Chasing Amazon

Accelerated Underwriting

Focuses on CX

Chasing Amazon

Accelerated Underwriting

Focuses on CX

Underwriting is the backbone of the life insurance industry. It is the art and science of using a small amount of information to make enormous decisions, and it plays a substantial role in keeping life insurance affordable.

The world of underwriting is not the realm of “educated guesses;” it is grounded in more than a century of hardwon data. As our world grows increasingly complex, information is more available and abundant. In the current environment, what separates good underwriting from great is the ability to separate the wheat from the chaff — to find the most important information in an infinite field of facts, all while balancing cost, time, and customer expectations.

Today, some companies use sophisticated programs to mine health data and accelerate the decision-making process. A recent Milliman study found that 18 percent of companies use simplified issue, and 36 percent use accelerated underwriting for term life policies.1 Especially in the case of accelerated underwriting — which focuses on keeping premium cost aligned with fully underwritten policies — these programs can have a profound effect on customer experience (CX) and perception of the insurance industry. This article — based on a recent LIMRA study — offers an overview of company use of different data sources, program goals, straight-through processing strategies, and the success and headwinds experienced with accelerated underwriting.

Historically, many life insurance writers have found a wealth of data in certain key sources, such as fluid samples like blood or saliva, provided by applicants, as well as attending physician statements (APSs). However, COVID-19 complicated the data collection equation and fast-tracked underwriting changes that were already underway in our industry.

Fluid samples offer some of the most in-depth and up-todate health information on life insurance applicants — sometimes more information than the applicants know themselves. Despite this wealth of information, however, fluid collection causes a significantly less customer-friendly process. Fluid collection is an onerous touch point in the underwriting process that applicants often find invasive.

In addition, COVID-19 now poses a serious health risk to those involved in collecting these samples.

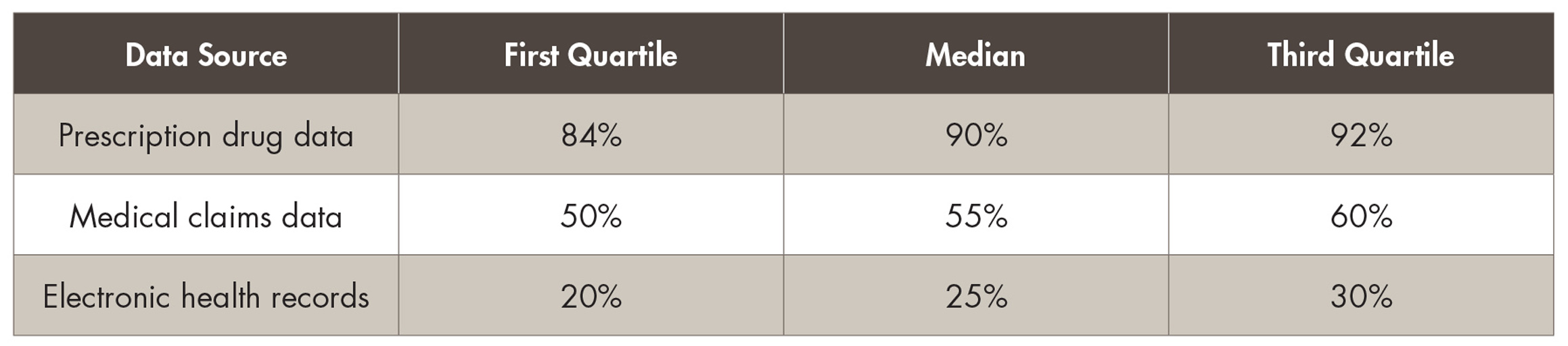

In response, 1 in 5 insurers with an accelerated underwriting program have stopped collecting blood samples. One third of companies have stopped swabbing saliva. Losing this source of information means losing what, historically, was the most valuable underwriting data. In response, companies are beginning to explore electronic alternatives that provide similar information to real-time fluid samples, using a much less invasive process. We asked companies about three of these data sources:

Medical claims databases and EHRs have lower hit rates than prescription drug databases, but that is offset by the sheer amount of useful information included in successful queries. Life insurance writers can use an array of these (and many other) electronic data sources to balance higher hit rates versus larger volumes of useful data. Regardless of which electronic data sources companies choose to enhance their accelerated underwriting programs, they all offer clear benefits over traditional underwriting. These benefits include increased speed and improved customer satisfaction, while limiting touch points in the process.

Source: Automated and Accelerated Underwriting: Life Insurance Company Practices in 2020, LIMRA, 2022

In diverse sectors across the global economy, many companies succeed based on speed of delivery and convenience to the consumer: Think Amazon, Netflix, and DoorDash. For some life insurance companies with accelerated underwriting systems, speed and convenience also justify their programs. In fact, the three most common goals are:

Over 80 percent of insurers with accelerated underwriting met their goal of reducing the amount of time it takes to issue policies, and for the rest it is too soon to tell. At the same time, just over 60 percent of companies met their customers’ expectations, making applicants happier. Companies clearly are building their accelerated underwriting programs with the consumer in mind. Some life insurance writers are doubling down on their commitment to reduce policy turnaround time with straight-through processing (STP). The aim of STP — an extension of accelerated underwriting — is for a company to receive an application, aggregate the data for the underwriting decision, rate the applicant based on that data, and issue a policy with an electronic contract, all without human intervention.

With perfect execution, STP can take a policy from application to issue in a matter of minutes, with clear benefit to both consumer and company. John Hancock, for instance, recently designed their JH eApp — in part as a response to the COVID-19 crisis — for this very purpose. The JH eApp connects the entire application process digitally, eliminating time and paperwork, allowing producers to focus on client needs and concerns, and “reducing processing times from weeks to, in some cases, minutes.”2 These new digital solutions create the possibility of virtually instantaneous underwriting decisions, allowing for a more enhanced customer experience.

This focus on the end consumer exists as well in new products offered based on customer preference, with the end goal of reaching underserved markets. Symetra‘s SwiftTermSM, launched in 2021, offers “fast, affordable coverage through a streamlined application process. Clients apply, pay, and get their policy online — from whatever device they choose — in as little as 25 minutes.”3 These digital approaches also allow companies to reach new, untapped markets, diversifying their consumer reach.

Online life insurance brokers are also upping their game — offering more of these innovative products to reach more Americans and help them take charge of their financial stability. The nation’s leading online insurance marketplace, Policygenius, offers innovative life insurance products like Lincoln Financial Group’s Lincoln TermAccel®, which provide eligible consumers with quick and convenient access to life insurance options, without medical exams.4

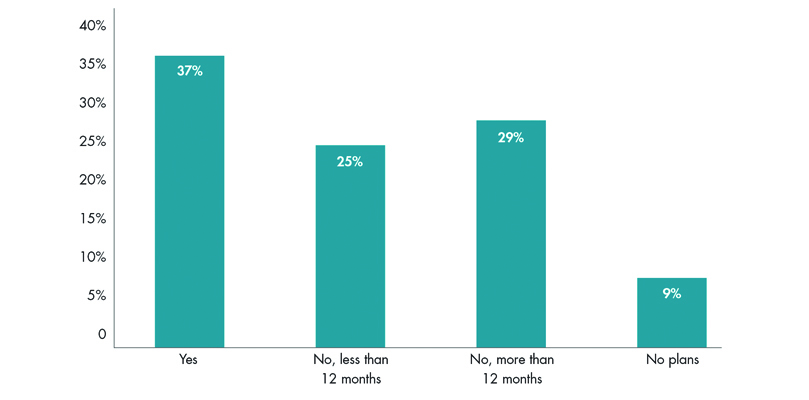

In terms of the overall industry, our study shows that over one third of companies with an accelerated underwriting program already have a fully electronic process that requires no human touch (Figure 1). In addition, 6 out of 10 plan to implement a fully electronic process in the future.

Based on responses to: Do you have a fully electronic process that requires no human touch?

Source: Automated and Accelerated Underwriting: Life Insurance Company Practices in 2020, LIMRA, 2022.

Despite the obvious upside for companies and consumers, accelerated underwriting is far from a one-size-fits-all solution. New processes, technology, and training mean there are costs and challenges associated with implementing accelerated underwriting. The most common difficulty that companies face is interacting with existing legacy systems. These legacy systems represent the single greatest challenge in execution for several life insurance companies. Because of these antiquated systems, insurers struggle to find useful data in a usable format.

In addition to the structural roadblocks, companies may not always see an immediate payoff after creating an accelerated process. Two thirds of life insurance writers state that one objective of their accelerated underwriting programs is to increase sales. Yet, as of 2020, 1 in 5 companies had not met that goal. But consumer demand for ease and convenience — as well as pandemic conditions — will likely drive more sales in the future. As of 2020, our research found that more than 29 percent of people who intended to purchase life insurance preferred an online process.5 That percentage has likely increased, as the pandemic changed distribution methods across all channels. This is good news for companies focusing on accelerated underwriting to help meet the consumer need for financial security.

It is remarkable to see how underwriting systems have changed to meet the demands of a mercurial world. New and improving sources of electronic data continue to write new chapters in the storied history of life insurance underwriting. Innovative automation techniques drive turnaround times faster and faster, and consumers are taking notice. At this time of upheaval, companies in our industry are utilizing science and creativity to build underwriting programs that will help address the pervasive coverage gap in our industry.

1 Term Life Insurance Issues Survey, Milliman, 2021.

2 John Hancock Launches Electronic Application Platform to Streamline Life Insurance Sales Process, John Hancock press release, June 23, 2020.

3 Symetra Targets New Customer Segments With SwiftTerm, Fast, Easy, Online Term Life Insurance, Symetra press release, June 29, 2021.

4 Policygenius Expands Marketplace With Accelerated Life Insurance From Lincoln Financial Group, Policygenius press release, September 2020.

5 Insurance Barometer Study, LIMRA and Life Happens, 2020.