Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

10/23/2019

WINDSOR, Conn., Oct. 23, 2019 – LIMRA, LOMA and the Secure Retirement Institute (SRI) today launched FraudShare TM, a new platform that will enable financial services companies to better detect and prevent account takeover attempts.

“We designed FraudShare, in collaboration with 10 leading financial services firms, as an industry solution to help companies identify fraudulent activity so they can better understand and prevent account takeover attacks and protect customer and company assets,” said Russell Anderson, head of the LIMRA and LOMA Fraud Prevention Program. “According to new LIMRA-Boston Consulting Group research, 7 in 10 financial services companies consider fraud a growing concern. Companies report the incidence of account takeover fraud is increasing for individual life insurance and annuity contracts and defined contribution retirement plan accounts. Beyond the tangible damages, such as replenishing customer accounts, and potential fines, legal fees and lawsuits, companies risk losing something even more valuable: consumers’ trust.”

FraudShare is the latest shared solution developed by LIMRA, LOMA and SRI, in partnership with the industry, to address common industry concerns. It will enable our members to:

“For more than 100 years, our association has developed cost-efficient, industry-standard solutions like anti-money laundering (AML) training, our Customer Assurance Program, best interest training and most recently our FraudShare solution,” noted Anderson. “In each case, we worked with our members to design the solution to ensure it addressed the critical issues the companies face. FraudShare will also help business leaders monitor and measure the occurrence of account takeover at their firm and across the industry.”

In the case of FraudShare, LIMRA, LOMA and SRI established a Founders Council, made up of representatives from 10 leading financial firms. The members advised the organization on various development and implementation criteria throughout the lifecycle.

In the case of FraudShare, LIMRA, LOMA and SRI established a Founders Council, made up of representatives from 10 leading financial firms. The members advised the organization on various development and implementation criteria throughout the lifecycle.

The Founders Council included representatives from the following firms: AIG, John Hancock Life Insurance Company, MassMutual, Nationwide, New York Life, Pacific Life Insurance Company, Prudential Financial, Sammons Financial Group, Securian Financial and Symetra Life Insurance Company.

“We are grateful for the tireless commitment and considerable expertise each of the Founders Council members provided to us as we developed FraudShare,” noted Anderson. “Their support and knowledge helped us deliver a state-of-the art tool that will help our industry fight account takeover fraud, protecting companies and their clients.”

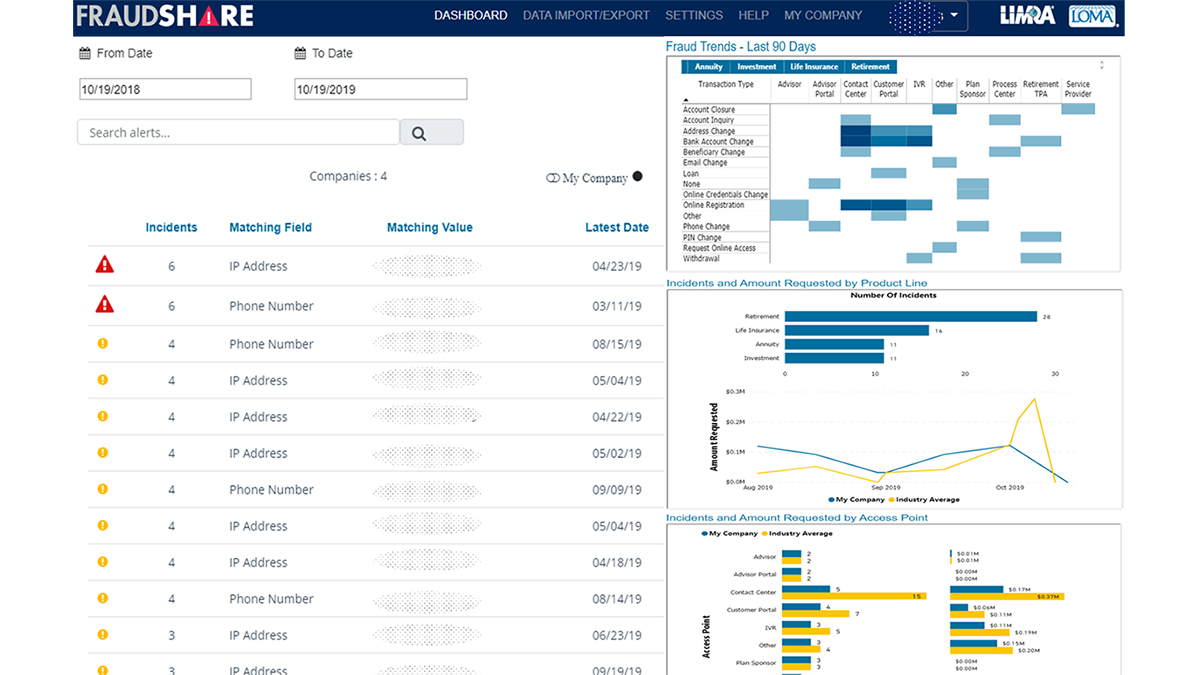

FraudShare is an innovative, easy-to-use tool for cross-industry reporting about the types and frequency of account takeover fraud occurring in the life insurance and retirement services industries. The tool is a fraud information clearinghouse and alert system that allows companies to better protect themselves against fraud while providing industry-level reporting of account takeover activity.

“Our members expressed deep concern about the growing occurrence of account takeover fraud they were witnessing and asked us to build an industrywide solution that could help them,” said Anderson. “We believe our industry is stronger working together to protect our customers. Establishing FraudShare fulfills a year-long effort to build a tool that will empower our member companies to band together to thwart criminal attacks.”

For more information about FraudShare, or to participate in an interactive demonstration of the tool, please visit the FraudShare microsite.

-end-

Follow us on Twitter: @LIMRANewsCenter

About LIMRA

Serving the industry since 1916, LIMRA, a worldwide research, consulting and professional development organization, is the trusted source of industry knowledge, helping more than 600 insurance and financial services companies in 64 countries. Visit LIMRA at www.limra.com.

About LOMA

Established in 1924, LOMA is committed to business partnerships with over 900 worldwide members in the insurance and financial services industry. LOMA’s goal is to improve company management and operations through quality employee development, research, information sharing and related products and services. Visit LOMA at www.loma.org.

About Secure Retirement Institute

The Secure Retirement Institute provides comprehensive, unbiased research and education about all aspects within the retirement industry to improve retirement readiness and promote retirement security. For information on the Secure Retirement Institute, visit: www.secureretirementinstitute.com.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257