement savings plans (29 percent).

This study was based on a survey of 1,005 American consumers aged 18 and older, fielded in August 2018. All survey results were weighted to represent the U.S. adult population.

-end-

Follow us at @LIMRANewsCenter

LIMRA Secure Retirement Institute provides comprehensive, unbiased research and education about all aspects within the retirement industry to improve retirement readiness and promote retirement security. For more information, please visit www.secureretirementinstitute.com.

1 Current State of Fraud in Life Insurance, Annuities, and Retirement Plans, LIMRA (2018)

2 2018 Identity Fraud: Fraud Enters a New Era of Complexity, Javelin Strategy & Research (2018)

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257