Sept 2023

Navigating the Shifting Life Insurance Landscape

There are numerous forces shaping today’s life insurance landscape. Which factors will most affect your firm’s ability to keep pace and grow?

Choosing a Financial Professional: What Attributes Are Important to Consumers?

Many things influence consumers when choosing a financial advisor. See how gender, age and various attributes play into their choice.

How Generational Preferences Are Redefining Workplace Benefits

Workers are rethinking what benefits are most important to them. What must employers consider to meet employees’ changing needs?

Playing for Keeps: Strengthening Retention Through Professional Development

Feeling “cared for” by their employer is important to employees’ general health, happiness and engagement. How does your organization need to change to make that happen?

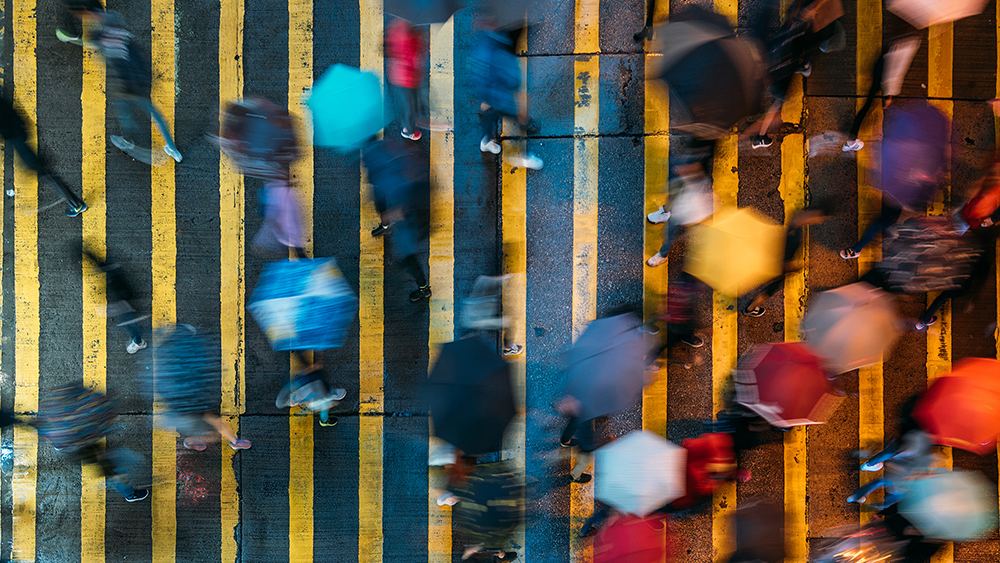

The View From the Road: Insights Into Asia

Discover some of the consistent themes in work culture, distribution and digital engagement found in Asian markets.

COMMENTARY Maximizing Today’s Bancassurance Model

Data is the most dramatic driver of bancassurance performance in the coming decade. What are some of the complex interdependencies that can hinder success?

How Are We Going to Reverse This Trend?

Many Americans live with a life insurance coverage gap. Learn the reasons people don’t buy life insurance and where you can find helpful resources to engage and educate consumers.

Insights & Trends

Beginning with this issue, you will be able to find many of the same great features and content previously found in Member Connection in this Insights & Trends section of MarketFacts — giving you access to our full menu of content in one publication. Enjoy your expanded issue of MarketFacts!