Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

3/30/2021

WINDSOR, Conn., March 30, 2021 — FraudShare — the shared industry solution to help financial services companies better detect and prevent account takeover attempts — is expanding to include Canadian financial services companies.

LL Global, the parent company of LIMRA, LOMA and Secure Retirement Institute® (SRI®), working in collaboration with 10 leading U.S.-based financial services firms, launched FraudShare in late 2019. Since its launch, 43 leading financial services companies have adopted FraudShare as part of their fraud prevention program and many others are in various stages of due diligence and adoption.

Since fraud knows no borders, LL Global has expanded the program to allow Canadian financial services firms access to the same warehouse of incidents and threat indicators that their U.S. peers have used to detect account takeover attacks targeting over $10 million in customer account balances. These Canadian-based companies will also receive data and analyses to help them better understand account takeover activity trends and how their experiences compare to their peers.

Since fraud knows no borders, LL Global has expanded the program to allow Canadian financial services firms access to the same warehouse of incidents and threat indicators that their U.S. peers have used to detect account takeover attacks targeting over $10 million in customer account balances. These Canadian-based companies will also receive data and analyses to help them better understand account takeover activity trends and how their experiences compare to their peers.

“In 2019, our members expressed deep concern about the growing occurrence of account takeover fraud they were witnessing and asked us to build an industrywide solution that could help them,” said Russ Anderson, head of LL Global’s Financial Crime Prevention Services. “We believe our industry is stronger working together to protect our customers. Expanding FraudShare to our Canadian members will increase the power of this collaborative effort to thwart criminal attacks and protect customers’ assets.”

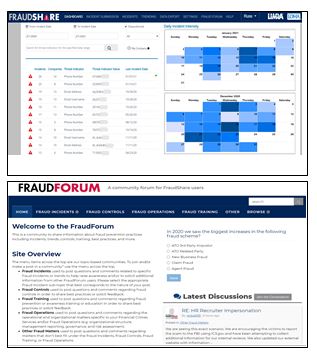

Companies using FraudShare also have access to the FraudForum. This platform allows companies to interact with each other securely and anonymously and discuss a wide variety of fraud-related topics ranging from fraud incidents and fraud controls to fraud training and fraud operational matters.

In the lead-up to FraudShare’s launch in Canada, LL Global established a Founders Council, made up of representatives from four leading Canadian financial firms — Sun Life, Canada Life, Manulife and RBC Life. These members provided guidance and expertise that helped make FraudShare available in the Canadian market.

“We are grateful for the commitment and expertise each of the Founders Council members provided,” noted Anderson. “Their support and knowledge helped us expand access to our state-of-the art tool and will give us better understanding of the evolving criminal activity with regard to account takeover fraud.”

For more information about FraudShare, or to participate in an interactive demonstration of the tool, please visit FraudShare microsite.

For more than 100 years, LL Global has developed cost-efficient, industry-standard solutions like anti-money laundering training, the Customer Assurance Program, best interest training and, most recently, the Remote PROductivty Toolkit to help financial services companies address common challenges with remote workers.

-end-

About LL Global

LL Global is the non-profit parent company for LIMRA and LOMA. LL Global provides a unified management and board structure for both trade associations. LIMRA and LOMA have a combined membership of more than 1,400 insurance and financial services companies in 71 countries worldwide.

About LIMRA®

Serving the industry since 1916, LIMRA helps to advance the financial services industry by empowering nearly 650 financial services companies in 51 countries with knowledge, insights, connections, and solutions. Visit LIMRA at www.limra.com.

About LOMA®

Established in 1924, LOMA helps to advance the financial services industry by empowering more than 900 financial services companies in 63 countries with knowledge, insights, connections, and solutions. Visit LOMA at www.loma.org.

About Secure Retirement Institute®

The Secure Retirement Institute® (SRI®) helps its members advance retirement readiness and the financial security of their clients through research, peer forums, education and innovation. Members develop valuable relationships and build a bridge to the future. For information on the Secure Retirement Institute, visit: www.limra.com/sri.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257