Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

9/27/2023

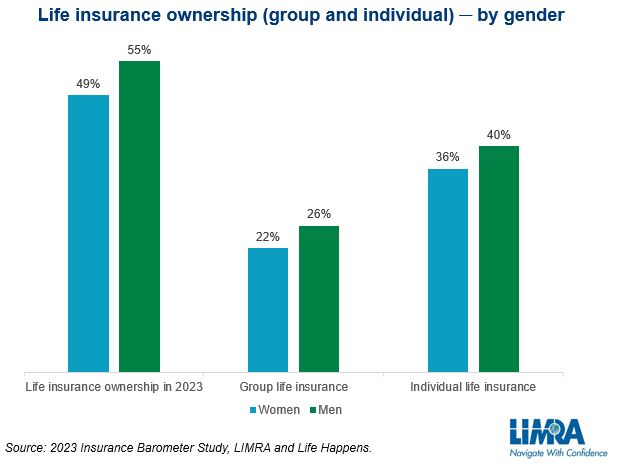

Women make up a significant market opportunity for the life insurance industry. According to the 2023 Insurance Barometer Study, 44% of women believe they need (or need more) life insurance, which represents 54 million women. In general, women are less likely than men to own life insurance.

To find success in the women’s market, financial professionals need to understand the financial concerns of women as well as what they value in a financial professional.

The financial concerns of women:

Generally, women tend to feel more stressed about finances than men (34% vs. 23%). Some of the top financial concerns women have include:

Ultimately, women want to avoid leaving their dependents in difficult financial situations should they die prematurely. While purchasing life insurance may not be the highest priority for women, it can promote feelings of security and peace of mind. Nearly 7 in 10 life insurance owners say they feel financially secure compared to less than half of non-owners.

“There’s a theme of women wanting to take care of their families and themselves,” noted Alison Salka, senior vice president and head of research for LIMRA and LOMA. “Our industry is positioned to show how life insurance fits perfectly with that theme.”

What women want in a financial advisor:

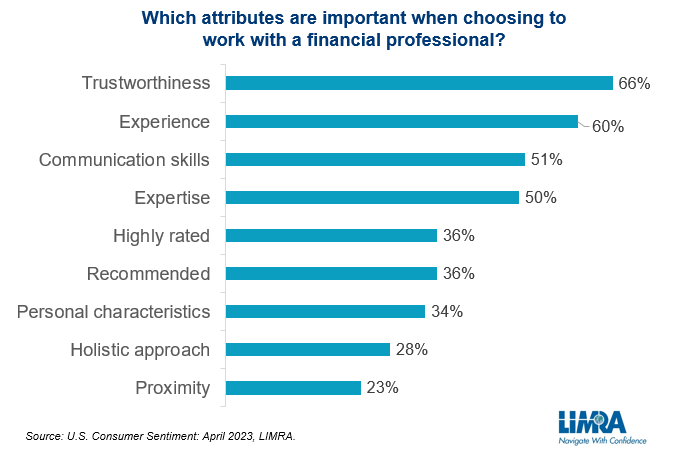

LIMRA data shows that 41% of women and 52% of single mothers who are not currently working with financial professionals, are seeking one. When asked what attributes are most important, 66% of women said trustworthiness, 60% said experience, and 51% valued communication skills.

“Women value trustworthiness from their financial professional,” explained Gina Birchall, chief operating officer for LIMRA and LOMA. “They [women] want someone who isn’t trying to take advantage of them and who respects that they may need more time to make a financial decision.”

When shopping for life insurance, 44% of women say they would research life insurance online but ultimately buy from an insurance agent or other financial professional. Women also search for life insurance online, by mail, by phone call, by personal meeting with a financial advisor, and by speaking with friends and family.

The latest LIMRA data shows that nearly half of adult women believe they need (or need more) life insurance. Yet, lack of confidence is often cited as the reason why they delay purchasing the life insurance they know they need. To overcome this obstacle, carriers and financial professionals should encourage their female clients to ask questions, clarify terms, and ensure they walk away with more knowledge of the products available.

To learn more about the women’s market:

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257