Media Contacts

Helen Eng

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834

4/29/2025

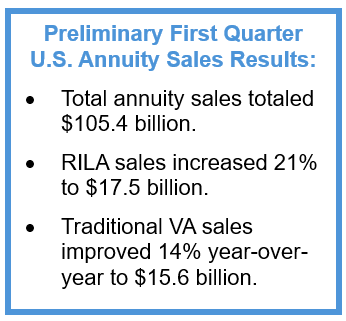

WINDSOR, Conn., April 29, 2025 —Total U.S. annuity sales were $105.4 billion in the first quarter of 2025, 1% below the record set in the first quarter of 2024, according to preliminary results from LIMRA’s U.S. Individual Annuity Sales Survey, representing 84% of the total U.S. annuity market.

“For the sixth consecutive quarter, total annuity sales topped $100 billion, demonstrating the elevated interest in principal protection and guaranteed income continues,” said Bryan Hodgens, senior vice president and head of LIMRA research. “Our latest Consumer Sentiment Survey shows Americans’ concern about the economy has risen sharply since January. This growing economic anxiety drove March sales results to be the second highest in history. LIMRA expects the current environment will likely attract more investors to registered indexed-linked and fixed-indexed annuities, which offer greater protected growth opportunity.”

economic anxiety drove March sales results to be the second highest in history. LIMRA expects the current environment will likely attract more investors to registered indexed-linked and fixed-indexed annuities, which offer greater protected growth opportunity.”

Registered Index-Linked Annuities

Registered index-linked annuity (RILA) sales continue to outperform traditional variable annuity sales in the first quarter of 2025. RILA sales jumped 21% year over year to $17.5 billion.

“Product innovation, new market entrants and expanded distribution have broadened the market capacity for these products,” said Hodgens. “Because these products are attractive to both insurers and investors, providing investors the ability to mitigate equity market downturns and allowing companies greater flexibility to hedge against risk as market conditions change. LIMRA is forecasting 2025 RILA sales to match or exceed the record-high sales set in 2024,” Hodgens said.

Traditional Variable Annuities

Despite the heightened market volatility, first quarter traditional variable annuity sales increased year over year for the fifth consecutive quarter. In the ninety days of 2025, traditional VA sales were up 14% to $15.6 billion, compared with first quarter 2024 results.

Fixed-Rate Deferred

Total fixed-rate deferred annuity (FRD) sales were $39.5 billion in the first quarter, down 8% from first quarter 2024 sales. Despite the decline, FRD annuities remain the primary driver of annuity sales growth, representing nearly 38% of the total annuity market in the first quarter.

“Although first quarter FRD sales were lower year-over-year, sales rebounded 35% from fourth quarter results, driven largely by March sales results,” noted Hodgens. “The average crediting rate for a three-year FRD product remains nearly 200 basis points above the average CD rate. For conservative investors who wish to avoid market volatility risk, these products continue to be an attractive option. LIMRA predicts — even with expected interest rate cuts — FRD sales will be above $120 billion in 2025.”

Fixed Indexed Annuities

Fixed indexed annuity (FIA) sales fell 7% year over year to $26.7 billion in the first quarter of 2025. Although lower than the prior record-setting sales experienced throughout 2024, this quarter’s results rank as the fifth highest recorded in history.

Income Annuities

Although interest rates remained steady in the first quarter, income annuities tumbled. Single premium immediate annuity (SPIA) sales were $3 billion in the first quarter, 17% lower than the prior year’s results. Deferred income annuity (DIA) sales were $950 million in the first quarter, down 19% year over year.

“While all fixed annuity product line sales dropped below the record first quarter sales in 2024, sales of these products remain higher than historical norms,” said Hodgens. “LIMRA believes broader distribution, product innovation, and most importantly, greater investor awareness and interest in the investment protection fixed annuities offer, will keep fixed annuity product sales strong through 2025.”

Preliminary first quarter 2025 annuity industry estimates are based on monthly reporting. A summary of the results can be found in LIMRA’s Fact Tank.

The top 20 rankings of total, variable and fixed annuity writers for the first quarter of 2025 will be available in mid-May, following the last earnings calls for the participating carriers.

With more than 100 years of expertise, LIMRA conducts over 80 benchmark studies — producing nearly 500 reports annually — for our members and the industry as a whole. These studies provide trusted insights and a comprehensive understanding of market dynamics, trends, and behaviors.

-end-

About LIMRA

Serving the industry since 1916, LIMRA offers industry knowledge, insights, connections, and solutions to help more than 700 member organizations navigate change with confidence. Visit LIMRA at www.limra.com.

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834