Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

9/23/2021

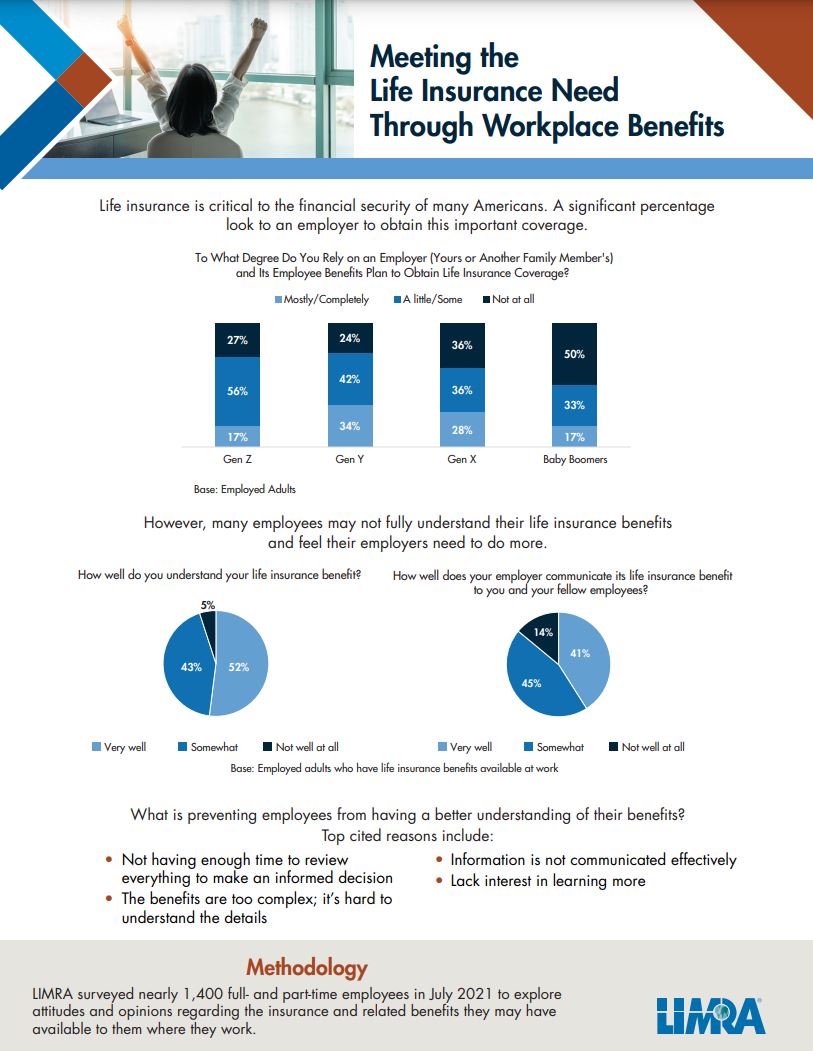

According to the 2021 Insurance Barometer Study, 57% of U.S. workers have life insurance through their workplace, and new LIMRA research finds two-thirds of employed Americans rely on workplace life insurance (theirs or another family member’s) to meet their life insurance needs.

According to the 2021 Insurance Barometer Study, 57% of U.S. workers have life insurance through their workplace, and new LIMRA research finds two-thirds of employed Americans rely on workplace life insurance (theirs or another family member’s) to meet their life insurance needs.

COVID-19 has raised awareness about the importance of life insurance. According to LIMRA research, almost two-thirds of employees are now paying more attention to the benefits their company offers and the coverages provided. Half of workers say they believe life insurance benefits are more important now because of the pandemic, and 1 in 5 workers with employment-based life insurance coverage reported purchasing additional workplace coverage last year due to COVID-19.

As we approach the 2021 open enrollment season, how can employers and the industry help workers better understand their life insurance benefits and get more employees life insurance coverage through their workplace?

Communication is key. Almost half (48%) of workers say they don’t understand or just ‘somewhat understand’ the life insurance benefit offered at their workplace. Only 4 in 10 workers believe their employer does a good job of effectively communicating their life insurance benefit to them and their coworkers.

While the majority of workers rely on their employers to learn about the workplace benefits available to them, 4 in 10 contact their benefits providers to gain a better understanding of their benefit offerings. LIMRA research shows more than half of employees say they prefer to engage with their benefits providers for information about their benefits coverage. Armed with this knowledge, carriers should partner with employers to improve and expand communications around life insurance benefits.

Employers can also leverage auto-enrollment to raise participation levels. Today, just 17% of employers leverage auto-enrollment for non-medical benefits like life insurance, but 70% of employers with a contributory or 100% employee-paid life benefit are very interested in automatically enrolling their employees in the coverage. The majority of employers believe that auto-enrollment can help employees understand the importance of benefits and ensure that employees are covered by important benefits. At a time when the country continues to grapple with rising infection rates and death due to COVID-19, ensuring workers’ families are protected is a key concern for many employers.

Auto-enrollment also appeals to many employees. More than three quarters of employees who are familiar with auto-enrollment believe it would make enrolling in insurance benefits easier, and 65% say auto-enrollment in non-medical insurance benefits protects employees against the unexpected. Nearly half of all employees agree that automatic enrollment in insurance benefits is the best way to protect their financial wellbeing. In fact, almost 3 in 10 employees say if they were auto-enrolled into their life insurance benefit, they would keep the benefit, and 44% say they would consider the cost before making a decision.

Workplace life insurance is a convenient, effective way for American workers obtain the coverage they need to protect their loved ones. As we celebrate Life Insurance Awareness Month, it is an opportunity for our industry and employers to find ways to better engage workers during the upcoming open enrollment season to ensure that they have adequate life insurance protection.

To learn more about U.S. employees’ perceptions about workplace life insurance, please visit: Meeting the Life Insurance Need Through Workplace Benefits.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257