The Human-Tech Connection

Reaching Consumers Where They Are

The Human-Tech Connection

Reaching Consumers Where They Are

August 2022

Consumer use of social media for financial purposes more than doubled in the last three years, to 53 percent. Today’s consumers not only use these applications more frequently for financial advice, but also they use multiple sites more often. In 2022, the average user visits almost three sites for the same purpose. As a consequence, the definition of “family and friends” pertains to a broader network of consumers now, providing industry professionals with more access points for brand awareness and business development.

Americans who use social media are online an average of 2.5 hours a day. Since we know that consumers use social media to research financial information, knowing what is on consumers’ minds can inform what your organization needs, to earn the coveted “click through” to your firm’s or your own professional website. For life insurance professionals, these consumer insights provide opportunities to communicate that owning coverage can address consumer financial concerns, including living benefits.

Every year, LIMRA surveys thousands of consumers about their financial concerns in four areas: healthcare, saving goals, life insurance, and living expenses. While more Americans cite saving for a comfortable retirement as their top financial concern, increasingly they express concern about employment stability, having an emergency fund, becoming disabled, and needing long-term care. Millennials are more concerned on every dimension than the general population, from credit card debt to income replacement to funding a college education.

Finding solutions to financial worries looms large for most Americans today. They face the continuing impacts of inflation at a 40-year high, and decades-long wage stagnation for the majority of the American labor market. The severity of the COVID-19 pandemic created a nationwide looking glass, through which consumers took stock of where they are and where they want to go. Whether changing jobs, increasing savings, or otherwise preparing for emergencies, consumers are making moves in their lives. In 2022, 31 percent said the pandemic increased their likelihood to buy life insurance, which represents an estimated market size of 82 million consumers.

Six in ten Americans say they have looked for information about life insurance online, and that they have visited a life insurance company’s website. More than 1 in 5 say they purchased life insurance online in the past year.

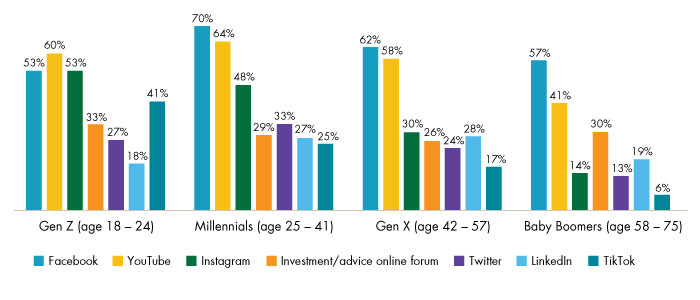

More than half of Americans (53 percent) say they used social media sites for financial information and communications, up from 25 percent in 2019. Facebook and YouTube continue to lead the pack, popular across all generations (Figure 1). Instagram, Twitter, and TikTok are making significant inroads as cited resources for financial information, appealing more to younger Americans.

Source: Insurance Barometer Study, LIMRA and Life Happens, 2022.

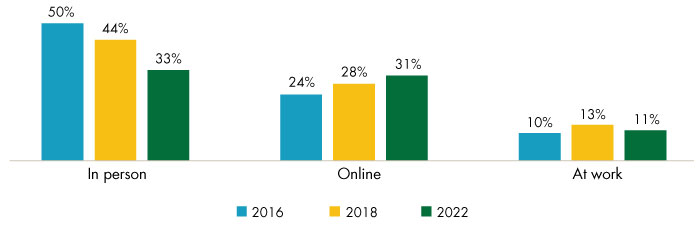

Given the current adoption rates and usage of YouTube and Facebook and their videoconferencing capabilities, these platforms should remain fertile ground for education, shopping, and service (Figure 2). Generation Z is much more comfortable learning and shopping entirely online, as long as they have the chance to speak “face to face” with an insurance professional, making them 41 percent more likely than the general population. Millennials and Generation Z are digital natives. They learn, think, and interact with the world differently than do older Americans. While they may be more tech-savvy and platform-reliant than older Americans, they still acknowledge the importance of face-to-face conversations for complex or important transactions and relationships.

Forty-four percent of Americans work with a financial professional, and nearly another quarter (66 million people) are looking for one. During COVID, advisors had an opportunity to flex their technology muscle through videoconferencing to build and sustain relationships with prospects and clients. As important as a dynamic, pervasive web presence is, a third of consumers still want to meet with a professional to complete the application or to complete their life insurance purchase. Videoconferencing has become an efficient and effective alternative to complete a purchase without meeting in person.

Source: Insurance Barometer Study, LIMRA and Life Happens, 2022.

The past two years put the world on notice that our physical and financial health are in need of closer evaluation and increased action to protect survivors in the event of premature death of one or more family members. The past three years accelerated technological expectations for both shoppers and owners of life insurance. Web-based education and transaction capabilities are table stakes today, in addition to the human advisor who “fills in the blanks” and provides reassurance that products will provide the protection the consumer seeks. The human advisor remains essential in closing sales and driving retention. At key moments in their lives, consumers will reach out to the financial services companies that provide the easiest and most consultative information and education.