Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

5/25/2023

New market entrants coupled with increased plan sponsor interest drive record results

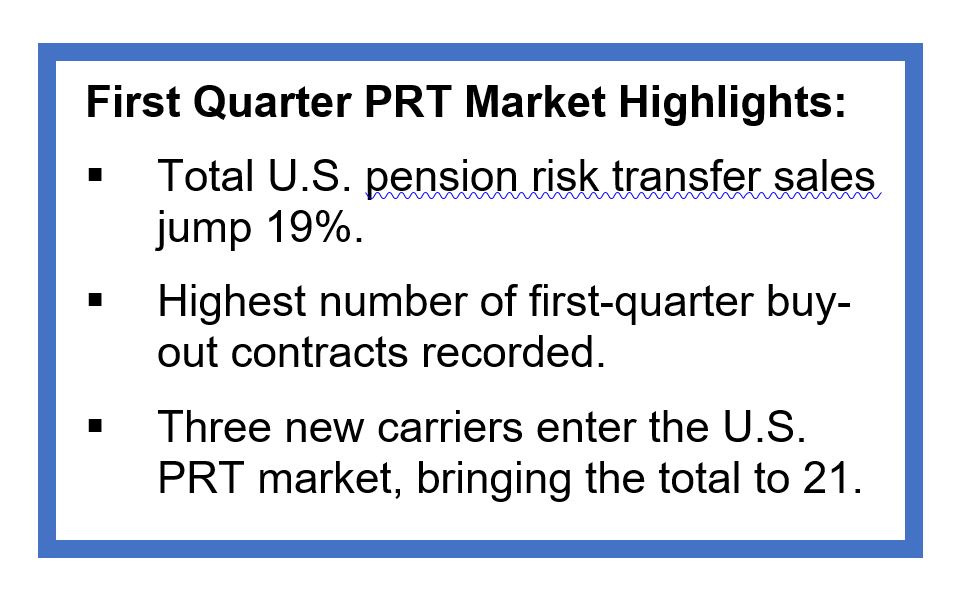

WINDSOR, Conn., May 25, 2022 —Total U.S. single premium pension risk transfer sales were $6.3 billion, up 19% from first quarter 2022 results. These are the highest first-quarter sales ever recorded, according to LIMRA’s U.S. Group Annuity Risk Transfer Sales Survey.

“Traditionally, first quarter sales tend to be sluggish. This year, buy-out sales posted strong results in both premium and volume, demonstrating broad growth across the industry,” said Mark Paracer, assistant research director, LIMRA annuity research. “With three new carriers entering the market and growing plan sponsor awareness and interest, sales activity is expected to be strong in 2023. LIMRA is forecasting sales to surpass $35 billion.”

“Traditionally, first quarter sales tend to be sluggish. This year, buy-out sales posted strong results in both premium and volume, demonstrating broad growth across the industry,” said Mark Paracer, assistant research director, LIMRA annuity research. “With three new carriers entering the market and growing plan sponsor awareness and interest, sales activity is expected to be strong in 2023. LIMRA is forecasting sales to surpass $35 billion.”

Buy-out sales topped $6.3 billion in the first quarter, which is 138% higher than prior year results. There were 116 buy-out contracts sold in the first quarter, up 55% from the first quarter 2022. There were no new buy-in contracts sold in the first quarter.

Single premium buy-out assets reached $239.5 billion in the first quarter, up 25% from the prior year. Single premium buy-in assets were $5.9 billion falling 8% from the first quarter 2022.

“Rising interest rates and escalating costs to maintain pension plans will likely drive plan sponsor interest in 2023,” said Paracer. “As the market competition increases, we expect to see carriers introduce innovative solutions and new partnerships to win new deals in 2023.”

A group annuity risk transfer product, such as a pension buy-out product, allows an employer to transfer all or a portion of its pension liability to an insurer. In doing so, an employer can remove the liability from its balance sheet and reduce the volatility of the funded status.

This survey represents 100% of the U.S. pension risk transfer market. Breakouts of pension buy-out sales by quarter and pension buy-in sales by quarter since 2016 are available in the LIMRA Fact Tank.

-end-

About LIMRA

Serving the industry since 1916, LIMRA offers industry knowledge, insights, connections, and solutions to help more than 700 financial services member organizations navigate change with confidence. Visit LIMRA at www.limra.com.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257