Media Contacts

Helen Eng

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834

2/12/2026

Registered index-linked and fixed indexed annuities set sales records in 2025

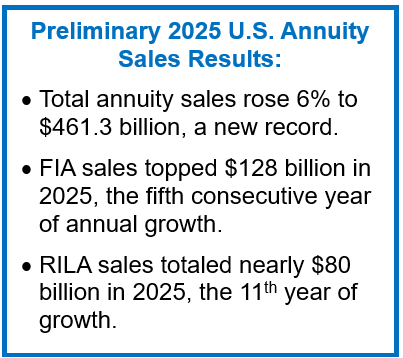

WINDSOR, Conn., Feb. 12, 2026—Total U.S. annuity sales increased 6% to $461.3 billion in 2025, according to preliminary results from LIMRA’s U.S. Individual Annuity Sales Survey, which represents 92% of the total U.S. annuity market.

Fourth quarter sales jumped 12% to $114.4 billion, representing the ninth consecutive quarter of $100+ billion in sales.

“Indexed products — registered index-linked and fixed indexed annuities — represented 45% of total sales in 2025, up from just 24% market share a decade ago. Expanded capacity, enhanced products, growing distribution and investor demand have propelled sales of these solutions,” said Bryan Hodgens, senior vice president and head of LIMRA research. “LIMRA is forecasting RILA and FIA sales to grow through 2028 and expand their market share of the total annuity market.”

Expanded capacity, enhanced products, growing distribution and investor demand have propelled sales of these solutions,” said Bryan Hodgens, senior vice president and head of LIMRA research. “LIMRA is forecasting RILA and FIA sales to grow through 2028 and expand their market share of the total annuity market.”

Fixed Indexed Annuities

Fourth quarter fixed indexed annuity (FIA) sales improved 8% year over year to $34.4 billion. In 2025 FIA sales were $128.2 billion, 1% higher than 2024 results. This is the fifth consecutive year of annual sales growth for the product line and sets a new sales record.

Registered Index-Linked Annuities

Registered index-linked annuity (RILA) sales set new quarterly and annual sales records. In the fourth quarter of 2025, RILA sales were $22.2 billion, 24% higher than the prior year. In 2025, RILA sales increased 20% year over year to $79.6 billion, 10 times the sales recorded a decade ago for this product line and marks the 11th consecutive year of growth.

“LIMRA expects the RILA market will continue to expand as more carriers enter the space or introduce new products,” said Keith Golembiewski, assistant vice president and head of LIMRA Annuity Research. “LIMRA is projecting RILA sales to exceed $85 billion in 2026, and for this market to grow through 2028.”

Traditional Variable Annuities

Traditional variable annuity sales were $18 billion in the fourth quarter, up 8% from fourth quarter 2024. For the year, traditional VA sales improved 7% year over year to $65.2 billion.

Fixed-Rate Deferred

Although fourth quarter 2025 fixed-rate deferred annuity (FRD) sales declined 24% from the prior quarter, they increased 12% year over year to $32.8 billion. In 2025, FRD sales improved 5% year over year to $160.6 billion.

“In the third quarter of 2025, FRD sales were elevated as investors rushed to lock in rates before anticipated interest rate cuts. Though fourth quarter sales have normalized, FRD products continue, on average, to offer better rates than CDs and remain attractive to risk-averse investors who are looking for higher protected investment growth,” noted Golembiewski. “LIMRA is forecasting 2026 FRD sales to fall below 2025 sales levels as short-duration appeal fades in conjunction with lower interest rates.”

Income Annuities

Single premium immediate annuity (SPIA) sales increased 12% in the fourth quarter to $3.5 billion. For the year, SPIA sales ticked up 3% to $14 billion. Deferred income annuity (DIA) sales jumped 20% to $1.4 billion in the fourth quarter. DIA product sales fell 3% to $4.8 billion in 2025.

“Over the past five years, industry has done a remarkable job of expanding and enhancing the portfolio of annuity solutions to meet the needs of today’s investors,” said Hodgens. “We are in the middle of Peak65, when more than 4 million Americans turn 65 each year, often with fewer protected lifetime income sources available. Our research suggests the demand for solutions that offer security — and peace of mind — has never been greater. This year, LIMRA has expanded its mission to help engage and educate financial professionals and consumers about the important role annuities can play in a holistic retirement plan to ensure lifetime financial security.”

Preliminary fourth quarter 2025 annuity industry estimates are based on monthly reporting. A summary of the results can be found in LIMRA’s Fact Tank.

The top 20 rankings of total, variable and fixed annuity carriers for 2025 will be available in mid-March, following the last of the earnings calls for the participating carriers.

LIMRA’s Retail Annuity Sales Survey represents 92% of the U.S. market. With more than 100 years of expertise, LIMRA conducts over 80 benchmark studies — producing nearly 500 reports annually — for our members and the industry. These studies provide trusted insights and a comprehensive understanding of market dynamics, trends, and behaviors.

-end-

LIMRA Retirement Public Relations/Social Media Lead

Work Phone: (860) 285-7834