Media Contacts

Helen Eng

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834

12/15/2025

Sales growth of disability and supplemental health insurance slip

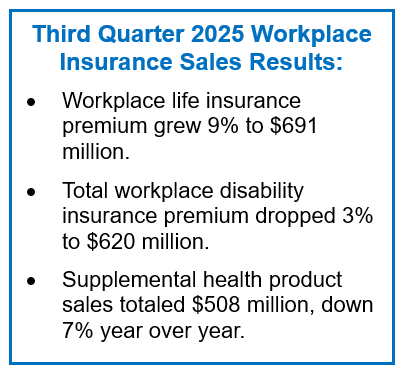

WINDSOR, Conn., Dec 15, 2025 — For the second consecutive quarter, workplace life insurance premium rose year over year, overcoming a shaky start in the first quarter. In the third quarter of 2025, workplace life insurance new premium increased 9% to $691 million.

In the first nine months of 2025, workplace life insurance new premium was $3.38 billion, down just 3% from last year’s results. Despite the decline, a majority of carriers reported gains, with the top 10 companies generating 64% of the sales.

with the top 10 companies generating 64% of the sales.

Permanent life insurance product premium rose 8% for the quarter and term premium grew 9%. Term sales are 4% lower over the first nine months of the year.

“One of the biggest obstacles of workers’ participation in non-medical insurance benefits is lack of knowledge about what is available and what the benefit provides. New LIMRA research shows less than half of workers closely reviewed their life insurance benefit and just a third closely reviewed their disability and critical illness benefits. Even more concerning is that 10% –15% either skipped the information or didn’t recall seeing it,” said Grace Rafferty, corporate vice president and director of LIMRA’s workplace benefits research program. “While most employers say they plan to continue to offer a competitive benefits package to attract and retain the best workers, if they perceive these non-medical benefits are not appreciated, they may not continue them. It is imperative that carriers, brokers and employers work together to educate workers about the financial protection these cost-effective benefits can offer when so many are feeling economic uncertainty.”

Disability Insurance

Total workplace disability insurance new premium was $620 million in the third quarter, down 3% year-over-year. In the third quarter, short-term disability insurance new premium slipped 1% and long-term disability insurance premium fell 6%.

In the first nine months of 2025, total workplace disability insurance premium fell 5% year over year to $3 billion. Short-term disability new premium dropped 5% and long-term disability new premium fell 6%, YTD. The top 10 carriers accounted for 74% of total new disability insurance premium sales in the first three quarters of 2025.

Supplemental Health Insurance

In the third quarter, workplace supplemental health product sales, which include accident, critical illness, cancer, hospital indemnity, and other supplemental health insurance products*, were $508 million, down 7%, compared with third quarter 2024 results. Based on new premium, all product lines showed both quarterly and year-to-date losses in the third quarter of 2025.

In the first nine months of 2025, supplemental health new premium totaled $2.5 billion, down 5%, year over year. The top 10 carriers collectively represented 66% of all supplemental health product sales in the first nine months of 2025.

Group workplace and individual workplace supplemental health product sales accounted for 79% and 21% of all new premium collected, respectively. Group workplace supplemental health products fell 5% YTD, while individual worksite sales contracted 3%.

LIMRA’s workplace benefits sales surveys for life insurance, disability insurance and supplemental health represent more than 90% of their respective annualized premium markets.

The latest data table with U.S. workplace sales trends is published in LIMRA’s Fact Tank.

With more than 100 years of expertise, LIMRA conducts over 80 benchmark studies — producing nearly 500 reports annually — for our members and the industry as a whole. These studies provide trusted insights and a comprehensive understanding of market dynamics, trends, and behaviors.

-end-

*“Other supplemental health products” represents products that do not fit the other categories, such as gap insurance, minimum essential coverage plans, limited benefit medical, and heart/stroke products.

About LIMRA

Serving the industry since 1916, LIMRA offers industry knowledge, insights, connections, and solutions to help more than 700 member organizations navigate change with confidence. Visit LIMRA at www.limra.com.

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834