Leaders Rethink Allocation

of Operational and

Financial Resources

Leaders Rethink Allocation

of Operational and

Financial Resources

April 2023

The pandemic accelerated the use of new technologies that facilitate remote work and virtual meetings. Now, financial services agency leaders are further integrating remote work technologies as they define their firm’s operations and investments for the future.

The third article in our Firm of the Future series examines the evolution of operations and financial strategies based on findings from research conducted by LIMRA’s Research Agency Group (RAG). RAG, which is made up of agency leaders from top insurance companies and thought leaders from across the industry, explored how agencies adapted throughout the pandemic and the best practices they’re carrying forward.

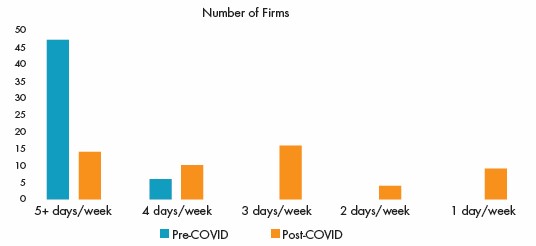

In the early days of the pandemic, agency leaders had decisions to make. Many opted to temporarily close their physical offices and enable associates to work from home. For some, remote work lasted for a few weeks. For other firms, the work-from-home model continued for several months. For most, it shifted their approach to remote work and how often team members are expected to be in the office. Pre-pandemic, most firms required their staff to work in the office five days a week. More recently, many firms have adopted a hybrid work model, allowing staff to work remotely one or more days per week.

Source: RAG-Finseca Firm of the Future Survey, 2022

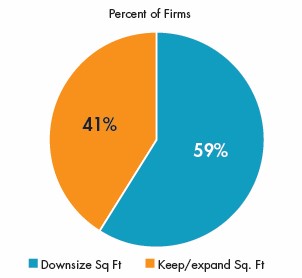

As hybrid work becomes the norm, firms must navigate the operational and financial implications. For example, hybrid work models have a significant impact on office space needs. With advisors working remotely for a portion of the work week, some firms are taking a hoteling approach to workspace needs, with advisors reserving shared desks in the office as needed. Fifty-nine percent of firms report plans to reduce their office’s square footage and invest the money saved in other areas.

Source: RAG-Finseca Firm of the Future Survey, 2022

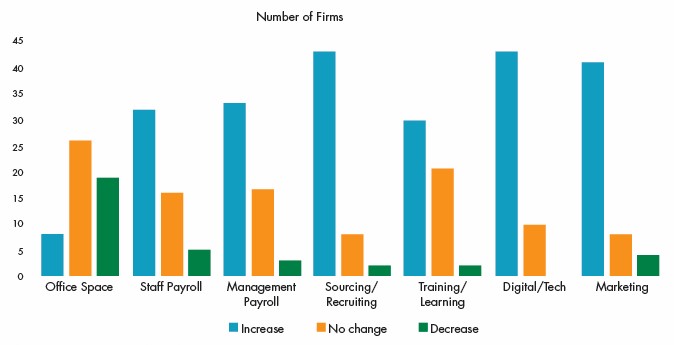

As events, in-person meetings and trips shifted to virtual during the pandemic, many firms had an opportunity to adjust their budgets. Dollars allocated to events and meetings were reallocated to investments in technology. During the pandemic and in the new hybrid work environment, laptops, scanners, printers, virtual meeting software, chat systems and pipeline management tools were all relied on more heavily.

Looking ahead, firm leaders are planning to invest in several different areas to support their growth goals. While most firms expect to spend less on physical office space, they are increasing their budgets to support sourcing and recruiting, digital technology and marketing.

“We are at such a crossroads with what I feel the firm of the future will look like,” says Lisa Davis, managing partner at 1847Financial. “We will always invest in lead generation and support for our advisors.”

Source: RAG-Finseca Firm of the Future Survey, 2022

Beyond the financial investments that firms are making to prepare for the future, they also are monitoring the business landscape and trends as they make decisions and set growth objectives. Key focus areas include:

Inspired by events in recent years and evolving marketplace trends, the firm of the future will continue to adapt its operational and financial strategies to optimize its resources and fuel growth. To read the complete Firm of the Future report based on LIMRA’s Research Agency Group (RAG) research, click here.

[1] Executives Plan Investments to Support Hybrid Work, Statista

[2] Gen Z Technology Habits and Media Consumption by the Numbers, Basis