Learn about small employers’ views of offering insurance, retirement, and other employee benefits.

Kimberly A. Landry; Ron Neyer, M.B.A., AIRC, CLU, ChFC 3/28/2019

Learn about small employers’ views of offering insurance, retirement, and other employee benefits.

The vast majority of employers have fewer than 100 employees. However, these businesses are less likely than their larger counterparts to offer insurance and retirement benefits. What benefits are small businesses currently offering, and what are their plans for the future? How has this changed over time? To answer these questions and more, LIMRA conducted an online survey of 1,504 U.S. small employers with 2 to 99 employees in late 2018.

Learn how small businesses feel about insurance benefit advisors.

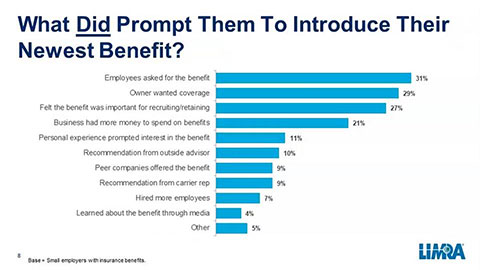

Learn about small businesses’ decision-making process for insurance benefits.

Learn about small employers’ views of offering insurance, retirement, and other employee benefits.

The vast majority of U.S. employers have fewer than 100 employees. However, these businesses are less likely than their larger counterparts to offer insurance and retirement benefits to their workers.

Be aware of micro-climates in the small business employee benefits market — in particular, the hotter regions where revenue growth may be easier to achieve.

LIMRA’s Small Business Owner study provides an inside look at how entrepreneurs integrate insurance and financial services for their business and personal lives.

How many small firms offer employee benefits? How many carry business insurance? Learn about the current state of the market and discover new opportunities!

Learn about the decision-making process of small businesses when it comes to employee benefits, including key challenges, sources of information, and reasons for not offering benefits.

The Supplemental Health, DI & LTC Conference provides a unique opportunity to consider a cross-functional view of supplemental health products, individual disability insurance, and long-term care standalone and combination products.

Gain fresh ideas and insights to successfully address short-and long-term changes in the U.S.

Research tailored to your individual business needs.