Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

12/17/2019

With the hectic pace of the holidays, increased online shopping and travel, the season is the perfect time for financial fraudsters.

According to LIMRA research, almost 8 in 10 consumers are very or somewhat concerned about fraud. In fact, 36% of consumers have been a victim of financial fraud at least once. Of those affected by fraud, 64% of the events have happened in the last five years.

The types of fraud occurring are as varied as the consumers, and include credit card fraud (22%), being misled to give money to a fraudulent person or organization (8%), false tax filing or stolen tax refund (7%), current accounts access (7%) and having new accounts opened (5%).

Account takeover (ATO) occurs when an unrelated third party impersonates a client or advisor in order to access accounts or records for the purpose of stealing information and/or requesting disbursements. LIMRA recently surveyed more than 300 life insurance licensed advisors. The study found that 1 in 12 advisors have been a target of ATO fraud, and 1 in 9 have clients who have been targeted.

According to the Secure Retirement Institute® (formerly LIMRA SRITM), many people look to the financial services industry for guidance. In fact, about 7 in 10 consumers agree that they wish financial services companies would tell them more about their efforts to prevent financial fraud. In addition, 2 in 3 consumers want information on how to reliably detect and prevent financial fraud on their own.

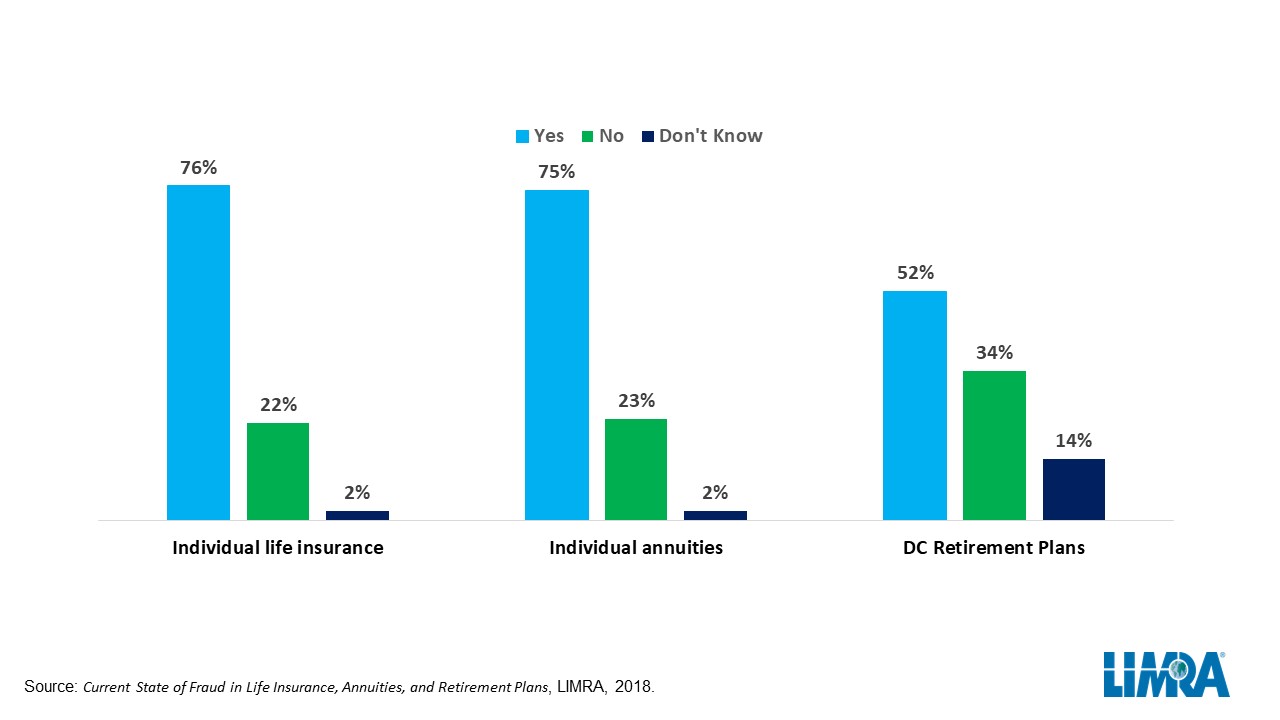

Since Jan. 1, 2017, the incidence of fraud is rising among individual life insurance and annuities, and defined contribution (DC) retirement plans (see chart).

Not just consumers are concerned. In a recent LIMRA /BCG study of "What's on the Minds of Executives," 79% of life insurance executives from around the globe cite fraud among their top concerns.

Not just consumers are concerned. In a recent LIMRA /BCG study of "What's on the Minds of Executives," 79% of life insurance executives from around the globe cite fraud among their top concerns.

LIMRA, LOMA and SRI are working to help financial services companies detect and deter account takeover fraud through the FraudShare platform. FraudShare helps enable financial services companies to better detect and prevent account takeover attempts. For more information about FraudShare, visit the FraudShare microsite.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257