Defined contribution advisors are unique in the financial advisor community. See how their preferences and priorities further differ based on their DC assets under advisement (AUA) and type of DC compensation.

Deb Dupont 1/28/2019

Defined contribution advisors are unique in the financial advisor community. See how their preferences and priorities further differ based on their DC assets under advisement (AUA) and type of DC compensation.

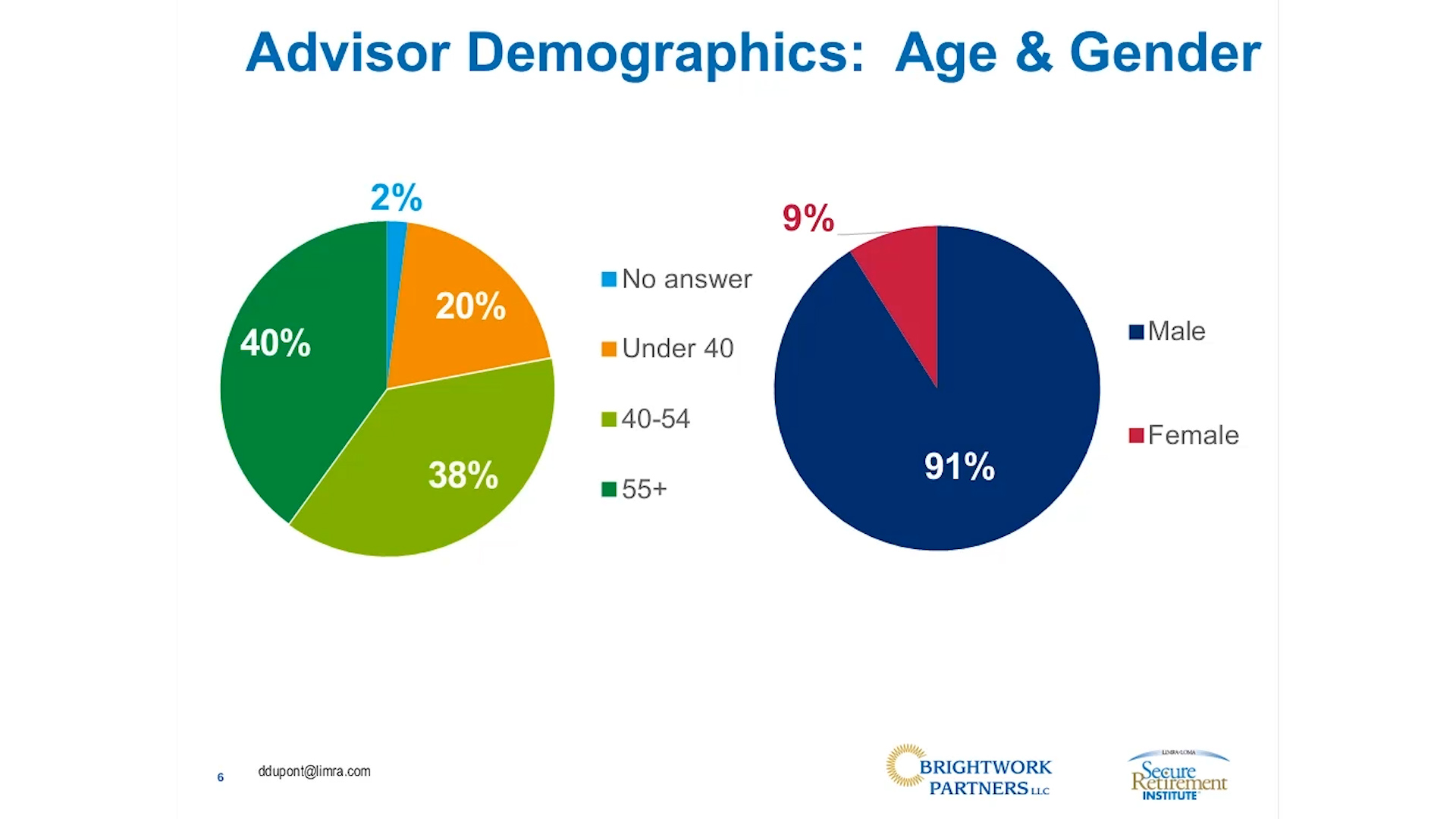

Advisors who sell defined contribution (DC) plans and services, and consult on DC investment menus, represent a unique subset of the financial advisor community. Even within this universe — advisors who “play” in the DC space — there are subtle distinctions among practices.

This research examines advisors based on their DC assets under advisement (AUA) and the way they are compensated for their DC business (fees and/or commissions). It looks at their preferences and requirements for investment platforms and services, what they look for in provider partners, and how they evaluate funds for their DC clients, offering important insights for providers who are looking to partner or deepen their relationships with this critical audience — which represents a “gateway” to DC plan sales and clients.

Service to sponsors and participants is of paramount importance to plan advisors, and in order to better support their efforts, knowing how they craft their own service offering is paramount.

Advisors who sell DC plans are unique. Learn more about the services they offer to plans and participants, and explore how your company can add value as a provider of choice.

How can defined contribution stakeholders and suppliers support employers tasked with leveraging and complying with the provisions of the SECURE Acts? The answer begins with knowing how plan sponsors perceive and understand the implications of these Acts for them and their plans. Full report and Executive Summary available.

Benchmark sales for a range of fixed and segregated fund contracts; by distribution system and province. New Q3 2025 summary.

This study explores how employers — sponsors of defined contribution (DC) retirement plans — feel about and act upon the need for financial wellness programs in the workplace.

This quarterly survey benchmarks Canadian pension sales and member activity. New Q3 2025 glimpse.

Don't You Forget About Me: There's Market Potential in Gen X

Access information regarding recent retirement specific research, educational resources, industry news and much more.

Understanding the advisors who sell Defined Contribution plans is critical for companies – particularly recordkeepers and other service providers – who want to succeed in the DC space.