Media Contacts

Helen Eng

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834

6/3/2025

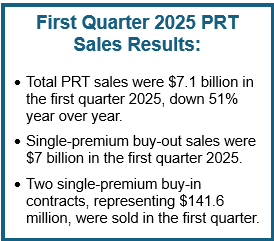

WINDSOR, Conn., June 3, 2025 —Total U.S. pension risk transfer (PRT) new premium was $7.1 billion in the first quarter 2025, according to LIMRA’s U.S. Group Annuity Risk Transfer Sales Survey. While this is 51% lower than the record-high sales set in the first quarter of 2024, it is 10% higher than the sales results in the first quarter of 2023.

There were 127 contracts sold in the first quarter, down 13% from prior year. These contracts cover almost 100,000 pension participants. Since January 2020, U.S. PRT deals have covered more than 3.1 million participants.

There were 127 contracts sold in the first quarter, down 13% from prior year. These contracts cover almost 100,000 pension participants. Since January 2020, U.S. PRT deals have covered more than 3.1 million participants.

“Although larger plan deals fluctuate quarter to quarter, smaller and mid-sized plan sponsor interest in PRT solutions remained strong in the first quarter. Our data shows the majority of first quarter sales (57%) were retiree-only carve outs,” said Keith Golembiewski, assistant vice president, head of LIMRA Annuity Research. “While current heightened economic uncertainty may initially dampen growth in the PRT market this year, LIMRA expects the expanded PRT market capacity combined with plan sponsor interest will ultimately propel strong PRT sales throughout 2025.”

Single-premium buy-out sales fell 51% to $7 billion in the first quarter. There were 125 buy-out contracts in the first quarter, 13% lower than first quarter of 2024.

There were two single-premium buy-in contracts reported in the first quarter, representing $141.6 million. This represented a 67% decline in premium year over year.

Single premium buy-out assets reached $301.1 billion in the first quarter, up 10% from the prior year. Single premium buy-in assets were $7 billion for the quarter, 9% higher than in first quarter of 2024. Combined, single premium assets were $308.3 billion, an increase of 10% year over year.

A group annuity risk transfer product, such as a pension buy-out product, allows an employer to transfer all or a portion of its pension liability to an insurer. In doing so, an employer can remove the liability from its balance sheet and reduce the volatility of the funded status.

This survey represents 100% of the U.S. Pension Risk Transfer market. Breakouts of pension buy-out sales by quarter and pension buy-in sales by quarter since 2018 are available in the LIMRA Fact Tank.

-end-

About LIMRA

Serving the industry since 1916, LIMRA offers industry knowledge, insights, connections, and solutions to help more than 700 financial services member organizations navigate change with confidence. Visit LIMRA at www.limra.com.

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834