Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

9/26/2023

All major workplace benefits product sales recorded positive results in the first half of 2023

WINDSOR, Conn., Sept, 26, 2023 — Following a 6% increase in new annualized premium in the first quarter, U.S. workplace supplemental health product sales ― accident, critical illness, cancer, hospital indemnity, and other supplemental health insurance products* ― totaled $513 million, representing a collective 5% increase in the second quarter. Accounting for 96% of all workplace insurance sales, accident, critical illness, cancer and hospital indemnity insurance showed new premium gains of 2%, 5%, 17% and 8%, respectively.

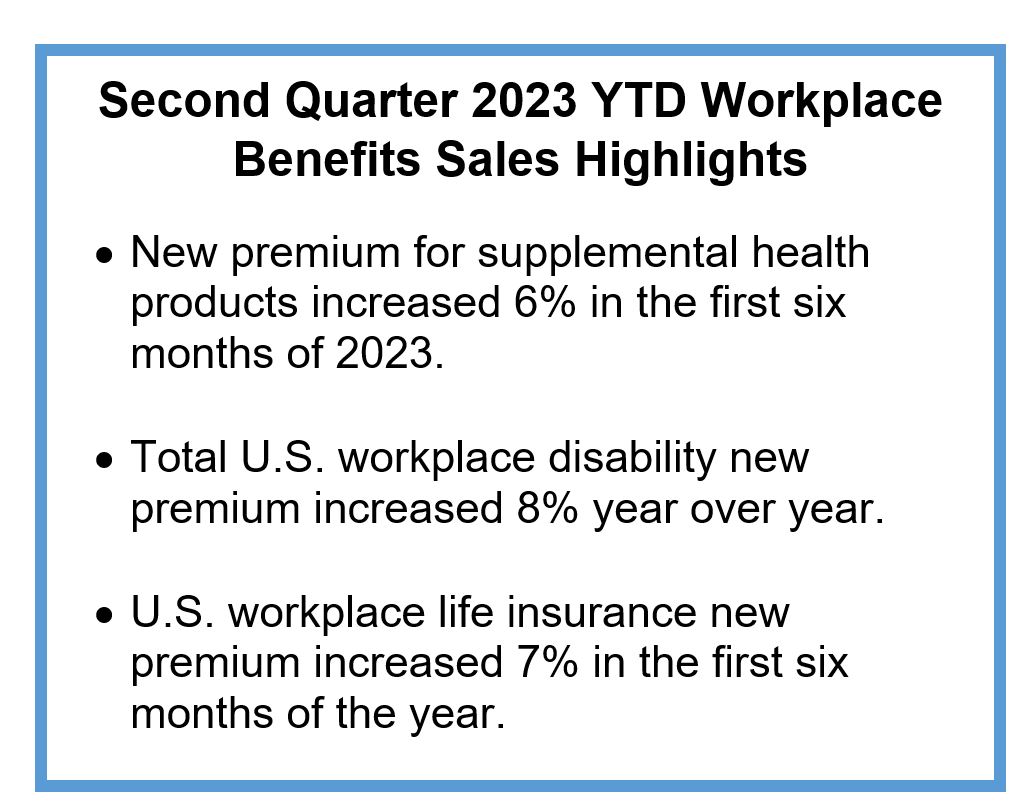

In the first six months of 2023, new premium for supplemental health products totaled nearly $1.8 billion, a 6% increase over the same period in 2022.

“Coming out of the pandemic, all major supplemental benefit product lines have shown quarterly growth since the second quarter of 2021,” said Patrick Leary, corporate vice president and director of LIMRA’s workplace benefits research program. “While LIMRA research shows a majority of workers aren’t certain if their employers offer these benefits, more than 4 in 10 say these benefits are extremely important to them. This signals an opportunity for employers and carriers to expand their educational efforts to help inform employees about the broad benefit offerings available to them ahead of this year’s open enrollment season.”

“Coming out of the pandemic, all major supplemental benefit product lines have shown quarterly growth since the second quarter of 2021,” said Patrick Leary, corporate vice president and director of LIMRA’s workplace benefits research program. “While LIMRA research shows a majority of workers aren’t certain if their employers offer these benefits, more than 4 in 10 say these benefits are extremely important to them. This signals an opportunity for employers and carriers to expand their educational efforts to help inform employees about the broad benefit offerings available to them ahead of this year’s open enrollment season.”

Disability Insurance

Total workplace disability insurance new premium sales were $594 million in the second quarter, down 7% from prior year. While short-term disability insurance premium increased 6%, long-term disability insurance premium plummeted 21%.

Year-to-date (YTD), workplace disability product new premium remained elevated, up 8% due to strong results in the first quarter. Total workplace disability product premium totaled $2.4 billion in the first six months of 2023. Total short-term disability insurance new premium grew 19% while long-term disability insurance new premium fell 3% for the first six months of the year.

Life Insurance

Workplace life insurance new premium totaled $622 million in the second quarter, dropping 3% from prior year. New premium for term products fell 13% while new premium for permanent products shot up 32%. Keep in mind, permanent product sales represent only 10% of the workplace life insurance market.

In the first six months of 2023, total workplace life insurance new premium was $2.5 billion, up 7% from prior year results. Term product new premium recorded an increase of 4% YTD, while permanent products ended the first half of 2023, 21% higher than prior year.

“Reasons for strong permanent sales were varied and included new product introductions, successful expansion of permanent business, gaining new distribution, and carriers providing richer plan designs,” Leary notes.

LIMRA’s workplace benefits sales surveys for life insurance, disability insurance and supplemental health represent at least 90% of their respective annualized premium markets.

You can find the latest data table with U.S. workplace sales trends in LIMRA’s Fact Tank.

-end-

*“Other supplemental health products” represents products that do not fit the other categories, such as gap insurance, minimum essential coverage plans, limited benefit medical, and heart/stroke products.

About LIMRA

Serving the industry since 1916, LIMRA offers industry knowledge, insights, connections, and solutions to help more than 700 member organizations navigate change with confidence. Visit LIMRA at www.limra.com.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257