Media Contacts

Helen Eng

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834

LIMRA.com and LOMA.org will be off-line for scheduled maintenance February 21, 2026 from 6 - 10 a.m. ET.

12/11/2025

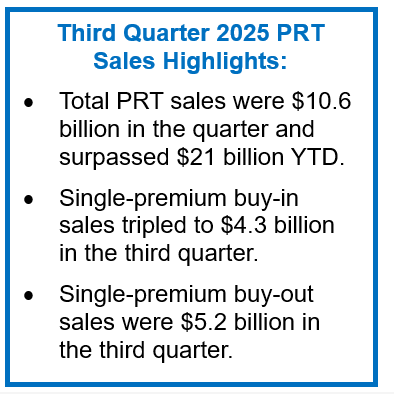

WINDSOR, Conn., Dec. 11, 2025 —Single-premium buy-in sales jumped 328% in the third quarter to $4.3 billion, according to LIMRA’s U.S. Group Annuity Risk Transfer Sales Survey. This is the highest quarterly sales for buy-in products recorded.

Although third quarter 2025 PRT sales fell 32% year over year, results were 137% higher than second quarter 2025 results. In the third quarter, total PRT new premium was $10.6 billion. YTD, total PRT sales were $21.6 billion, down 48% year over year.

“While the jumbo market has been quiet in 2025, we are seeing significant activity with small contracts. More than 80% of the contracts sold this year were less than $50 million, signaling broader market interest in these pension liability mitigation solutions,” said Keith Golembiewski, assistant vice president, head of LIMRA Annuity Research. “Although this year’s sales will likely remain below the record sales set in 2024, this is a very cyclical market. More carriers have entered the market, which has expanded market capacity and increased opportunities to engage small and mid-sized plan sponsors. This will ultimately boost PRT sales in future years.”

In total, there were 183 contracts sold in the third quarter, 12% lower than the prior year’s results. In the first three quarters of 2025, PRT carriers sold 441 contracts, 18% below the number of contracts sold in the same period of 2024.

Single-premium buy-out sales fell 60% to $5.2 billion in the third quarter but were 39% higher than second quarter results. There were 178 buy-out contracts in the third quarter, 12% lower than the third quarter of 2024. YTD, there were 431 buy-out contracts totaling nearly $16 billion, representing a 56% sales decline.

There were five single-premium buy-in contracts reported in the third quarter. In the first nine months of 2025, new buy-in premium totaled $4.7 billion, up 43%. YTD, U.S. carriers reported 10 buy-in contracts. This is an 11% increase year over year.

Single premium buy-out assets reached $308.6 billion in the third quarter, 18% higher than the prior year. Single premium buy-in assets were $10.4 billion for the quarter, up 16% from the third quarter of 2024. Combined, total PRT assets totaled $319 billion, representing a 7% year-over-year increase.

A group annuity risk transfer product, such as a pension buy-out product, allows an employer to transfer all or a portion of its pension liability to an insurer. In doing so, an employer can remove the liability from its balance sheet and reduce the volatility of the funded status.

This survey represents 100% of the U.S. Pension Risk Transfer market. Breakouts of pension buy-out sales by quarter and pension buy-in sales by quarter since 2020 are available in the LIMRA Fact Tank.

With more than 100 years of expertise, LIMRA conducts over 80 benchmark studies — producing nearly 500 reports annually — for our members and the industry as a whole. These studies provide trusted insights and a comprehensive understanding of market dynamics, trends, and behaviors.

-end-

About LIMRA

Serving the industry since 1916, LIMRA offers industry knowledge, insights, connections, and solutions to help more than 700 member organizations navigate change with confidence. Visit LIMRA at www.limra.com.

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834