Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

11/30/2023

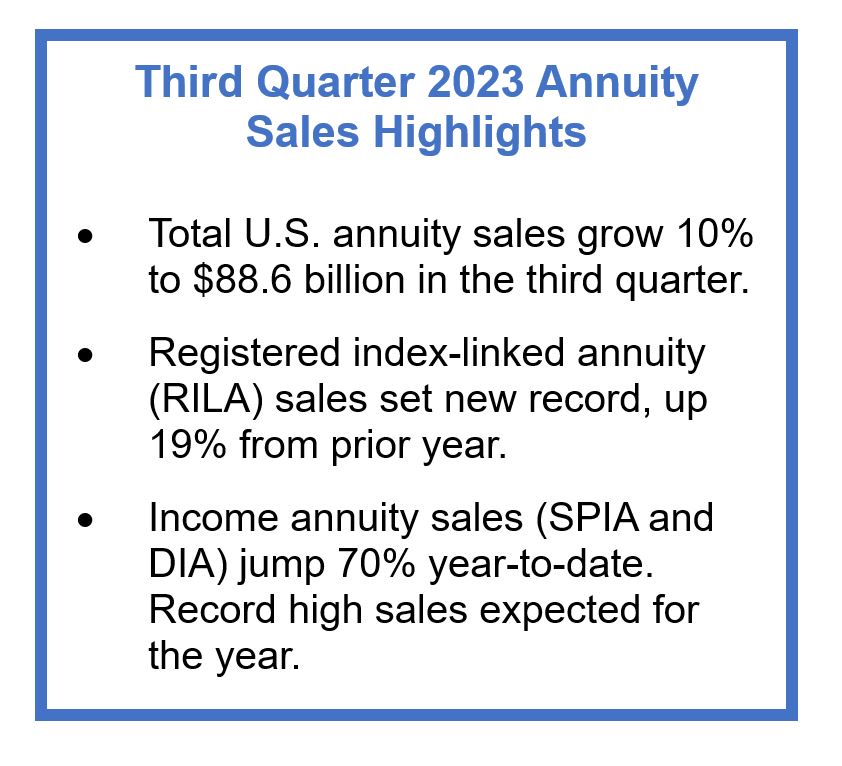

WINDSOR, Conn., Nov. 30, 2023 — For the second consecutive quarter, registered index-linked annuity (RILA) products set a new sales record. RILA sales were $12.6 billion, up 19% year-over-year and 11% higher than the prior record-setting quarter, according to LIMRA’s Third Quarter 2023 U.S. Retail Annuity Sales Survey.

“Despite the slight decline in the S&P in the third quarter (down 3.3%), the market remains up more than 13% for the year with expectations of steady growth through 2024,” said Todd Giesing, assistant vice president, LIMRA Annuity Research. “Interest rates are expected to fall in early 2024, dampening demand for risk-free solutions, such as fixed-rate deferred and fixed indexed annuities. This shift in interest rates will benefit RILA sales as investors lean in on solutions that have greater upside potential while protecting against a possible downturn.”

“Despite the slight decline in the S&P in the third quarter (down 3.3%), the market remains up more than 13% for the year with expectations of steady growth through 2024,” said Todd Giesing, assistant vice president, LIMRA Annuity Research. “Interest rates are expected to fall in early 2024, dampening demand for risk-free solutions, such as fixed-rate deferred and fixed indexed annuities. This shift in interest rates will benefit RILA sales as investors lean in on solutions that have greater upside potential while protecting against a possible downturn.”

Over the first nine months of 2023, RILA sales totaled $34.4 billion, 11% above prior year’s results. LIMRA is forecasting record-high RILA sales in 2023, and for this trend to continue into 2024 with nearly 10% growth projected.

Fixed Indexed Annuities

Fixed indexed annuity (FIA) sales also had a strong quarter. FIA sales were $22.6 billion in the third quarter, up 5% from the prior year’s results. Year-to-date (YTD), FIA sales increased 23% to $71 billion.

“Equity market growth combined with attractive cap and participation rates drove investor interest in fixed indexed annuities,” noted Giesing. “LIMRA is projecting 2023 sales to surpass $90 billion, breaking the record set in 2022. While lower interest rates may slightly diminish the demand in 2024, LIMRA expects FIA sales to be close or equal to $90 billion next year.”

Fixed-Rate Deferred Annuities

Fixed-rate deferred (FRD) annuity sales were $34.4 billion in the third quarter, 15% higher than third quarter 2022 results. YTD, FRD sales totaled $106.4 billion, up 43%. LIMRA expects sales to top $130 billion, setting an annual sales record for the second consecutive year.

Income Annuities

Income annuity products are having a spectacular year due to rising interest rates. Single premium immediate annuity (SPIA) sales were $2.9 billion in the third quarter, 16% higher than the prior year’s results. In the first nine months of 2023, SPIA sales jumped 62% to $9.7 billion.

Deferred income annuity (DIA) sales were $950 million, increasing 88% from sales in the third quarter 2022. In the first nine months of the year, DIA sales jumped 104% to $2.8 billion.

“Income annuities will hit record levels in 2023, with sales in this category expected to exceed $16 billion for the year,” Giesing notes. “Falling interest rates early in 2024 will reduce sales of income annuities in 2024 (compared with 2023 record results) but we predict sales will be more than 40% higher than sales results in 2022.”

Traditional Variable Annuity

Traditional variable annuity (VA) sales remain far below the results from the prior year. Traditional VA sales were $13 billion in the third quarter, down 8% from third quarter 2022 results. YTD, traditional annuity sales totaled $39.1 billion, falling 20% compared with the same period in 2022. In 2023, traditional VA sales will fall below sales levels reached in 2022, as investors continue to look for growth and protection. However, LIMRA is forecasting sales of this product to grow as much as 5% in 2024, driven by steady equity market growth.

Total Annuity Sales

Total sales increased 10% year-over-year to $88.6 billion in the third quarter 2023. YTD, total annuity sales were $269.6 billion, jumping 21% from prior year’s results. LIMRA is forecasting sales to exceed $350 billion, more than 10% higher than the record set in 2022.

For more details on the sales results, go to Third Quarter 2023 Annuities Industry Estimates in LIMRA’s Fact Tank.

Third quarter 2023 annuity industry estimates are based on LIMRA’s quarterly annuity sales survey, which represents 88% of the total market.

-end-

About LIMRA

Serving the industry since 1916, LIMRA offers industry knowledge, insights, connections, and solutions to help more than 700 member organizations navigate change with confidence. Visit LIMRA at www.limra.com.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257