Media Contacts

Helen Eng

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834

6/25/2025

LIMRA and Life Happens study finds that the lack of knowledge may be contributing to coverage gap among young consumers.

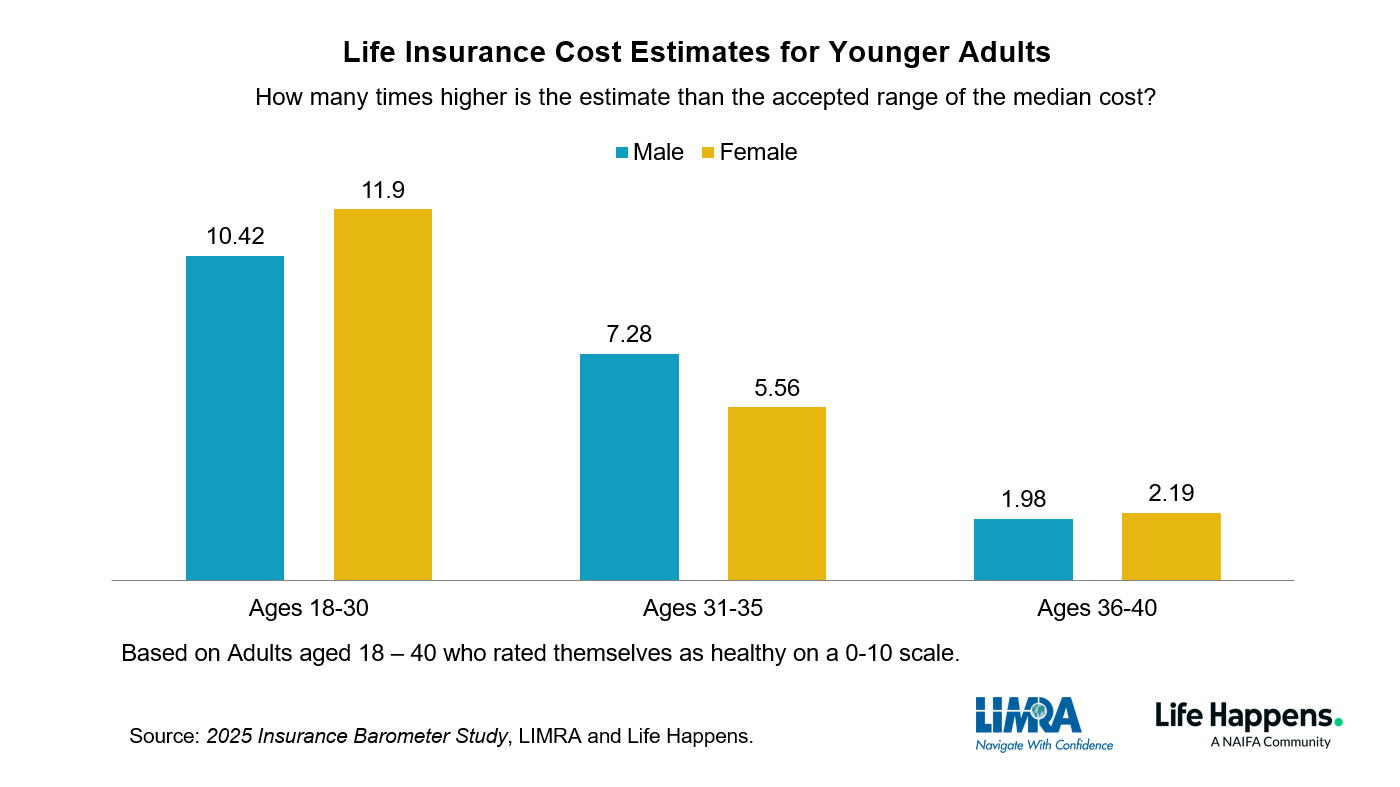

WINDSOR, Conn., and ARLINGTON, Va., June 25, 2025 — The 2025 Insurance Barometer Study, conducted jointly by nonprofit associations LIMRA and Life Happens, shows that young adults believe the cost of a policy is significantly more than its actual price. When asked to guess what the premium of a $250,000 20-year, level term policy would be for themselves, healthy adults in the 18–30-year-old range overestimated the median cost about 10–12 times more than its true cost.

The study also reveals young adults (Gen Z or Millennial) do not understand the underwriting process nor the different types of life insurance products available. Less than a quarter of Gen Z adults and Millennials say they are knowledgeable about life insurance underwriting — the process where the insurance company evaluates the risk of insuring an applicant and determines the terms of the policy.

The lack of knowledge could be inhibiting healthy, young consumers from obtaining the coverage they need to protect their families.

“Too Good to be True”: The Lack of Knowledge Contributes to the Need-Gap Among Young Adults

The Insurance Barometer Study suggests a connection between knowledge about life insurance and ownership. Of Gen Z adults and Millennials who own life insurance, 47% say they are extremely or very knowledgeable about life insurance, compared to 24% who say they lack knowledge. Additionally, over half of young adults (53%) who say they are somewhat or not at all knowledgeable about life insurance have an insurance coverage gap; meaning they recognize they need (or need more) life insurance, but do not possess adequate coverage.

While young adults recognize their need for insurance, the survey indicates they seem too intimidated by the overall process to purchase the necessary coverage.

“The good news is that 54 million Gen Z and Millennial adults recognize their need for life insurance. Yet, there appears to be some ‘too good to be true’ thinking that complicates their purchase decisions,” said Bryan Hodgens, senior vice president, Head of LIMRA Research. “In a separate qualitative LIMRA study, even when young adults were presented with a true median cost of an insurance policy, some participants still doubted us. This remains one of the biggest challenges for our industry to overcome — convincing consumers that life insurance is far more affordable than they realize.”

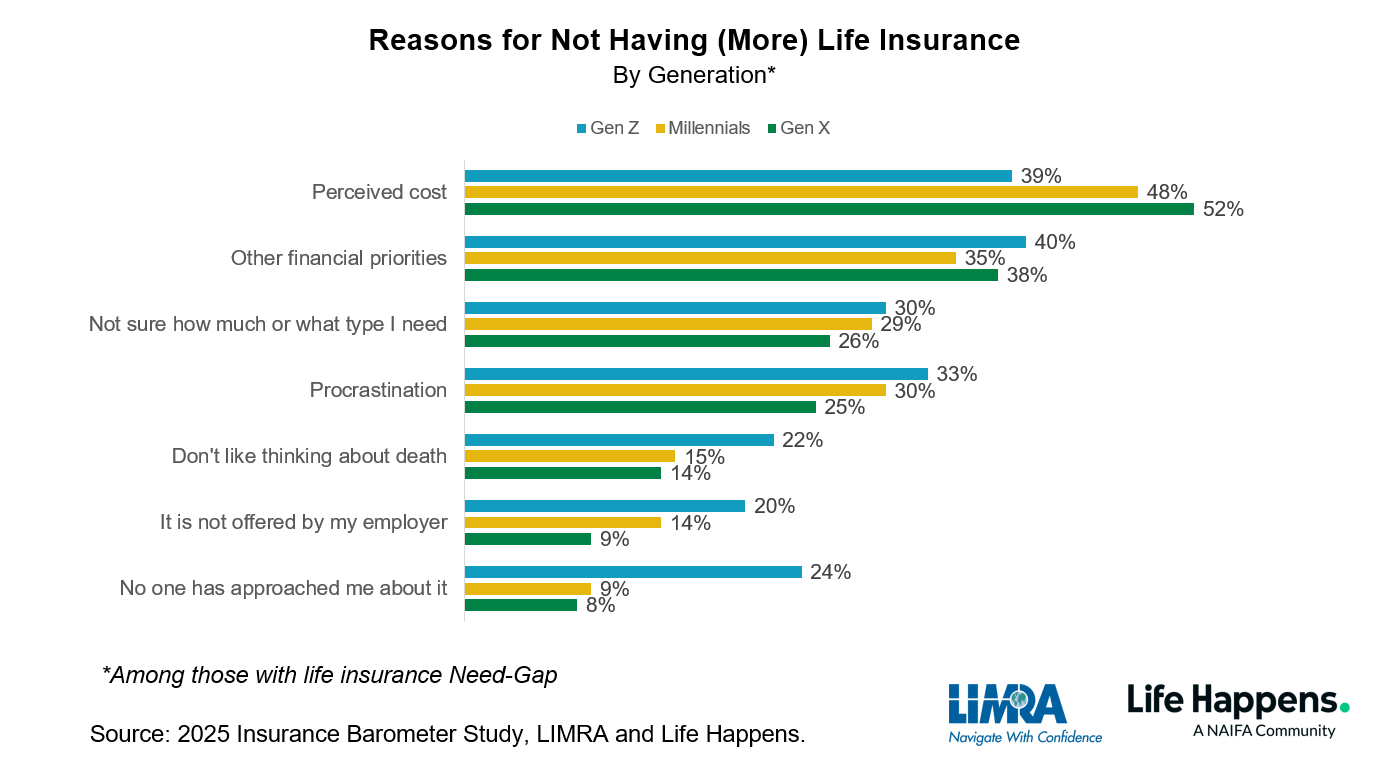

When asked about their reasons for not owning (more) life insurance, nearly half of Millennials (48%) and 39% of Gen Z adults mentioned the perceived cost. About one-third of both Gen Z and Millennials said they were unsure of how much life insurance they need or what type to buy.

Cutting Through the Noise: Educating Consumers Through Social Media

Social media continues to grow rapidly as an effective channel to engage with and educate consumers, especially young adults. Sixty-two percent of all adults—and 80% of those under 45—use social media to seek information on financial or insurance products, which is up from 29% when this question was first asked in 2019.

Nearly half of Gen Z adults and Millennials value recommendations from experts, influencers or spokespeople. Of young adults who use social media for financial information, 45% say they follow financial advisors and 33% say they follow financial influencers.

“Educating consumers about life insurance on social media is no longer a ‘nice to have;’ it’s a ‘must.’ But a lot of financial advice circulating on social media is inaccurate and unreliable. That’s why we as an industry need to be there,” said Brian Steiner, Executive Director of the educational nonprofit Life Happens, now a NAIFA community. “Companies and financial professionals need to meet consumers where they’re at with education and authenticity so we can show them how life insurance provides a stable way to protect their families.”

The AI-Human Touch

The growing use of artificial intelligence is also impacting how consumers learn and shop for insurance. According to the Barometer Study, nearly six in 10 young adults say they would use an AI tool to research a life insurance policy. When young adults are ready to purchase the policy, however, 42% say they would prefer to buy from a financial professional in person, while three in 10 would prefer to purchase directly from a company over the phone, through mail, or via an online video service.

The Need-Gap Remains Elevated Since COVID-19

The total need-gap for consumers who need (or need more) life insurance improved two percentage points over last year, down to 40% from 42% (and 45% at pre-pandemic levels). However, the 2025 figure still represents approximately 100 million Americans without adequate coverage.

The need gap is the highest among:

Currently, 51% of Americans between 18 – 75 years old say they own life insurance. Just under 4 in 10 owners say they purchased life insurance on the retail market. A majority of working adults (55%) say they have life insurance coverage through their employer.

For additional findings from the 2025 Insurance Barometer Study, please read Ensuring a Protected Tomorrow With Life Insurance.

-end-

About LIMRA

Serving the industry since 1916, LIMRA offers industry knowledge, insights, connections, and solutions to help more than 700 member organizations navigate change with confidence. Visit LIMRA at www.limra.com.

About Life Happens

Life Happens is a nonprofit organization dedicated to helping consumers take personal financial responsibility through the ownership of life insurance and related products. The organization does not endorse any product, company or insurance advisor. Since its inception in 1994, Life Happens has provided the highest quality, independent and objective information for people seeking help with their insurance buying decisions. The organization supports the insurance industry by providing marketing tools and resources and convening the industry each September for Life Insurance Awareness Month. Life Happens is supported by many of the nation’s leading insurance companies and as of 2024 is part of the NAIFA community. To learn more, visit www.lifehappens.org.

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834