Anti-Money Laundering (AML) Training

LIMRA's U.S. Anti-Money Laundering Training Program is a fast, easy, and inexpensive way for financial services companies to meet key requirements of U.S. Treasury Department rules.

This industry-wide training program allows producers to complete core training just once, and documentation is sent to every carrier they represent that participates in the program. In addition, the Anti-Money Laundering Program

- Provides training for insurance and securities producers and home office employees

- Is based on real-life industry scenarios with interactive content to help learning stick

- Provides reporting to see who has started, not started, and completed training

- Train your employees to understand and recognize money laundering with the LIMRA AML Training for Home Office Employees

- Quick, easy to access, 100% verifiable. Enroll employees with your producers for volume discounts and check AML training off your list with the LIMRA AML Training for Home Office Employees.

- Industry-specific AML Training strengthens your AML program and allows you to meet regulatory requirements

Get a Demo of the LIMRA AML Training for Home Office Employees today!

Anti-Money Laundering for Insurance Review – The Impact of Artificial Intelligence (2025)

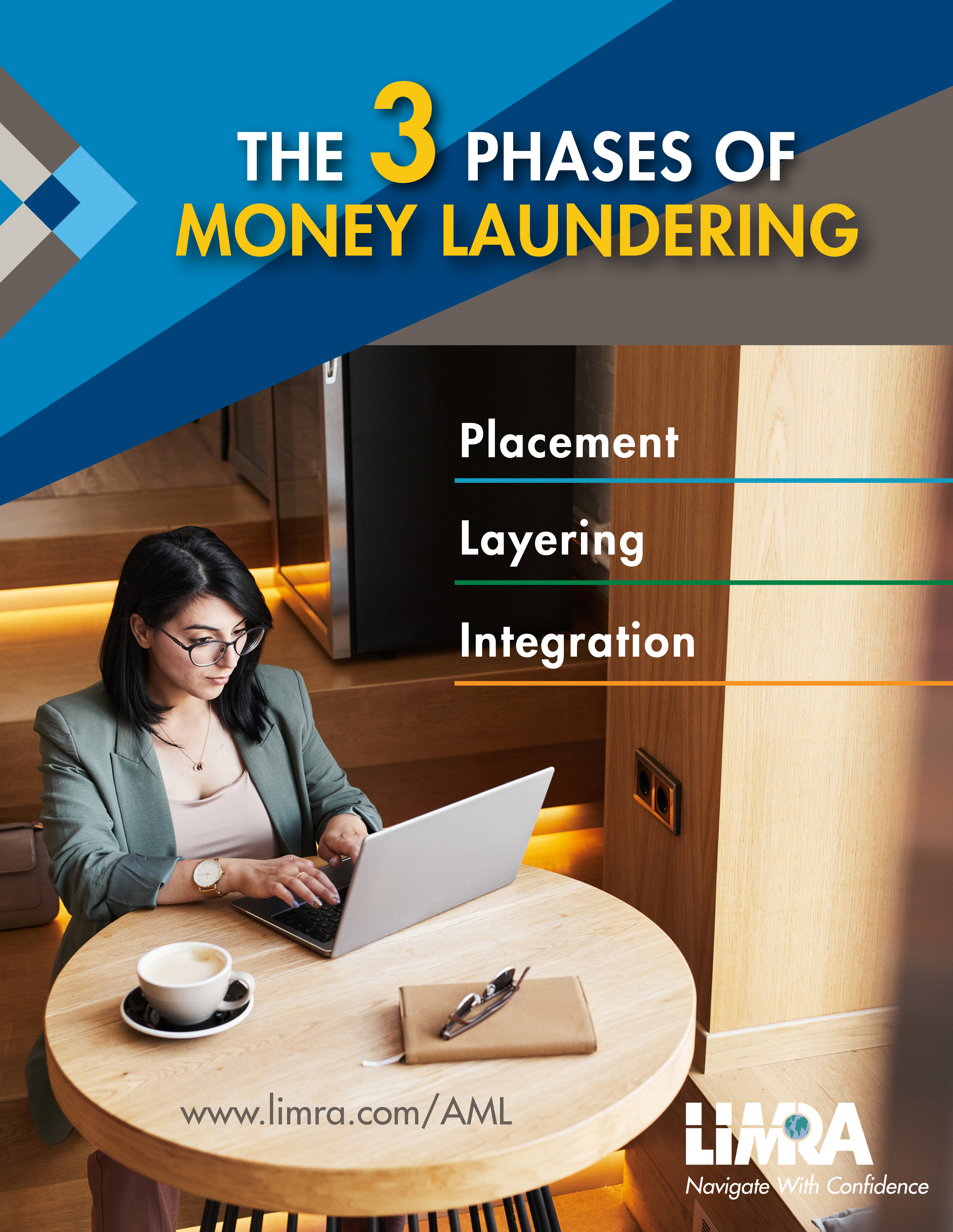

LIMRA’s 2025 AML course enhances understanding of money laundering within the insurance industry and explores ways artificial intelligence (AI) can create efficiencies for those working in insurance. It also prepares learners to recognize and prevent AI from being leveraged in fraudulent schemes.

The course reviews important topics like Know Your Customer, Customer Identification Program, Activity Monitoring and Red Flags.

The LIMRA Program also includes an AML Resource Library, available 24/7, where learners can review course content. The Library includes insurance-specific awareness posters and images that can be shared to heighten attention to potential money laundering.

A branded company page offers companies the opportunity to customize program content with specific and unique information learners need to know.

Learn more about how you can protect your company, employees, financial professionals and customers today by completing the form below.